Although hedge funds don’t often see net inflows from investors in September, the redemptions in the past month were unusually large.

Net hedge fund outflows reached $21 billion in September this year, almost twice as large as the September average from 2014 to 2021, according to the latest asset flow report from eVestment, which is part of Nasdaq. It was the fourth consecutive month in which hedge funds had negative inflows.

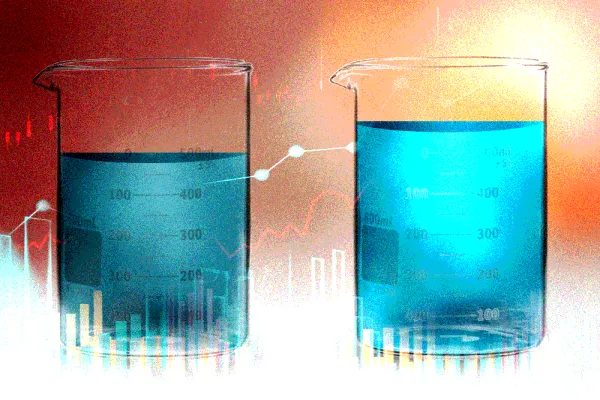

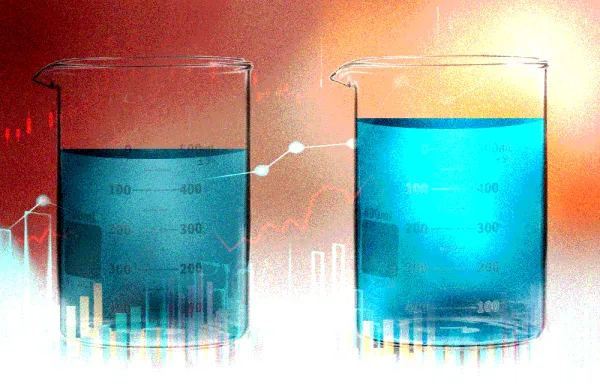

Hedge funds enjoyed a good start in 2022, thanks to an increasing number of institutional investors seeking shelter from the market turmoil. But as time went by, the gap between the best and worst hedge funds grew wider, leading investors to pull money out of the worst-performing funds. The net outflow in the first three quarters reached $63 billion, putting 2022 on track for the second-largest annual net outflow since 2009, according to the eVestment report.

Macro, long-short equity, and multi-strategy funds saw the highest redemptions in September. According to the report, a total of $5.2 billion was removed from macro funds last month, even though the strategy was one of the few that generated positive returns in 2022. Long-short equity funds and multi-strategy funds each had a net outflow of approximately $3 billion in September.

Managed futures strategies were the category that saw positive inflows last month, according to the report, attracting $300 million in net inflows in September and $7.8 billion in the first three quarters of 2022. These strategies gained an average of 2.4 percent in September, followed by alternative risk premia funds, which returned 0.24 percent. Part of the reason managed futures continued to attract assets was that “the largest managers in the space have produced some excellent returns in an otherwise extremely difficult environment,” according to the eVestment report.

Size plays a role in hedge fund redemptions, too. According to Ben Crawford, head of research at Backstop-BarclayHedge, the largest 10 percent of hedge funds picked up an average of 13.5 percent in assets over the trailing 12 months ending in September, while the smallest 10 percent of hedge funds lost an average of 4.5 percent. Across strategies, a randomly selected small fund is far more likely to experience outflows than its larger peers in the current environment, Crawford told II in an e-mail.