Private credit is on a roll. Investors love the strong cash yield and return potential, as well as the diversification and risk mitigation it can bring to a portfolio. Late in 2020 news broke of a new strategic partnership in the asset management space between Mackenzie Investments, one of Canada’s largest investment management firms, and Northleaf Capital Partners, a global private markets investment firm specialized across private equity, private credit, and private infrastructure. Northleaf has been actively investing third-party capital in the private markets since 2001, and in short order the new strategic partners introduced an innovative option to help provide broader access to prospective private credit investors in Canada, in particular for retail high-net-worth clients.

David Ross heads Northleaf’s private credit investment program and says it “has been a great experience collaborating with a trusted and reliable partner in Mackenzie to support both the education of a wider set of investors to the asset class and the distribution of our private credit fund to expand its investor reach.”

I recently spoke with Ross about why investors feel so good about private credit these days, how the asset class complements their portfolios and how it helps shape the “New 40” modern fixed income portfolio.

What is driving growth in private credit right now?

David Ross: Two very strong secular trends have underpinned growth in the private markets. First, the shift toward private markets has been a consistent macro trend over the past few decades: while private markets have grown substantially during this period, the number of publicly traded companies has declined over the past 20 years. So, there are more private companies that require debt financing to fund their growth.The second trend is that banks were historically the primary source of loans for private companies while institutional investors were focused on predominantly liquid loans and niche mezzanine junior debt. That all changed after the global financial crisis when stricter regulation led banks to reduce the size of their balance sheets. The market quickly transitioned to investors like Northleaf, who have replaced bank lenders by raising dedicated funds from institutional clients like pension plans or insurance companies as well as high-net-worth individuals.

How do you describe the size of the opportunity to investors?

Ross: Private credit provides a sizeable opportunity to participate in value creation that is taking place outside the listed markets. Today, almost $1 trillion of capital sits in private credit. The opportunity in private credit is highly diversified, growing, and increasingly global across North America and Europe, with a nascent but growing market in Asia. Overall, the landscape looks more similar today to traditional fixed income in terms of diversification and scale than it has at any point over the last 20 years.Does that similarity to fixed income make investors a little more comfortable with private credit?

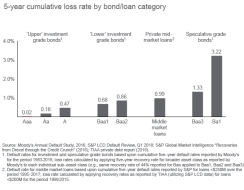

Ross: Once investors engage with the asset class, they understand it has provided stability – in terms of low loss rates and limited volatility – and can deliver relatively high cash yields even on a loss-adjusted basis. Demand from investors for private credit has increased as they have started to view it through the broader lens of their fixed income portfolios as opposed to considering it as a part of smaller alternative or private asset allocations. More broadly, this growing demand for private credit also reflects the modernization of traditional fixed income portfolios and private credit’s critical role in shaping the “New 40”.Middle market loans have exhibited similar loss rates five years after issuance as compared to the lower end of investment grade bonds (Baa2).

What types of borrowers are accessing private credit and driving its growth?

Ross: The majority of borrowers are backed by private equity sponsors. Generally, the asset class has focused on lending to companies with high cash-flow generation and stable business models, and the companies are often regional, if not national, leaders in their specific segments. Ultimately, these borrowers are accessing private debt because they are looking for partners they can trust and who will participate alongside them in a journey toward their strategic plan. They are also looking for some degree of flexibility to achieve their business objectives, which is why they are often willing to pay a premium over other lending alternatives.Many borrowers in private credit are too small to access liquid capital markets, and in some cases private markets are their only source of capital for acquisitions, organic growth, and scaling through capital investment. We have lent to software companies that have strong customer demand and need incremental capital to help drive that growth, insurance businesses that are acquiring competitors and seeking to consolidate the market, and pharmaceutical businesses looking to buy out an equity stake from an existing partner.

What attributes does private credit bring to the modern portfolio?

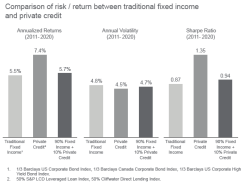

Ross: Private credit has provided investors with high cash yield, low volatility and loss rate and floating rate returns. When we run the analysis for investors on the portfolio impact of private credit, we see that even adding a modest allocation to private credit to their existing bond portfolio often brings the potential benefits into focus – higher returns, lower volatility, and stronger Sharpe ratios.Over the period from 2011 to 2020, adding 10% private credit allocation to a portfolio of public corporate bonds would have improved the return while reducing volatility, resulting in an improved Sharpe ratio.

Another important element at the portfolio level that helps with risk mitigation is the floating rate nature of loans. Particularly where we are now with interest rates and inflation risk, floating rate loans help offset portfolio fixed income rate exposure and reduce the duration risk.

How would you characterize the middle market and what about the middle market should appeal to investors?

Ross: The middle market has been characterized by stability in deal volume and attractive relative value. Within private lending, middle market loans account for the largest volume of deals and the most consistent flow of investments. That means investors have a solid and steady deal pipeline that can consistently create a rich and stable set of investment opportunities.Spreads of US mid-market LBO loans have averaged 600+ bps over the past decade and have widened during periods of dislocation, as lenders require a higher premium to compensate for market volatility.

In terms of risk-return – perhaps the most important element for investors – middle market spreads over the past decade have been consistently between 500 and 700 basis points over LIBOR. The market values creditor protections and investors are attracted to the combination of high cash yield and strong capital preservation potential. The downside risks are mitigated in private lending because lenders directly negotiate and control the key terms in the documents, so you can control the downside protections that you put in place in the individual loan.

The Covid pandemic has been a stress test for every investment strategy and asset class. How did private credit hold up?

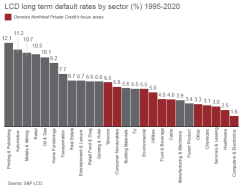

Ross: In many ways it has been the first major cycle for private credit as a more mature asset class. If we look critically at our portfolio, all of our borrowers maintained strong liquidity and every company remained current on their cash interest payments. That’s the critical litmus test. I can’t speak for other managers, but I think private credit is fundamentally about backing strong and stable businesses. So, it isn’t too surprising that the outcome for Northleaf investors was positive. However, I do think that the specific risk profile and the investment philosophy of private credit managers will potentially lead to differentiation over the next couple of years in terms of the performance that comes out of this kind of dislocation event.From our perspective, industry allocation is fundamental. We have systematically avoided sectors that are either capital-intensive or are cyclical and dependent on consumer discretionary spending. This includes sectors such as restaurants, storefront retail, energy, travel, and leisure. Time will tell on any manager’s specific differentiation, but from a private credit standpoint, I think investors and borrowers have generally fared very, very well.

Sectors that are capital-intensive, cyclical, or traditionally dependent on consumer discretionary demand tend to exhibit higher default rates.

What do you think differentiates one private credit manager from another?

Ross: Managers that have access to differentiated deal flow will be able to provide consistent outperformance. Private credit managers should be selected and judged based on their credit underwriting and their loss rate. Our investors are looking for capital preservation and strong cash return, but there is a reasonable expectation that the asset class should generate an illiquidity premium and provide higher returns relative to the other options in the fixed income universe.At Northleaf, we review more than 600 transactions every year and ultimately invest in 20 to 30 individual borrowers. However, origination takes an enormous amount of resources. We have a unique origination model that leverages our private equity relationships that we have built as a firm over decades, and that helps us be highly selective through rigorous diligence – three to six weeks of direct access to management teams and third-party due diligence across financial, operations, legal, and tax. With private companies we can access a significant amount of information over a longer period of time to really ensure that we are underwriting solid businesses.

Why is it important for Northleaf as a firm to create greater access to private credit for a broader base of investors?

Ross: It’s an incredibly important theme for us as we continue to grow our business. Private credit used to be allocated primarily from institutional investors to their alternative baskets and saw quite limited appetite, but institutional investors now see it as a natural extension of what they are doing in traditional fixed income and that has dramatically increased their appetite for the asset class. As we have thought about further broadening the base of investors beyond institutional clients, it really comes down to product education and fund structuring. This is really where the partnership with Mackenzie has significantly enhanced the combined proposition by taking our institutionally-focused private credit strategies and making them accessible for broader distribution to Mackenzie’s clients in Canada.From a product education standpoint, it is absolutely recognized how important it is for us to educate the different channels we are targeting. We have spent a significant amount of time and resources ourselves and increasingly with Mackenzie to ensure that investors truly understand the private credit space, since for many it is a new asset class to their portfolio.

On the fund structuring side, historically private credit has taken the form of closed-end drawdown structures where capital is locked in for the term of the fund, which work really well for larger institutional clients, but it isn’t great for smaller institutions and high net worth investors who may be looking for regular access and more liquidity. Across our existing private markets platform, we have been very pleased to serve investors of all sizes, including some of the largest pension plans in the world – but we have specifically looked to accommodate and democratize private credit to new investors.

Northleaf launched an open-end evergreen structure in 2018 that is open each quarter to new investors and provides a certain amount of quarterly liquidity, and it is the first of its kind in the Canadian market. It has been very well received and expanded the set of investors to include smaller institutional investors that couldn’t or didn’t want to participate in closed-end structures, as well as family offices and high-net-worth investors. It certainly has provided validation that private credit is an asset class that has a wide appeal and that more investors want to access it.

For more information on Northleaf private credit strategies, contact Keith Wosneski at Mackenzie Investments.

This material is for marketing and informational purposes only and does not constitute an offer of investment products or services (or an invitation to make such an offer). This material, including examples related to specific securities, is not intended to constitute investment advice or any form of recommendation.