Erik Norland, CME Group

AT A GLANCE

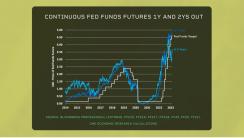

- There are long and variable lags between when monetary policy changes and when those changes show up in economic data

- The effects of tightening monetary policy sometimes don’t show up until six to 24 months after the end of a tightening cycle

But investors, economists and policymakers be warned: there are long and variable lags between when monetary policy changes and when those changes show up in economic data. The effects of tightening monetary policy sometimes don’t show up until six to 24 months after the end of a tightening cycle. The current tightening cycle most likely won’t end for several more months, at the earliest.

2006 offers a classic case in point. Between June 2004 and June 2006, the Fed hiked rates by 425bps. Yet, it wasn’t until December 2007 – a year and a half after the end of the tightening cycle – that the economy officially went into a recession.

After tightening cycles in 1989 and in 2000, it took the economy approximately one year to tip into recession. As such, lag times between monetary policy changes and their impacts on the economy can make it difficult for investors and policymakers alike.