12

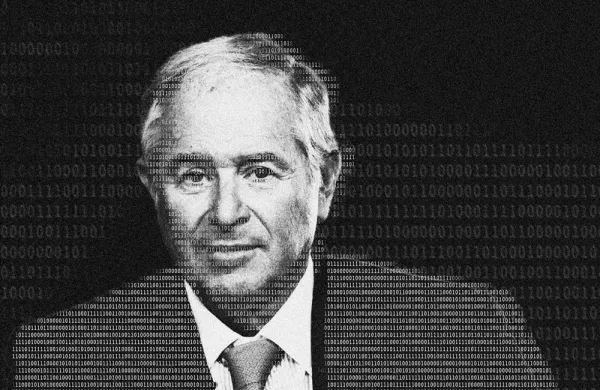

David Craig

President, Financial & Risk

Thomson Reuters

Last Year: 11

At the World Economic Forum meeting in Davos, Switzerland, in January, David Craig’s business card was a conversation piece: Printed on it is a bar code that when scanned displays his Thomson Reuters Permanent Identifier, or PermID. The New York–based media and information company has created some 200 million such codes for people, legal entities and securities in a drive to automate and secure identification processes in an increasingly digital marketplace. One area where strong identification is currently lacking is the blockchain, which was designed to protect anonymity. “We believe that transactions cannot be anonymous in a trusted world,” says Craig, 46, president of Thomson Reuters Financial & Risk, which accounts for half of the corporation’s $12.2 billion in annual revenue. “While you might not want the market to know who your counterparty is, you need to know.” PermID is being offered to various blockchain and federated-identity initiatives, and is being rolled out on World-Check, Thomson Reuters’ anti-money-laundering and know-your-customer compliance service. Financial & Risk, the unit Craig has headed since 2011 — three years after Thomson Corp.’s $17 billion acquisition of Reuters Group — has consolidated more than 850 products into some 150 offerings on three flagship platforms: the Eikon desktop, Elektron for data and trading applications, and Accelus for governance, risk and compliance. “We’ve moved from product to platform, which for us is about a business model, not just a technology play,” Craig explains. Under the open platform model, third-party developers and clients can create applications and integrate them into their Eikon terminals. The App Studio, launched in October, is generating a regular flow of new programs from independent software developers in what amounts to an expanding ecosystem for innovation. “I really admire these fintech companies that I spend a lot of time with,” Craig says. “Five men and women in a garage can do a lot at the moment.”

Visit The 2016 Tech 50: Making Financial Services Faster, Cheaper, Bigger for more.

The 2016 Tech 50

Bessant Bank of America Corp.

Intercontinental Exchange

Markit

CME Group

Bloomberg

Goldman Sachs Group |

BlackRock

Nasdaq

Citi Ventures

KCG Holdings

Fidelity Investments

Thomson Reuters |

ICAP

Depository Trust & Clearing Corp.

Hong Kong Exchanges and Clearing

BATS Global Markets

Digital Asset Holdings

R3CEV |

D.E. Shaw & Co.

Tradeweb Markets

MarketAxess Holdings

Liquidnet Holdings

Capital One Financial Corp.

IEX Group |

State Street Corp.

DBS Bank

TMX Group

Deutsche BÖrse

PayPal Holdings

Wells Fargo & Co. |

S&P Global Market Intelligence

Options Clearing Corp.

Fidelity National Information Services

Numerix

Axioma

BT Radianz |

MaplesFS

AQR Capital Management

Winton Capital Management

London Stock Exchange Group

First Derivatives

eVestment |

Xignite

OpenFin

NRI Holdings America

Saxo Bank

Perseus

Broadridge Financial Solutions |

Xenomorph Software

Adyen |