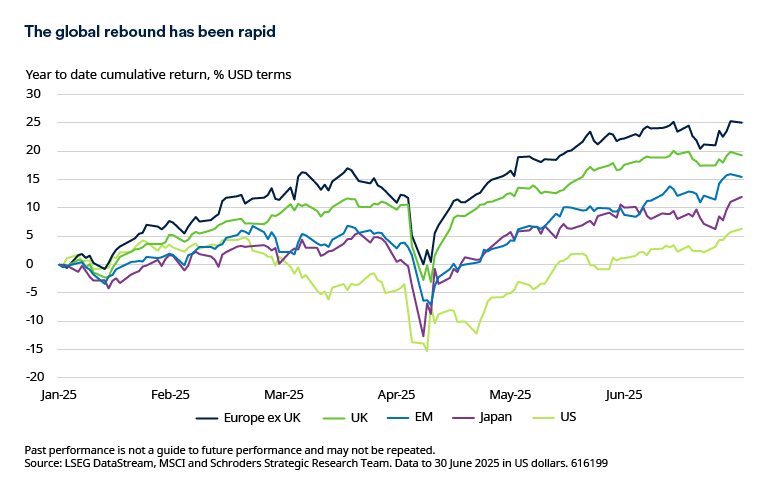

There’s been no shortage of alarming news flow for investors in recent months, including tariffs. Middle East conflict, and rising government debt levels. Yet stock markets have barely broken stride, with US shares shaking off Q1 2025 weakness to reach new all-time highs.

At such junctures, it’s important to remember that stock market performance doesn’t necessarily correlate with political and economic headlines. Stock market trends are driven by a wide variety of influences, including company fundamentals and investor behavior.

But the recent strong performance of equities creates its own unease: can markets keep powering higher? Will the same set of winners continue to lead the way? And how can equity investors position for resilience amid current uncertainty?

High levels of retail participation powering markets

One explanation for the upward move in markets is the ongoing enthusiasm of retail investors. Bob Kaynor, Head of US Small & Mid Cap, said, “The amount of retail exposure in the market is extreme. Over the past 15 years, the retail investor has been trained to buy every dip. That’s resulted in ‘fear of missing out’, rather than a focus on risk-adjusted returns”.

That retail enthusiasm contrasts with the circumspect approach being taken by some more sophisticated investors. Darren Hodges, Portfolio Manager, noted, “Retail investors have been continuously buying, especially in large-cap and high-leveraged stocks, while hedge funds were cutting positions.”

Buying by retail investors is a trend that spans geographies, as Robin Parbrook, Co-Head of Asian Equity Alternative Investments, noted, regarding investment flows into the Chinese market. “More retail-oriented investors tend to prefer themes and momentum; these are stocks whose products are considered ‘on trend’ with rapidly changing Chinese consumer tastes. If you get these thematics right, you can make a lot of money, but the longevity of some of the brands is questionable. It's dangerous to try to second guess thematics when it's driven by retail investors. My view is to be more contrarian.”

It's not only retail investors who are behind the flows in China, though. Both Robin Parbrook and Louisa Lo, Head of Asia ex Japan Equities, highlighted the role of investors seeking high dividend yield stocks. “In China, domestic insurance company money is coming into certain stocks, notably banks, because of the dividend yield,” said Louisa Lo.

A dilemma for active fundamental investors

The difficulty for many active investors is that the stocks powering markets higher are not necessarily supported by fundamentals.

For example, the sustainability of those sought-after Chinese bank dividends is debatable. Tom Wilson, Head of Emerging Market Equities, noted that, “Banks are facing pressure on net interest margins, while asset quality looks unsustainably and suspiciously benign. On existing dividend payout ratios, without raising capital, banks will not generate sufficient capital to support requisite credit growth.”

Some investors who are focused on fundamentals prefer quality stocks over factors like high dividend yield or momentum, but that stance hasn’t necessarily paid off recently.

“There’s a perception that quality has performed well in the US”, said Bob Kaynor, “But actually that’s just a large-cap phenomenon because the Magnificent Seven stocks are such high quality and dominate the S&P 500. Among small caps, quality has not outperformed.”

Quality stocks may not have outperformed recently amid the enthusiasm for themes and high dividend yield. However, the theory is that, with their strong competitive positions and consistent profitability, quality stocks can deliver higher returns in the long run and prove more resilient in the event of a market downturn.

This resilience can prove valuable for long-term investors. The Schroders Global Investor Insights Survey 2025 indicated that 55% of respondents are prioritizing portfolio resilience for the coming 12-18 months, with just 26% saying returns were their top priority.

How long can current market dynamics persist?

The volatility sparked by President Trump’s “Liberation Day” tariff announcements in April briefly put a pause on equity market progress. However, since then, markets have resumed their advance.

Robin Parbrook said, “Large scale overcapacity in many industries in China is helping to keep inflation benign, and that is probably helpful to market sentiment, barring either a rollover in artificial intelligence (AI) capital expenditure or a sovereign bond crisis”.

Indeed, while it’s easy to focus on the risks, there are also many reasons to believe that shares can continue their advance.

“The short-term perspective looks quite positive for equities”, said Alex Tedder, CIO Equities. “Good economic data, plus stimulus from the US tax bill, solid corporate earnings and a slightly improved geopolitical picture could see the S&P 500 reach the 6,700-6,800 level (from about 6,300 as of early August). Clearly, tariff uncertainties persist but the same underlying trends could also be beneficial for some non-US markets such as the UK, Germany and parts of Asia including Japan”.

While much focus has been on the US, some emerging markets may start to look relatively more attractive for long-term investors. James Gautrey, Portfolio Manager, Global Equities, said, “Many countries in the West have very high debt and deficits, and governments unable or unwilling to do anything about it. By contrast, many emerging markets – including parts of Asia – have already had their fiscal crisis and now have lower debts, as well as better demographics. That can make companies located in those regions more interesting.”

Signs of market breadth improving

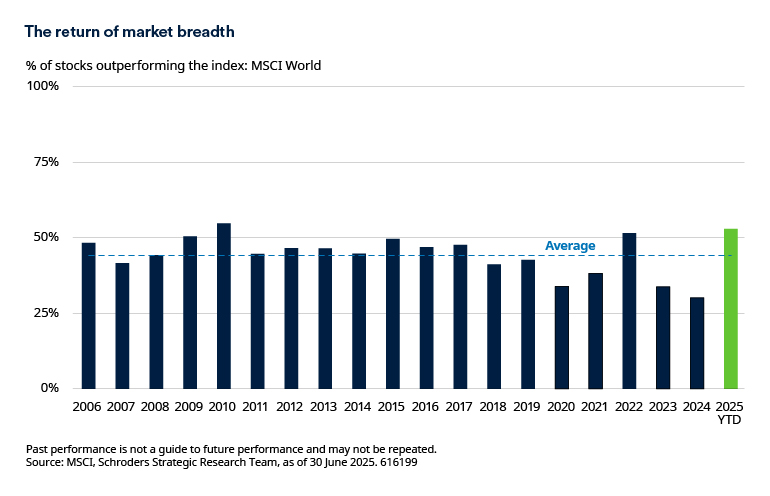

The question is when other parts of the market might start to participate more fully in the gains. Market breadth – the percentage of companies outperforming the index – has been low in four of the past five years (2020, 2021, 2023, 2024).

Flows into those thematic and high yield parts of the market have resulted in ongoing narrow market breadth in some regions, notably China. Louisa Lo highlighted that, “In China, only 19% of the market has outperformed the benchmark, which is unhelpful for investors with diversified portfolios”.

However, there are some signs of improvement so far in 2025, as the chart below shows. Higher market breadth creates a more conducive environment for active investors.

The opportunities for active long-term investors may therefore be expanding, supported by a broadening out of growth drivers in the US, and a reappraisal of the attractions of other regional markets amid worries over US debt.

To find out more about Schroders and the Active Edge, click here

Important information

Marketing material for financial professionals only. All investments involve risk, including loss of principal.

The views and opinions contained herein are those of Schroders and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. Such opinions are subject to change without notice. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Diversification cannot ensure profits or protect against loss of principal.

This information is a marketing communication

Information herein is believed to be reliable but Schroders Capital does not warrant its completeness or accuracy. The data contained in this document has been sourced by Schroders Capital and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders Capital, nor the data provider, will have any liability in connection with the third-party data.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realized.

Schroder Investment Management North America Inc. (“SIMNA Inc.”) is registered as an investment adviser, CRD Number 105820, with the US Securities and Exchange Commission and as a Portfolio Manager, NRD Number 12130, with the securities regulatory authorities in Alberta, British Columbia, Manitoba, Nova Scotia, Ontario, Quebec and Saskatchewan. It provides asset management products and services to clients in the United States and Canada. Schroder Fund Advisors LLC (“SFA”) markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SFA is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker-dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick.