Eric Leininger, CME Group

AT A GLANCE

- As the Federal Reserve reduces its balance sheet, the supply of U.S. Treasuries could allow other entities to expand their own positions

- On its current trajectory, the U.S. Treasury will issue $23 billion fewer securities per month, leaving approximately $146 billion in net new duration issuance before the end of 2022

Even though the Treasury will be issuing fewer bonds over that period, the lower supply does not outweigh the lower demand from the Fed. This means that the U.S. rates market will only balance if there is increased buying by other entities, including the private sector.

The Fed recently announced that they will look to reduce their buying by up to $522.5 billion in 2022 and $1.14 trillion in 2023. As the Fed reduces its balance sheet, other entities will see available supply of U.S. Treasuries grow, allowing them to expand their own positions.

The implications of the change in policy from both the Fed and the Treasury are just beginning to become clearer. As well as the greater reliance on non-Fed buyers, another important development is that the supply of government bonds will increase further down the curve relative to more prompt issuance.

One further development is that the changing market profile could also have a significant impact on the derivative markets: as the broader interest rates market needs to absorb more bonds, the potential hedging needs could be massive.

Big Issues

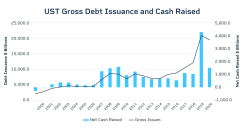

Treasury issuance, although slightly down, remains very high from a historical perspective.In the context of the period from 2002 to 2021, the current level of debt issuance remains enormous. In recent years, Fed purchases helped to digest these elevated levels. Now, though, the Fed is materially capping the purchases it will make from principal repayments.

More Length

The reduction in Treasury refunding will be felt primarily in shorter duration bonds rather than in the long end, although the mid-point of the curve – the 7-year bond – will see the sharpest drop off in issuance.In comparison, the long end – including the 10-, 20- and 30-year bonds — will only see a minor reduction.

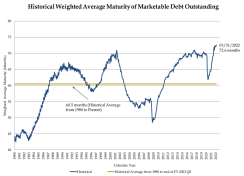

The U.S. Treasury typically targets a five-year duration profile for its issuance, but in recent years it has been issuing securities with a much longer duration.

The Treasury’s aim has been to actively extend the duration of its typical bonds in order to take advantage of the recent low-rate environment. Earlier this year, the Treasury reported that its debt-weighted average maturity had crept out to around six years, while the latest Quarterly Refunding Schedule implies a duration of slightly over eight years.

When we add together likely Treasury issuance with potential mortgage requirements, the market may be looking at up to $146 billion of six-year duration from treasuries and $192.5 billion of five-year duration on the mortgage side.

Grossing up the Treasury notional for five-year equivalent duration by multiplying it by 6/5, the total duration increases to $175 billion. This suggests that around $368 billion of five-year duration will hit the market from June to December.

This figure could be lower if we see slightly less treasury issuance and less mortgage production, but any rise in rates or more issuance would increase duration. A reasonable range of duration is $350 billion to $400 billion in 5-year notes.

Hedging Demand

Such large sums imply an equally large demand for hedging. In derivatives terms, this level of issuance would be equivalent to 3.5-4 million more 5-Year T-Note Future contracts.The current 5-Year Note futures averages a daily trade level of around 1.6 million contracts.

The need for increased hedging in the 5-Year futures is likely to be long lasting, given that outsize issuance around the five-year duration point is expected to keep hitting the market for at least the next two years.

Much of this activity will begin from June onwards as the market is currently expecting that the Fed will hike interest rates by another 50 basis points. Managing and hedging all of this increased duration could potentially keep the interest rates market extremely busy, both this summer and beyond.

Read more articles like this at OpenMarkets