2020 has been an extraordinary year for many reasons. We expect (hope) 2021 to be more subdued as acute tail risk due to COVID-19 and the U.S. elections fade into history and global economies return to “normal.” However, better economic fundamentals may prove a challenge for fixed- income investors if interest rates also normalize—meaning move higher. In short, we expect 2021 to be a year where we pursue “protecting capital and maximizing income” in fixed-income portfolios.

For the macro backdrop in 2021, we expect the U.S. economy to grow above trend (greater than 3.0%) as COVID-19 pressures abate, the U.S. Treasury yield curve to steepen, and the U.S. dollar to weaken. The wildcard is likely to be inflation. Consensus forecasts suggest a benign outlook, but a possible snapback in demand following a vaccine rollout could cause a sharp inflationary spike next year amid lean inventories and less available supply.

For all fixed-income investors, the balance between liquidity management, income generation, and purchasing power protection is always a fine line to walk. 2021 may be particularly tricky if bond yields normalize. All combined, fixed-income investments should provide plenty of opportunities to generate income and maximize total return through a combination of deft curve positioning, astute credit selection, and default avoidance. Below we provide our investment strategies across fixed-income markets as we start 2021.

At WFAM, we highly value diversity of opinions and independent thought across our investment teams. As such, you may notice different views on similar asset classes.

To our clients, best of luck in 2021, and we look forward to working together to navigate these markets.

Money markets

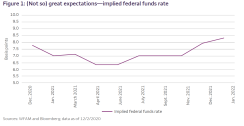

The Federal Reserve (Fed) has demonstrated a commitment to ensuring the smooth functioning of capital markets in 2020. Therefore, we think it would likely be very accommodative in the near term if market volatility were to result from either a rocky political transition or acute COVID-19-related economic struggles prior to widespread vaccinations.

The Fed appears wedded to maintaining a low interest rate environment for at least the next two years or more, judging by policy statements as well as the collective forecast contained in the dot plot (the graph of the Federal Open Market Committee projections). In addition, the recent adoption of the

Flexible Average Inflation Targeting, a form of average inflation targeting that aims for the inflation rate to average 2% over time, as a fait accompli has raised the bar for further tightening, reinforcing a bias toward lower rates for a longer period.

The Fed has also reiterated its commitment to ensuring the smooth functioning of the capital markets. Four lending facilities whose expiration dates had previously been extended from September 30 to December 31 were again extended to expire on March 31, 2021: the Commercial Paper Funding Facility (CPFF), the Money Market Mutual Fund Liquidity Facility (MMLF), the Primary Dealer Credit Facility, and the Paycheck Protection Program Liquidity Facility. The first two programs, the CPFF and MMLF, are of particular importance for short-term market liquidity during times of acute stress. The Fed notes that these facilities “support market functioning and enhance the flow of credit to the economy” and their continued availability will help spur our economic recovery. With that in mind, should we continue to be gripped by the pandemic going into early spring 2021, it would not be unusual for these facilities to be extended for another quarter.

There are currently two vacancies on the Fed’s Board of Governors—one since 2014 and the other since 2018. The confirmation of the first of Trump’s nominees for the vacancies, Judy Shelton, failed to advance in the Senate when put to the vote in late November. The second Trump nominee, Christopher Waller, the director of research at the St. Louis Federal Reserve Bank, is scheduled for a vote in early December. President-Elect Biden, then, will have the opportunity to nominate an individual to fill at least one seat—and maybe both seats if Waller’s nomination also fails to be confirmed by the Senate. For those keeping track of the balance of power, this may seem important in ensuring a consistent approach to monetary policy. The political persuasion of such candidates may not be meaningful, however, because the Fed, in spite of a 4-1 Republican composition, has fiercely resisted politicizing

its policy decisions.

The apparent election result of a divided government has greatly dimmed the prospects for a significant fiscal package to boost the economic recovery, likely spurring the Fed to be more accommodative than it would have been had fiscal policy been stronger. Given its apparent continued distaste for negative interest rates, we expect the Fed will continue to lean on asset purchases and forward guidance, and it may extend the term of its securities purchases as its next easing move. As the Fed continues with its quantitative easing, banking system reserves grow, adding to the investable cash in the system. This growth in money market demand, combined with the steady erosion in supply as the U.S. Treasury gradually extends its liability mix away from Treasury bills, should weigh on money market yields over time.

Money market investment themes

Liquidity is key. It is the primary focus of our portfolio construction and is paramount for meeting the needs of our clients. Although liquidity levels are slightly elevated at the moment due to the perception of volatility-inducing events in the system, we will continue to pursue a strategy consistent with the current interest rate and risk environment.

Short-term taxable yields. It may be difficult to pass another large stimulus plan with a divided government. We therefore expect yields to grind lower. Newly reborn deficit hawks under Senator Mitch McConnell may balk at significant stimulus, leaving the U.S. Treasury bill market to slowly grind toward even lower yields as net issuance declines over time.

Short-term tax-exempt yields. We think the potential for reversals to 2017 Trump tax cuts could boost blue state finances and increase the attractiveness of tax-exempt securities.

Risks. Under a Biden administration, the financial regulatory team could take a tougher approach to financial industry regulation. This may increase the chances of regulatory reform targeted toward money market funds in the future.

Short duration

We expect the front end of the yield curve to remain anchored at low levels. The recent decision by the U.S. Treasury to end the extraordinary purchase programs affecting the corporate and municipal credit markets means overnight interest rates and asset purchases are again the primary tools the Fed has to affect monetary policy. While the intermediate and long end of the Treasury curve may be subject to higher yields due to inflation expectations, we expect three-year and shorter yields will be anchored by the Fed’s policy rate.

Corporate credit may add value

Triple-B-rated corporate bond spreads at the front end of the curve remain cheap compared with the tighter pre-pandemic spread levels, and we think it has room to tighten further because supply and demand factors are favorable. The risk to this outlook would be a dip in economic growth should there be new pandemic-driven lockdowns.

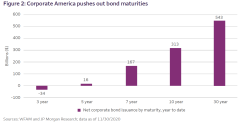

While corporate bond supply in the broad U.S. corporate market hit record levels in 2020, issuance in five-year and shorter tenors was little changed from 2019. Many companies redeemed their high coupon front-end issues in favor of long-end financing at cheaper rates. Looking ahead, full-year 2021 supply is expected to decline approximately 25%, a lull in issuance after many companies issued record amounts in debt in 2020 to bolster their cash balances to weather the pandemic’s economic fallout.

Demand trends look favorable because many investors continue to earmark portfolio allocations for the corporate sector and foreign investors find the intermediate and long end attractive on a currency- hedged basis. We see relative value in corporate bonds, especially since credit curves appear fair to cheap. And incremental risk can be very additive when measured on a percentage basis since absolute yields are low.

BS and MBS may be sources of diversification

The asset-backed securities (ABS) sector has repriced to levels more expensive than pre-pandemic because consumer credit metrics have held up more positively than they did during the global financial crisis of 2008. While there is little room for additional price improvement, the sector may provide diversification benefits and be defensive in nature. Being AAA-rated, we think the agency mortgage- backed securities (MBS) sector is attractive versus other short-term yield-advantaged sectors and it has maintained bid-side liquidity throughout the spring market disruption.

Municipals

The municipal bond market begins 2021 in an unsettled atmosphere because two Senate runoff elections in Georgia—which take place January 5, 2021—will determine the fiscal policy trajectory for at least the next two years. We continue to believe that a Biden administration will be supportive of municipalities around the country. Given this fairly benign backdrop, municipal portfolios are expected to benefit from a favorable technical environment in January and February and from potential spread tightening for lower-rated investment-grade bonds.

As such, we are biased to extend portfolio duration, maintain and/or add to an overweight in A-rated and BBB-rated bonds and high-beta sectors, and increase our exposure to widely held story credits (Illinois, Chicago, and the New York Metropolitan Transportation Authority). These three strategies are agnostic to the results of the Georgia runoffs because all are expected to perform in either divided or unified government. It’s worth noting that Democratic wins in the House, Senate, and presidency—a blue wave scenario—would be most beneficial to municipal investors.

Municipal investment themes

Extend duration. Our bias for longer duration in municipals is designed to capitalize on strong market technicals, which we expect to occur in January and February, and a steep-ish yield curve. Municipal issuers came to market in record levels in October, which likely included some transactions that would have otherwise been issued in early 2021. Moderate primary market issuance and projected net negative tax- exempt supply in January and February all point to supportive tax-exempt municipal technicals into early 2021. Should our interest rate expectations turn bearish, we believe it would be relatively easy to reduce duration in this supportive technical backdrop. On the other hand, our duration bias would benefit from the potential additional federal stimulus and other muni-friendly policies under a Biden administration.

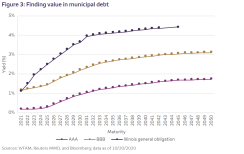

Overweight lower-rated investment-grade municipals. Our overweight to A-rated and BBB-rated municipals is predicated on our expectation that spreads between these two credit categories will compress. For example, between 2015 and 2019, BBB-rated 30-year Thomson Reuters Municipal Market Data (MMD) yields averaged 84 basis points (bps) over AAA-rated 30-year MMD yields.

During the pandemic, this difference in yield, or spread, peaked at 157 bps in early May. This spread has since narrowed to 128 bps in early December 2020 but still remains above recent averages and has room to tighten further in 2021. We think spreads will continue to tighten due to some combination of additional federal fiscal stimulus, a reestablishment of the Fed’s Municipal Liquidity Facility, and increased confidence in the economy resulting from the progress in and distribution of a COVID-19 vaccine. As we look at individual credits, we see that market technicals have driven prices to levels not supported by fundamentals on some issuers yet downside risk is more fully priced in than upside potential in other cases. This is where bottom-up credit analysis and individual security selection are key, especially for marginal credits in riskier sectors such as transportation, higher education, and health care.

Overweight select “story” credits. We continue to favor several large “story” credits in the municipal market, including the State of Illinois, New York Metropolitan Transportation Authority, and City of Chicago. These issuers have experienced significant spread widening over the past couple months and yields have decoupled from other high-yield bonds, and especially from similarly rated securities. At current levels, these credits have widened to levels inconsistent with the current ratings and potential bear rating cases. Given these wide spreads, we believe that even a modest tightening from an improved economy or additional fiscal relief package would provide significant relative value versus high-grade names.

Multi-Sector Fixed Income – Investment Grade

The economic effects of COVID-19 are likely to weigh on the U.S. and global economies for the coming months. With that for a background, we expect interest rates to stay low and the Fed to remain accommodative through 2021. In addition, investment-grade corporate credit appears rich to us, but we also see pockets of value. Meanwhile, structured products look attractive on a risk- adjusted basis.

Our central expectations for interest rates in 2021:

- Federal funds target rate: 0.00%–0.25% | 2-year Treasury yields: 0.15%–0.40%

- 5-year Treasury yields: 0.25%–0.50% | 10-year Treasury yields: 0.75%–1.25%

Corporate credit. We expect investment-grade corporate credit spreads will be range bound around current levels as the negative impacts of COVID-19 are offset with the positive impacts of fiscal and monetary stimulus early next year. Over the course of 2021, we expect credit spreads to trade in a range of 85 bps to 115 bps compared with a current level of 100 bps.

U.S. corporate credit is expected to remain well supported by strong supply and demand technicals. Investment-grade corporate gross and net supply is expected to decrease in 2021 by 30% and 55%, respectively, versus 2020 levels. Given our view for low interest rates across the U.S. Treasury curve, incremental yield in corporate credit should continue to be a high-quality source of income for domestic and global investment-grade fixed-income investors. This is particularly true for non–U.S. dollar investors searching for positive nominal yields. Favorable hedging costs should continue to encourage global investors to swap into U.S. dollar bonds as they stare into a stock of $17 trillion worth of negative-yielding debt in Europe and Asia.

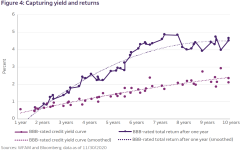

Steep credit curves also are expected to provide attractive total return opportunities in 2021. Demand technicals and the Fed’s front-end corporate purchasing program have resulted in a steepening in the intermediate part of the credit curve. The five- to seven-year part of the corporate credit curve offers opportunities to earn excess return through the roll-down effect, a natural decline in yields as the maturity shortens. We maintain an overweight to the five- to seven-year area of the credit curve heading into 2021 and will continue to look for attractive roll-down opportunities.

We prefer defensive, stable sectors with strong liquidity over cyclical sectors. This includes technology, communication, and banks. We are underweight basic industry and consumer sectors. That said, we maintain a modest bias toward BBB-rated debt as a beta compression trade continues as the economy recovers and progress is made toward a COVID-19 vaccine.

Structured products. ABS spreads are likely to tighten in 2021 as the labor market continues to recover and the economy expands. Credit losses and delinquency rates may increase over the first half of the year due to continued pandemic stress but are likely to then moderate as the economy expands.

High-quality consumers will be less affected than non-prime consumers. The market expects a second stimulus package in the near future, but it may be smaller than initially expected, which could put further pressure on credit performance. Fiscal policy going forward is likely to be limited in scope and impact. ABS supply is projected to increase to $220 billion in 2021, compared with $171 billion in 2020 year to date and $229 billion in 2019.

Conduit commercial mortgage-backed securities (CMBS) credit curves are likely to steepen in the first half of 2021. We think AAA-rated last-cash-flow spreads are likely to be range bound around current levels, while BBB-rated CMBS will lag. Despite a Biden win in the U.S. presidential election, we do not expect direct government help for commercial real estate borrowers in the near term. The proposed “Hope Act” is unlikely to pass in a divided Congress. New issues have been well received—however, without retail or hospitality loans. Transaction levels will be an important indicator of health of the commercial real estate market going forward. Widespread vaccinations and fewer lockdown restrictions would be promising for spreads, but not a panacea for commercial real estate fundamentals because the longer-term impacts on the retail and office sectors are yet to be seen.

Collateralized loan obligation (CLO) spreads are likely to compress modestly through 2021. We expect COVID-19 to continue to put pressure on leveraged loan issuers, causing many downgrades in the sector. However, CLOs have outperformed the leveraged loan market in terms of total return. The U.S. leveraged loan default rate has now risen to 4.0%, while CLO default rates remain below 2.5%. We think the credit impact on high-grade CLO tranches (AAA and AA) will remain limited due to high credit support levels of AAA/AA classes, their first priority in the cash-flow payment dates (known as waterfalls), diversified deals in terms of individual names and sectors; and the ability of CLO managers to identify and trade out of unwanted tranches.

Agency MBS will also likely experience positive technicals in 2021, as the Fed is expected to remain accommodative and banks are likely to continue to add to their holdings, thereby keeping valuations tight. Without a sharp move in interest rates, the refinancing wave will continue, reaching seasoned borrowers.

Multi-Sector Fixed Income – Plus

Over the past 11 months, the global economy has experienced a full business cycle—transitioning from expansion, recession, recovery, and back to expansion. The speed and intensity of the move is unlike any experienced in modern times. However, fixed-income investors were able to generate handsome returns and grow portfolios. As the year closes and we position for 2021, we find ourselves back in an environment where many fixed-income sectors are priced extremely rich with limited upside price potential and considerable downside price risk. As such, we are focused on capital protection and yield enhancement to improve the convexity characteristics of our portfolios and maximize total returns.

This environment favors an actively managed, highly diversified fixed-income portfolio that relies on tactical curve positioning, focused sector strategies across different segments of fixed income, and different cyclical sensitivities. While valuations are rich across many areas of fixed income, plenty of opportunities remain to add value as part of a diversified fixed-income portfolio in 2021.

Multi-sector plus investment themes

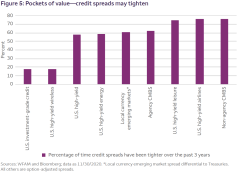

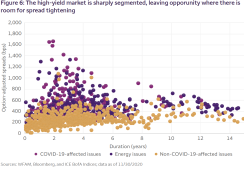

U.S. dollar high yield. On the surface, high-yield spreads are tight. Having rallied nearly 700 bps since their widest levels in March, high-yield bonds have certainly run pretty far. However, current index spreads are still wider than their pre-COVID-19 levels and are wider than they have been 60% of the time over the past three years. Digging into sector opportunities, those areas most affected by the pandemic and concurrent energy sell-off earlier this year remain wider than recent averages and present attractive opportunities, in our opinion. Thorough credit research and selectivity will be important to realizing gains in these areas, but we see potential for spreads here to narrow. COVID-19-affected sectors have more room to run, especially in a post-vaccine economy with pent-up consumer demand to deploy.

Non-agency CMBS. Agency CMBS spreads have narrowed to historically tight levels since March, having been supported by Fed purchases. We prefer to look for opportunities in A-rated and BBB-rated non- agency CMBS conduit deals that are trading closer to their long-term averages. We also see upside in single-asset, single-borrower structures that are collateralized by certain lodging and retail properties. This sector has significantly lagged other parts of the securitized market less affected by COVID-19, and we believe it will benefit from an improving economy.

Local currency emerging markets. Local emerging market debt is providing over 300 bps of incremental yield relative to U.S. Treasuries. This incremental yield pickup over Treasuries is roughly the same as it was on June 1, 2020, and flat compared with the year-to-date and five-year averages.

Macro fundamentals are also improving in many emerging market economies, and these fundamentals are expected to continue to outperform their developed market peers as vaccines rollout globally.

Local emerging markets also experienced the largest outflows on record in 2020, likely leaving many investors underexposed. However, recent flows indicate that global investors are migrating back into local emerging markets, providing additional room for local emerging markets to outperform given the relatively attractive valuations, improving fundamentals, and stronger global flows into the sector.

Global high-yield bonds and loans

The outlook for high-yield loans and bonds looks relatively bright next year, especially when compared with other parts of fixed income. We expect 2021 to be more subdued as acute tail risk due to COVID-19 and the U.S. elections fades and global economies recover. For investors in high-yield bonds and loans, the potential for mid- to high-single-digit returns over the course of 2021 is distinctly possible but will require deft curve positioning, astute credit selection, and default avoidance.

Global high-yield investment themes

Look for rising stars. Against this backdrop, we think high-yield energy companies should benefit and we also look for “fallen angels” in other sectors to transform to “rising stars.” COVID-19-related corporate recoveries will likely persist early in 2021 once an effective vaccine starts to roll out and consumer patterns normalize. Selling call-constrained high-yield bonds may also help boost performance. Conversely, bankruptcy risk is likely to persist in select stressed names as the economy normalizes at a decelerating pace.

Go global. Global diversification should help high-yield bond and loan portfolios. In Europe, improved earnings, a slower rate of credit-rating downgrades, and a peak in default rates should all conspire to support better fundamentals and a bias toward cyclical sectors over defensive sectors. We also expect favorable technicals to persist, specifically in the loan market as CLO creation is likely to be robust in the first half of 2021. As for valuations, absolute yields remain low. That said, the potential of a combination of spread compression and a stronger euro vis-à-vis U.S. dollar makes European credit attractive. In short, European sub-investment-grade spreads should tighten over the course of 2021, particularly during the first half of the year.

Positive credit convexity. At 420 bps, high-yield credit spreads are inside long-term averages but still remain about 120 bps wide of post-financial-crisis tights. We expect spreads to grind tighter over the coming year as yield-hungry investors pivot to the asset class and fundamentals improve. Spread tightening should more than offset higher U.S. Treasury yields and help drive total returns. Due to a sharp segmentation in the market, much of the spread tightening will likely come from recovery in COVID-19-related companies and energy sub-sectors. In addition, security selection among low-rated credits is likely to prove a deciding factor in portfolios. Select exposure to performing CCC-rated debt should bolster returns. Transportation, leisure, and non-bank finance all look relatively attractive compared with the overall high-yield market. A barbell curve strategy—one with a heavy focus on bonds with short-dated maturities and high yields to call coupled with long- end fundamental recovery stories—may bolster portfolio convexity while tempering the drag from expected Treasury curve steepening.

European investment-grade credit

European investment-grade debt is poised to benefit from very strong technicals in 2021.

Less supply, more demand. 2020 has seen historic volumes of corporate borrowing globally. While U.S. investment-grade bond issuance is up 56% year over year, the picture is more nuanced in Europe with overall supply up only 4% in 2020 compared with 2019. Popping the hood, this hides a record 25% increase in European nonfinancial corporate supply, masked by an 11% decline in bank issuance. The European Central Bank (ECB) flushed the financial system with liquidity to make sure banks didn’t have to come to market. The net result is that nonfinancial corporates are now sitting on record volumes of cash, with ICE BofA estimating that corporate treasurers have added €285 billion to their cash hoard in 2020 alone. As a result, supply is expected to be lower in 2021 at around €525 billion.

On the demand side, the ECB holds €270 billion of corporate bonds bought via its Corporate Sector Purchase Programme and Pandemic Emergency Purchase Program and it’s expected to buy another €115 billion in 2021. The ECB’s focus is likely to continue to be on primary issuance, further reducing supply available to market participants. Debt maturities will free up a further €290 billion for investors.

So all in all, after tenders (there is a potential for €45 billion worth of tenders next year), ECB purchases, and maturities, net supply is likely to be down significantly compared with 2020, creating a very supportive technical picture for the asset class.

European credit investment themes

Credit risk over duration risk. With the highest-yielding German government bond now yielding

-16 bps, the search for positive yield has pushed investors even further down the credit curve with some high-quality 10-year corporate bonds now trading at negative yields. With a reasonable third- quarter 2020 reporting season behind us, corporate cash buffers supporting fundamentals, and political headwinds switching to tailwinds, we think the environment in the next 12 months looks supportive for risk assets.

Green bond bonanza. The euro has become the funding currency of choice for green issuance, with euro-denominated bonds now making up 65% of the ICE BofA Green Index. Demand for green bonds remains incredibly strong, and this should only accelerate in 2021. Recent developments have included coupon step-ups to encourage issuers to meet key environmental, social, and governance (ESG) indicators, as seen in bonds issued from Italian utility Enel and global cement manufacturer LafargeHolcim. Snam, Europe’s largest listed utility, has even become the first issuer to make its sustainability rating legally binding by having a clause to have its sustainable label removed if its ESG rating drops below a certain level. The ECB has added sustainability-linked bonds to its list of eligible assets from January 2021, paving the way for more issuance and green money chasing euro assets.

Financials. We expect financial contingent convertible bonds (CoCos) to outperform traditional high- yield and investment-grade bonds in 2021. Overall, we believe that European bank balance sheet strength is sufficient to meet the challenges of a COVID-19-induced recession in 2021 and possibly into 2022.

- Bank capital levels have doubled from 7.2% to 14.6% in the past 12 years.

- As a result of COVID-19, regulatory capital requirements have been lowered to encourage bank lending. Therefore, already strong CoCo coupon buffers have improved in 2020 by an average of 25% for the larger banks.

- Government credit and employment support programs mitigate and delay defaults and absorb substantial COVID-19 recession credit costs from bank loan pools.

- Bank liquidity is extremely strong and will strengthen further with ongoing quantitative easing and ECB long-term repo operations.

In conclusion, we think strong technicals should ensure that euro investment-grade credit spreads continue to exhibit lower volatility relative to their U.S. dollar and British pound sterling counterparts. The expected improving environment suggests BBB-rated corporates and corporate hybrids should perform well in 2021, offering both a pickup in yield and some yield cushion should euro government bond yields rise on higher inflation expectations. Financials are likely to provide investment opportunities as supply and demand dynamics are expected to be more balanced than for nonfinancial corporates next year, and the ECB does not purchase bank bonds. Caution should prevail in sectors less affected by COVID-19, given valuations.

Global fixed income

Over the two-year period spanning 2020 and 2021, nominal GDP in developed economies is forecast to remain unchanged or falling, including the growth bounce-back expected in 2021. This comes at a time when budget deficits have exploded in response to the COVID-19-induced slowdown. We believe the net result will be a sharp deterioration in the debt dynamics of major economies (and many others, too). The past two decades in developed economies, particularly Japan and Europe, have shown that over- indebtedness is a strong deflationary backdrop.

Global fixed-income investment themes

Emerging market outperformance. Yields have converged dramatically in developed markets and the relative value between countries has diminished. While the U.S. still remains the best-value major market, value has been reduced. Elsewhere, the best value is to be found in some developing/emerging markets where there are superior nominal and real yields. We maintain overweights to Brazil, Mexico, India, Indonesia, Malaysia, Romania, Hungary, Russia, and South Africa.

Higher yields in developed markets. We do not foresee a huge rise in longer-maturity yields as the global economy recovers, but a shorter-duration profile is warranted for the time being. We prefer longer maturities only in our favored developing/emerging markets. Over the longer term, yields are likely to remain low as central banks keep short-term rates at or close to zero.

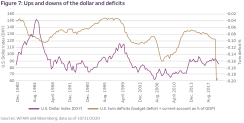

Weaker U.S. dollar. There have been three major periods of U.S. dollar strength over the past four decades: October 1978 to February 1985, September 1992 to July 2001, and March 2008 to January 2017. The first two periods were both followed by 40%–50% declines that lasted several years.

It may be too early to call January 2017 a major peak but it may well prove to be as the twin deficit continues to deteriorate and the U.S. has lost its relative interest rate advantage. The twin deficit equals the current account (% GDP) + the budget deficit (% GDP). The current account measures international transactions—in this case, the U.S. and the rest of the world—and includes net trade in goods and services, net earnings on cross-border investments, and net transfer payments.

With the huge increase in the budget deficit, the twin deficits have increased significantly—that is, they have become more negative, putting increased downward pressure on the U.S. dollar. In July, we reinstated an underweight to the U.S. dollar as we become more confident that a major move lower had begun. There have been several false dawns with respect to a new U.S. dollar bear market, but if this move accelerates and becomes entrenched, we will likely increase our underweight. Over the next year, this is likely to be the largest driver of returns for portfolios that can take currency risk away from the U.S. dollar. Historically, a declining U.S. dollar has supported returns from developing and emerging markets. Currencies that we currently have diversified overweights to are the euro, Canadian dollar, Australian dollar, New Zealand dollar, Indonesian rupiah, Mexican peso, Brazilian real, and South African rand.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The views expressed and any forward-looking statements are as of December 10, 2020, and are those of portfolio specialists George Bory, Helen Roberts, Michael Rodgers, and Danny Sarnowski and/or Wells Fargo Asset Management. The information and statistics in this report have been obtained from sources we believe to be reliable but are not guaranteed by us to be accurate or complete. Any and all earnings, projections, and estimates assume certain conditions and industry developments, which are subject to change. The opinions stated are those of the author and are not intended to be used as investment advice. Discussions of individual securities or the markets generally are not intended as individual recommendations. The views and any forward-looking statements are subject to change at any time in response to changing circumstances in the market and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally, or any mutual fund. Wells Fargo Asset Management disclaims any obligation to publicly update or revise any views expressed or forward-looking statements.

Wells Fargo Asset Management (WFAM) is the trade name for certain investment advisory/management companies owned by Wells Fargo & Company. These companies include but are not limited to Wells Capital Management Inc. and Wells Fargo Funds Management, LLC. Certain products managed by WFAM entities are distributed by Wells Fargo Funds Distributor, LLC (a broker-dealer and Member FINRA).

Copyright 2020. ICE Data Indices, LLC. All rights reserved.

Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility

in the bond market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the fund and its share price can be sudden and unpredictable. Investing in environmental, social, and governance (ESG) carries the risk that, under certain market conditions, the investments may underperform products that invest in a broader array of investments. In addition, some ESG investments may be dependent on government tax incentives and subsidies and on political support for certain environmental technologies and companies. The ESG sector also may have challenges such as a limited number of issuers and liquidity in the market, including a robust secondary market. Investing primarily in responsible investments carries the risk that, under certain market conditions, an investment may underperform funds that do not use a responsible investment strategy.

Diversification does not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

The ratings indicated are from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit-quality ratings: Credit-quality ratings apply to underlying holdings of the fund and not the fund itself. Standard & Poor’s rates the creditworthiness of bonds from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Moody’s rates the creditworthiness of bonds from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Fitch rates the creditworthiness of bonds from AAA (highest) to D (lowest).

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

FOR INVESTMENT PROFESSIONAL USE ONLY – NOT FOR USE WITH THE RETAIL PUBLIC

© 2020 Wells Fargo & Company. All rights reserved. PAR-1220-00776