IJ’s “Asset Owners in Japan” column regularly features conversations with corporate pension fund managers. However, people may still be curious about their identities and backgrounds. IJ’s sister site, AL-IN Web, surveyed 126 current managers of defined benefit pension funds to shed light on who they are, what they do, and what attributes they share. The survey was conducted online from March 2 to April 2, 2021.

Among the corporate pension funds surveyed, nearly 80% are fund-type, 15% are contract-type, and the remainder are non-corporate benefit organizations (such as mutual aid associations for public service personnel). And while the respondents are located throughout Japan, 44% are in Tokyo.

When categorized by asset scale, fund-types vary in size from less than JPY 10 trillion to over JPY 100 trillion, whereas 63% of contract-types are less than JPY 10 trillion. Non-corporate pension funds are sharply divided by size, with 43% under JPY 10 trillion and 57% over JPY 100 trillion.

Fewer personnel and greater concentration among fund-type funds

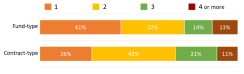

At most pension funds, asset management is performed by one or two individuals (or 2.35, on average). Compared to fund-type funds, contract-type funds generally employ more managers.Number of asset management personnel

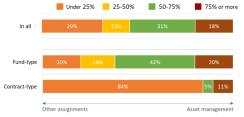

Most personnel designated as asset managers also perform additional work in other areas. More than 80% of contract-type managers report devoting “less than a quarter” of their time and energy to asset management. Contract-type funds employ more asset managers, but these employees are more likely to work concurrently with other assignments than asset managers at fund-type funds. These other duties are mainly general affairs, accounting, and HR at contract-type funds, and mainly finance and HR at fund-type funds.

Percentage of individual work resources devoted to asset management

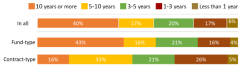

Experience in asset management

Veteran managers, with more than 10 years of experience, make up 40% of respondents. Among managers aged in their 60s and older, 64% have more than 10 years of experience, while more than 70% of young and mid-career managers in their 30s and 40s have more than five years of experience. At contract-type funds, where managers tend to be transferred frequently, more than half of all managers have less than five years of experience.Experience in asset management (in years)

Lastly, we asked managers to identify their primary medium for compiling daily financial information. Print media (56%) slightly outperformed web media (44%). When they use the internet to gather information, 90% of managers say they use PCs, largely ignoring mobile phones and tablets.