Crisis-battered investors continue to favor the relative certainty of current income over the “maybe” of future capital appreciation. If you ask me, however, the cult of Now is having a profound effect on the financial markets.

My colleagues and I have written a lot lately about the safety bubble in bonds, the lofty valuations of high-flying dividend-paying stocks and the risks these trends pose for passive index trackers.

Other examples include real estate investment trusts and master limited partnerships, which receive special tax treatment and consequently are required to distribute most of their earnings to shareholders. REITs offer a highly liquid way to invest in income-generating real estate, either directly or through mortgages. MLPs predominantly invest in energy-related businesses. Both vehicles have been wildly popular since the market crash.

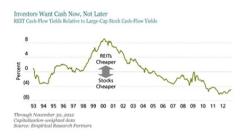

As investors chase income and safety, the operating cash flow yields of REITs have plunged to some of the lowest levels in 20 years. For S&P 500 stocks, however, those same yields have soared to near-record highs — and now exceed those of REITs by nearly 500 basis points. That’s the widest spread between the two in 20 years, as seen in the display below. The valuation gap between mostly energy-related MLPs and common stocks is similarly large.

These spreads reveal a deep skepticism about the future. As structured, REITs and MLPs don’t retain much of their earnings, so when they want to invest in growth, they generally have to raise capital. In contrast, common-stock companies are retaining earnings at arecord level, as evidenced by their historically low dividend payout ratios. Investors are assigning a substantially lower value to the cash flows of common stocks because they don’t trust that managements will deploy this cash wisely. They find much greater value in investment structures that force the return of cash at the expense of future growth.

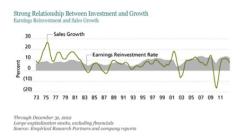

Are investors wrong? History is rife with examples of how managements have wasted money on ill-conceived acquisitions and internal investments. On the other hand, our research suggests that this wariness is excessive. As the second display illustrates, there is a strong correlation between cash reinvestment and sales growth. Both have ramped up recently. Broadly speaking, companies haven’t done such a bad job of putting cash to productive use. Moreover, corporate gross cash flows remain strong, and balance sheets are healthy, leaving plenty of room to increase dividend payouts and capital spending.

Faith in a better tomorrow remains fragile. Even the pullback in market volatility last year hasn’t doused the desire for safety. A steady flow of good economic and corporate-profit news, along with rising dividends, should eventually help rebuild confidence. But to believe that current conditions will become the status quo is to believe that the historical relationship between market values and corporate cash flows is forever broken. By our reading, the opportunity cost of distrust is pretty steep. The time will come when investors will no longer see the point in paying it.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Joseph G. Paul is chief investment officer of North American Value Equities at AllianceBernstein.