Blu Putnam, CME Group

AT A GLANCE

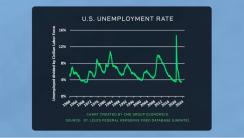

- Financial system challenges may be reflected in a rising unemployment rate during the second half of 2023

- In the currency world, central bank policies are shifting, but not in a synchronized manner

Recognizing increased risks and uncertainty in the corporate world, the emphasis will be on expense management, which means less hiring and, for formerly fast-growing companies, more layoffs. The job market in the second half of 2023 may be much less robust.

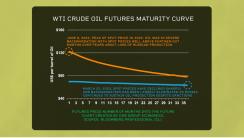

In the energy space, the ability of Russia to continue to sell its oil despite sanctions, albeit to an altered set of customers, coupled with slower economic growth in the aftermath of higher rates and banking system challenges. These factors have led to inventory accumulation and lower oil prices. The backwardation in oil futures prices – that is, spot prices higher than longer-term forward prices – may disappear.

In the currency world, central bank policies are shifting, but not in a synchronized manner. The potential for exchange rate volatility is rising, as each central bank resets its course to adapt to the disruptions, and then behavioral changes that have occurred.

The bottom line is that the second half of 2023 will look little like the first half. Behaviors are being adjusted to respond to all that has occurred. Government policies are being readjusted as well. Risk management is at the forefront in this uncertain world of rapid change.