Reshaping the Narrative

The institutional adoption of exchange-traded funds (ETFs) is no longer defined solely by efficiency or convenience. What initially began as a tool for transition management has matured into a foundational element of institutional portfolio construction. Today, ETFs are reshaping how investors think about liquidity, benchmark alignment, and precision exposures—not as short-term instruments, but as infrastructure for long-term implementation.

We examine how institutions are moving beyond traditional ETF narratives—leveraging them to strengthen implementation, reframe strategic decisions and challenge persistent misconceptions.

How ETF Usage Has Evolved in Institutional Portfolios

Institutional use of ETFs has significantly advanced over the past two decades, and many institutions have progressed through a similar set of milestones:

- Transition management: ETFs were first used as temporary placeholders during manager changes or asset reallocations—valued for their liquidity, speed, and low cost. For example, broad equity index ETFs (such as S&P 500 or MSCI EAFE trackers) gave institutions immediate market exposure while new mandates were being funded.

- Benchmark tracking: Institutions began using ETFs to gain broad, policy-aligned exposures more efficiently than building them with active managers. For example, large-cap equity ETFs, core investment-grade bond ETFs, and international developed-markets ETFs are often mapped directly to IPS benchmarks. Using ETFs to track policy benchmarks reduces operational complexity, lowers trading costs compared with holding hundreds of individual securities, and provides daily transparency on exposures.

- Tactical allocations: As familiarity grew, institutions started using ETFs to gain exposure to attractive, timely opportunities based on internal market views. For example, high-yield bond ETFs, sector-focused equity ETFs (e.g., technology or energy), and commodity ETFs (such as gold) enabled institutions to express short-term views quickly and at scale. The benefit over traditional active mandates is faster implementation and easier reversal when views change.

- Strategic asset allocation: Today, many institutions incorporate ETFs as permanent holdings to enhance liquidity, precision, and implementation control. For example, factor ETFs (such as minimum volatility or quality) and targeted fixed-income ETFs allow institutions to fine-tune risk exposures and maintain liquidity buffers within their long-term portfolios. Compared to traditional commingled funds or separate accounts, ETFs provide more flexibility, intraday tradability, and lower administrative burden.

This evolution has given rise to a variety of applications, several of which are now foundational to long-term institutional portfolio construction.

Strategic Asset Allocation: Five Key ETF Use Cases

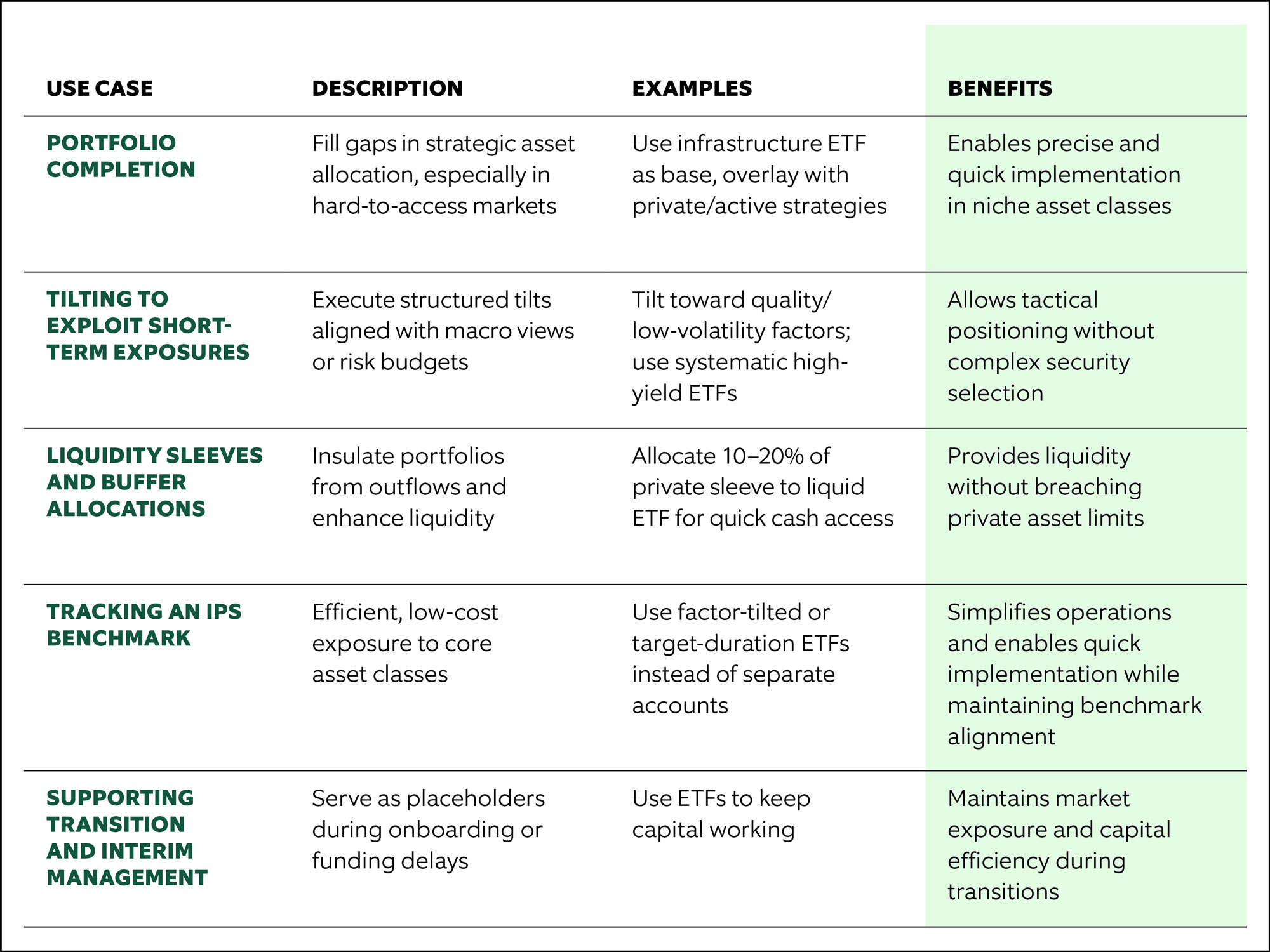

The current landscape of institutional ETF use reflects both innovative application and deliberate, long-term strategy. Here are five of the most prevalent ways institutions are using ETFs today:

Rethinking ETF Size and Liquidity

A common misconception among institutions is that ETF size equals ETF liquidity. In reality, the liquidity of an ETF is tied to the liquidity of its underlying holdings, not the vehicle’s trading volume or assets under management (AUM).

That said, many consultants and institutions still use a $1 billion AUM threshold as a screening tool. While this can simplify diligence, it may also exclude ETFs that deliver unique or differentiated exposures in underrepresented areas like real assets or targeted credit. For these use cases, institutions increasingly accept ETFs with $250–500 million in AUM when paired with education on trading mechanics and structure. In fact, U.S.-listed ETFs with less than $1 billion in AUM have seen $728.2 billion in net new assets (NNA) year-to-date, building off the strong momentum they had in 2024 when they garnered $1.05 trillion in NNA.1

Furthermore, ETF shares can trade at tighter bid-ask spreads than their underlying holdings in some cases—a testament to their ability to provide liquid, efficient exposure. For example, one Northern Trust fixed income ETF with $1.2 billion in AUM has a 30-day average spread of $0.01, or 0.028%, compared to the spread of the underlying bonds, which averaged $0.55 or 0.63%.2

Leading asset managers often have ETF capital markets desks and ETF product specialists who can help institutions navigate large trade sizes and better understand their size and liquidity concerns.

Explore how ETFs can improve liquidity in institutional portfolios

ETFs as Enablers of Precision and Progress

Beyond the product itself, the adoption of ETFs is also heavily driven by the infrastructure and expertise that support them. For example, Northern Trust’s ETF specialists work alongside asset class and capital market experts to help institutions align ETFs with broader investment strategies, providing guidance on everything from execution to portfolio fit.

This institutional support extends beyond investment considerations. For organizations new to ETFs, operational factors such as setting up brokerage accounts or updating internal processes can be meaningful hurdles.

Ultimately, whether the goal is benchmark alignment, risk management, or liquidity planning, ETFs offer institutions a flexible and powerful toolkit for long-term portfolio construction. As innovation continues across systematic strategies, real assets, and fixed income, the role of ETFs in institutional portfolios is poised to expand even further.

Explore how ETFs can fit into your portfolio

1 Source: Nasdaq ETF Intel.

2 Source: Northern Trust Asset Management, as of 8/21/2025.

IMPORTANT INFORMATION

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited, issued in the European Economic Association (“EEA”) by Northern Trust Fund Managers (Ireland) Limited, issued in Australia by Northern Trust Asset Management (Australia) Limited (ACN 648 476 019) which holds an Australian Financial Services Licence (License Number: 529895) and is regulated by the Australian Securities and Investments Commission (ASIC), and issued in Hong Kong by The Northern Trust Company of Hong Kong Limited which is regulated by the Hong Kong Securities and Futures Commission.

This information may not be edited, altered, revised, paraphrased, or otherwise modified without the prior written permission of NTAM. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. NTAM may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, its accuracy and completeness are not guaranteed, and is subject to change. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor.

This information is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, advisor risk, and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe NTAM’s efforts to monitor and manage risk but does not imply low risk.

Past performance is not a guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by NTAM. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index. Net performance returns are reduced by investment management fees and other expenses relating to the management of the account. Gross performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. For U.S. NTI prospects or clients, please refer to Part 2a of the Form ADV or consult an NTI representative for additional information on fees.

Forward-looking statements and assumptions are NTAM’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

Not FDIC insured | May lose value | No bank guarantee