Adila McHich, CME Group

AT A GLANCE

- Replacing coal with natural gas has led to a 33% reduction of U.S. emissions from their 2007 peak

- China is the world’s largest importer of natural gas, and its investments in gas projects are estimated at $152 billion

Competition among major countries over energy security and supply diversification has placed natural gas firmly in the geopolitical agenda. This is particularly true of the United States and China, which are the world’s largest economies and largest emitters of greenhouse gases.

Gas Expansion in U.S.

Natural gas is an essential engine entangled in many sectors of the economy: power generation, industrial, commercial, and residential sectors where it competes with other fuels.Natural gas has considerably increased its role in the U.S. power sector by displacing coal with its more competitive price. Coal-to-gas switching has led to a reduction of 33% of emissions from their peak in 2007 based on EIA data.

In 2020, gas accounted for approximately 40% of electricity generation in the United States. This has allowed the U.S. to achieve larger emissions savings than China. In addition, gas-fired generation offers the reliability and flexibility to be a backup source to intermittent renewables at least until the technology advances and cost-effective storage options are developed.

China Energy Security

In the last decade, China has embarked on a massive plan for economic expansion and social development that has been the impetus of significant growth in gas consumption.Chinese gas demand represented 8% of world gas consumption in 2019 compared to 3% a few years ago. Its gas reserve levels account for 4% of the world’s total against just 2% five years ago, while its production is approximately 4.5% of global market share.

China relies heavily on imports since its expanding demand is outpacing its production and gas reserves. In 2019, China became the world’s largest gas importer. Consequently, Beijing is well aware of its heavy reliance on imports, which represents an energy supply risk.

Belt and Road Initiative

The importance of natural gas in China’s economic planning is reflected in the Belt and Road Initiative (BRI) that launched in 2013.The BRI is a mega plan valued at over $2 trillion that is focused on expanding China’s economic, energy and geopolitical influence throughout the East and South China Seas, the Indian Ocean, and the Middle East.

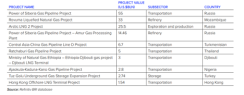

Digital and energy infrastructure constitutes one of the pillars of the BRI, which is perceived as one of the most ambitious infrastructure projects ever. Investments on gas projects are estimated around $152.4 billion. As the chart below indicates, exploration and production accounted for only 16.9% of this figure, while transportation and processing accounted for 81.3%. Power of Siberia, a 3,000 km-long gas pipeline linking eastern Siberia with China, is one of the most high-profile gas projects in the region due to its $55 billion cost and strategic significance as a symbol of an alliance between Beijing and Moscow.

BRI Gas Investment Projects

In a surprise step, President Xi Jinping announced at the United Nations General Assembly in September 2020 a commitment to achieve net zero carbon emissions by 2060.

Coal has historically played a major role in the Chinese energy mix and accounts for approximately 60% of electricity generation. Increased concerns about air quality and the environment have encouraged the Chinese government to put in place new directives and reforms to mitigate climate risk and also to expand the role of natural gas in different sectors.

Natural gas power plants have displaced coal boilers in those industrial and residential sectors that were major sources of greenhouse gas emissions. Also, wholesale prices at the point where natural gas is transferred from a pipeline to a local natural gas utility, referred to as Citygate tariffs, are being deregulated to allow market forces to determine prices.

On the investment side, the Chinese government has opened direct ownership of city gas companies to foreign investors as a way to incentivize private companies to invest in domestic infrastructure (i.e. pipelines and LNG import terminals). In September 2020, China created a new $55.9 billion pipeline company, PipeChina, to operate all pipeline and storage facilities.

Electric Future

The new energy system will be more electrified, digitized, and technology driven. The path to a carbon neutral economy will not eliminate previous geopolitical rivalries over energy resources. Instead, competition for natural gas resources and for technological supremacy may become a new “arms race” of the 21st Century.

The U.S. and China, for now, are in different phases of their natural gas production and usage. However, both have their eye trained on the opportunities the fuel presents for satisfying clean energy commitments.

Read more articles like this at OpenMarkets

BRI