Scott Bauer, for CME Group

AT A GLANCE

- Gold and bitcoin have seen a negative correlation recently, with gold rising 7.5% during bitcoin’s recent price decline

- The popularity of new trading tools like CME Micro Bitcoin futures show a rising interest in bitcoin even as volatility remains high

The extreme volatility of the cryptocurrency has been thoroughly documented, yet investors and financial professionals view that volatility differently depending on their stance on bitcoin. Investors who have taken the ride of bitcoin’s meteoric rise over the last several years have embraced the excessive volatility, whereas naysayers and bitcoin bears point to the high volatility as a burning red flag and reason to steer clear of the investment. During the same two-month span that bitcoin has dropped nearly 50%, gold has appreciated 7.5%.

Bitcoin has been referred to as a gold alternative and, similarly, an inflation hedge due to its finite supply and lack of centralized regulation. Given the recent negative correlation between the assets, is it still an accurate comparison or is there a more correct comparison to make?

Different Drivers

Bitcoin, gold and other commodities derive much of their value from limited supply and growing consumer demand during periods of increased inflation and government regulation fears. In times of uncertainty, investors will flock to gold and precious metals as a safe haven to stay away from government regulated currencies.Although bitcoin, gold and other commodities are similar in that they are not tied to any system, bitcoin differs in its volatility and tendency to be driven by rumors and news. Something as trivial as Elon Musk denouncing bitcoin on Twitter has been followed by major drops in the price of the cryptocurrency. On the other hand, bitcoin skyrocketed to all-time highs during the 2017 holiday season because it was a trendy gift to purchase for friends and family.

Bitcoin now has a volatility over 100%, which should not be surprising to investors or followers of the cryptocurrency who have seen the rollercoaster ride it has taken investors on over the past five years. Although bitcoin and gold may not be “competitors” as an inflationary hedge, they could possibly be complementary in one’s portfolio.

New Approaches to Trading

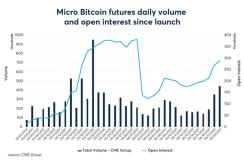

This realization by small and large investors can be seen in the emergence of new trading tools around bitcoin. Bitcoin futures were a notable success following their launch in 2017. And in May 2021, Micro Bitcoin futures launched as a lower-cost alternative to the larger contract (1/10 of one bitcoin) that helps participants hedge their bitcoin price risk without actually owning the asset. In less the two months, more than one million Micro bitcoin contracts have traded at CME Group.

Asset managers have begun to utilize bitcoin in the alternative investment space, as the traditional 60/40 equity-fixed income allocation is becoming outdated. An investment into bitcoin, paired with gold and other commodities, can act as an inflationary hedge while also providing the possibility of capital gains, a strategy rarely considered before when simply using gold as an inflationary hedge. For the investor that utilizes gold as a buffer against traditional equity and fixed income, bitcoin may not be the right fit due its innate volatility. However, for someone looking to break away from the traditional 60/40 allocation and add diversification, bitcoin may be worth investing in.

In order to be truly competitive with gold as a “safe haven” asset, bitcoin would have to be “safe;” and the extremely speculative nature of the asset combined with now 100% volatility have shown the leading crypto is far from being considered safe. However, as a low correlation, speculative investment, traders and investors are increasingly looking at the digital token as a way of achieving diversification in their portfolios.

Read more articles like this at OpenMarkets