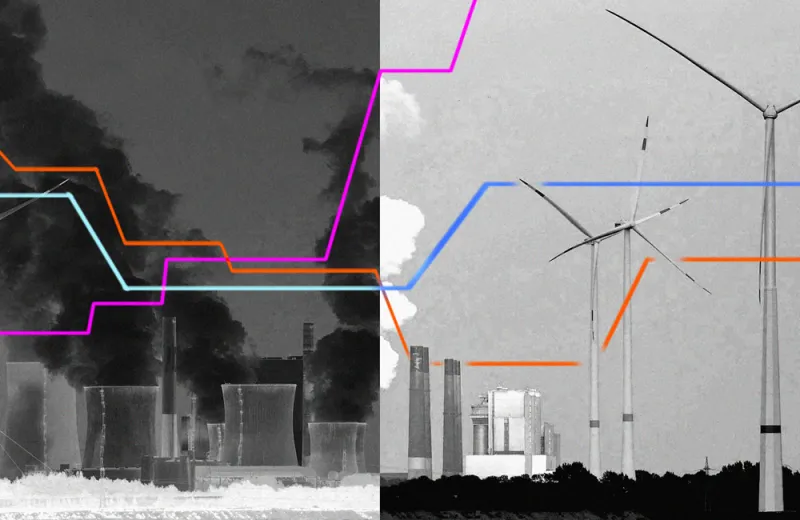

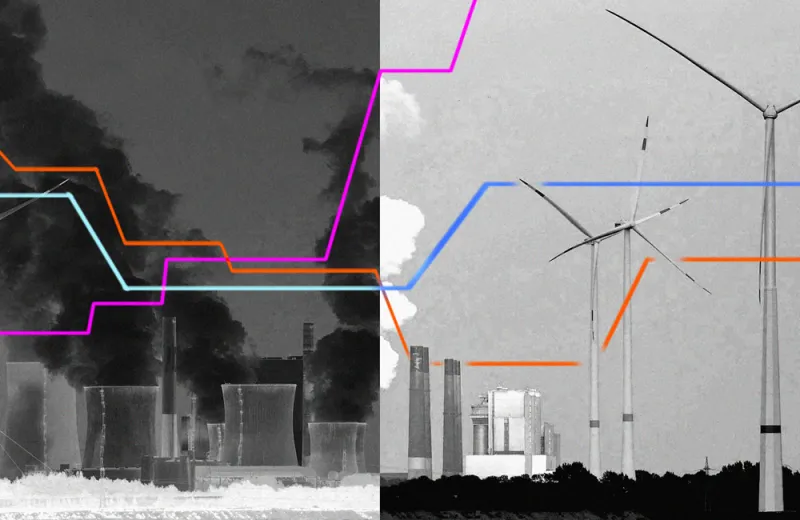

Investors Will Have to Make Big Changes to Truly Decarbonize Their Portfolios, Research Shows

As regulators encourage institutional investors to broaden the scope of carbon-focused investing, the gap between ESG and “traditional” portfolios will widen.