By Erik Norland, CME Group

AT A GLANCE

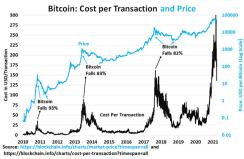

- Bitcoin’s price tends to follow its cost-per-transaction and its volume of trades

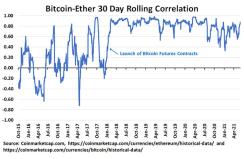

- Ethereum prices have a close correlation to bitcoin, but have seen even higher volatility

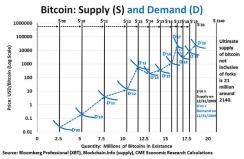

Part of the reason for bitcoin’s volatility is its perfect inelasticity of demand. No matter where the price moves, the supply of bitcoin increases at about the same, pre-ordained pace.

Bitcoin’s supply is perfectly inelastic and increases in supply are slowing with time.

Bitcoin’s latest bear market began at the end of April when prices peaked at around $64,000 per coin. Since then, prices have fallen to as low as $30,000 on an intraday basis. Were there any advance indications of its recent decline?

Here are three time series that cryptocurrency investors might find useful.

1) Cost Per Transaction: Bitcoin has had three previous bear markets in which it fell by 93%, 83% and 82%. Each one of these bear markets came after a spike in bitcoin’s “cost per transaction.” Cost per transaction spiked late last year, according to blockchain.info, rising 10-fold from about $25 per transaction to $250 or more before this year’s correction. Bull markets that followed past bear markets didn’t begin until trading costs had fallen and stayed low for some time.

Are bitcoin bear markets presaged by rising transaction costs of crypto exchanges?

2) Transactions per day: The relationship between trading volumes and bitcoin prices isn’t always clear, but since 2013 a rising number of transactions sometimes seemed to presage rising bitcoin prices, whereas stagnating or falling volumes sometimes appeared ahead of declines in prices. The number of bitcoin transactions has been falling in recent months .

Transactions have often stagnated or fallen before declines in bitcoin prices.

3) Difficulty: This represents the number of calculations necessary for a computer to mint a new bitcoin. In 2010, a computer could perform as few as 10 calculations to produce a coin. Today, it requires 25 trillion calculations on average. This means that with 18.7 million bitcoins in existence, producing the remaining 2.3 million coins will be computationally intensive and expensive. That might not increase the demand for bitcoin, but it will, by all appearances, keep a lid on new supply.

Does rising bitcoin mining difficulty put a floor under bitcoin prices?

What happens with bitcoin has implications for the wider crypto asset universe, including ether, the currency of the Ethereum smart contract network. Ether is both highly correlated with bitcoin and more volatile than bitcoin. To borrow the lingo of equity markets, this makes ether a high beta version of bitcoin. When bitcoin prices rise, ether prices tend to rise more. When bitcoin prices fall, ether prices tend to fall even further.

Bitcoin and ether have been highly correlated, especially since 2018.

Ether tends to be even more volatile than bitcoin.

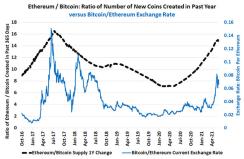

What’s curious is that ether supply isn’t limited in the same manner as bitcoin supply. With bitcoin, there will only be 21 million coins produced, of which about 18.7 million already exist. By contrast, there is no limit to the total number of ether coins that can be created, but only 18 million ether can be created in any 12-month period. One might have imagined that ether’s greater supply flexibility might dampen its volatility, but the opposite appears to be the case.

The ratio of the annual creation of new ether to bitcoin appears to follow the ETHBTC exchange rate. When ether prices rise relative to bitcoin, as they did in 2017 and as they have recently, this appears to incentivize the creation of additional ether coins relative to the pre-ordained number of new bitcoin being created. What this suggests is that new ether supply isn’t so much driving the price of ether as it is responding to the price of ether relative to bitcoin.

When ETHBTC rises, it tends to incentivize the creation of additional ETH.

This suggests that bitcoin retains a substantial first mover, incumbency advantage in the crypto currency world despite the fact that ether, as the currency of the Ethereum smart contract network, may have more practical applications than bitcoin, which is mainly used as a store of value. For many investors, bitcoin remains the first point of entry into the cryptocurrency universe and it retains a substantial role in price discovery for ether and other crypto assets.

Read more articles like this at OpenMarkets