Investors in emerging market debt (EMD) have been rewarded for holding their nerve following a bruising year for the asset class. A rebound in the fourth quarter of 20221 , has carried over into the early months of 2023. We expect this positive momentum to gather pace this year as elections in a number of key emerging economies ease political uncertainty.

Events in China and Brazil set the stage last year. In Brazil, the return of left-wing President Luiz Inácio Lula da Silva has raised investor concerns that his government’s social policies could have an adverse impact on the country’s fiscal position and deter foreign direct investment.

While we are overweight Brazil as a country, we are underweight on its sovereign debt because valuations in the space appear stretched. And while the new administration’s policies could weigh on performance in the quasi-sovereign sector, it is unlikely that any economically damaging policies will make it past the country’s strong institutional and economic frameworks.

In China, President Xi Jinping moved to consolidate power around his inner circle at the National Congress in October last year. It was, however, the abrupt halt of China’s strict zero-Covid policy in the weeks following the twice-a-decade congress that took markets most by surprise and is likely to unleash a sugar-rush of consumer spending across the region over the course of this year. We expect the move will have a positive short-term impact on sectors such as leisure, hotels and retail. But it remains to be seen whether this service-sector boost can be sustained as the country grapples with the colossal challenge of steering its economy from an investment- to a consumption-led model.

In terms of 2023, there are four key elections that EMD investors need to keep an eye on:

Nigeria (February 2023)

In Africa’s biggest economy and its largest democracy, the emergence of a credible third candidate –Peter Obi – in February’s election created a tight contest. Bola Tinubu, running for the incumbent All Progressives Congress, was declared the winner amid claims of voting irregularities by opposition parties.

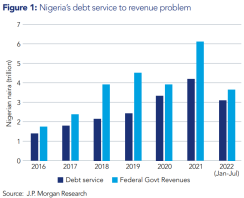

When the president-elect is sworn in on 29 May, he will face a range of economic challenges that have been complicated by Moody’s decision to downgrade Nigeria’s debt rating from B3 to Caa1 in January2. The rating agency cited the government’s fiscal position and national debt as being behind the move, despite there being no imminent risk of default.

In our view, any volatility spurred by Moody’s downgrade is likely to be short lived, and we remain confident in our underlying assessment of Nigeria’s sovereign credit profile. Nonetheless, the incoming administration will need to prioritise fixing the country’s low revenue-to-GDP ratio by expanding the tax base and clamping down on the informal sector.

On the positive side, we are likely to see improvements in Nigeria’s external accounts as the huge Dangote oil refinery begins domestic oil production this year. Crude purchases will be done in Nigerian naira (NGN) and refined product will be available to the domestic market in NGN. With fuel consumption likely to be less of a drain on foreign exchange (FX) reserves, a liberalised and functioning FX market could lead to more inward investment in upstream oil. At the present time, we are neutral Nigeria sovereign, and hold some corporate paper.

Turkey (May 2023)

Turkey is at a crossroads with parliamentary and presidential elections scheduled to take place on the 14 May. The main opposition candidate, Kemal Kilicdaroglu, leader of the centre-left Republican People’s Party (CHP), faces an uphill battle to unseat President Recep Tayyip Erdogan, despite an economic crisis and errors in responding to February’s powerful earthquakes. Erdogan is deeply unpopular with young people and educated professionals but is expected to remain in power. As a result, we expect the economic volatility and political tensions with the West that have characterised his tenure to continue.

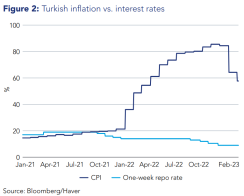

Turkey has pursued unconventional economic policies for more than a decade. The Turkish lira lost about 30% of its value against the dollar in 2022 and 44% the year before3, while inflation peaked at 85% in November4 following a 500-bps run of easing by the Central Bank of the Republic of Turkey. The country’s large structural current account deficit makes it vulnerable to a hard stop in the external funding market.

Despite these problems, policymakers have set about pump-priming the economy ahead of the election, raising the minimum wage by 55% and encouraging Turkish banks to extend credit. But these expansionary policies have impaired the one key strength of the Turkish economy: its fiscal position. As a result, we underweight the country’s sovereigns, and prefer to seek exposure through Turkish corporates and financials.

Pakistan (No later than October 2023)

With dwindling reserves and flatlining economic growth, Pakistan is under significant economic stress. The country negotiated an International Monetary Fund (IMF) bailout in 2019 but has struggled to fulfil the obligations of the agreement. Former prime minister Imran Khan lost a confidence vote last year and a government of national unit was put in place to see out the remainder of his term.

General elections are scheduled to be held less than 60 days after the dissolution of the National Assembly on 13 August. The country’s new leader faces a vast inbox of challenges, including resurrecting the IMF deal and addressing ongoing political tensions with India.

However, it is Pakistan’s relationship with China that is of primary concern to the market. China is the country’s largest creditor – through a vast and opaque network of loans – and wields significant influence over the Islamabad government. The secretive nature of these loans, as well as the IMF package and a free trade agreement with the Gulf Cooperation Council, has encouraged calls for Pakistan to move towards greater economic independence.

Argentina (October 2023)

Argentina’s vice-president and former president, Cristina Fernández de Kirchner – who was found guilty in December of a $1bn fraud case5 – will not contest October’s election. It leaves the field open for more market-friendly candidates to make their pitches for the top job.

The vast subsidies the Argentine state extends across the population ultimately push up inflation and erode living standards for everyone. However, there are signs that voters are re-evaluating the impact these subsidies have on Argentina’s economy and markets are pricing in a shift to a more fiscally-conservative leadership. In anticipation, the country’s bonds appear to have gotten ahead of themselves following an aggressive run in the second half of last year. While we are neutral on the country’s sovereigns, we are pricing in regime change as a positive catalyst.

Learn more about our emerging markets solutions here.

1 Emerging market stocks and bonds stage powerful rebound rally | Financial Times (ft.com)

2 Research: Rating Action: Moody’s downgrades Nigeria’s ratings to Caa1 with a stable outlook, concluding its review – Moody’s (moodys.com)

3 Turkish lira falls to record low near 19 to the dollar | Reuters

4 Turkey’s inflation tops 85% as Erdogan continues to rule out interest rate hikes (cnbc.com)

5 Argentina’s Cristina Fernández de Kirchner convicted of corruption | Financial Times (ft.com)

Disclaimer:

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested.

Investments in emerging markets tend to be more volatile than those in mature markets and the value of an investment can move sharply down or up.

For professional investors only. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.