Melvin Capital is out of the shorting game — or at least shorts that have to be disclosed publicly.

The New York hedge fund headed by Gabe Plotkin, which was a target of the Reddit crowd earlier this year because it was short GameStop, sold all of its listed put option positions during the first quarter, according to Melvin’s recent 13F filing with the Securities and Exchange Commission.

Melvin had already acknowledged covering its GameStop short, following a short squeeze tied to a Reddit forum called WallStreetBets, whose members included retail investors in the video game retailer.

But Melvin’s latest filing shows that in addition to selling all of its GameStop puts during the first quarter, it also sold puts on 17 other stocks. Closing out those puts during the quarter may have been unfortunate timing, as two of those put options were on stocks that collapsed during the late March liquidation of positions held by Bill Hwang’s Archegos Capital Management.

Two of the most notable Archegos liquidations were of GSX Techedu and ViacomCBS, which fell 67 percent and 30 percent in March, respectively.

Both had soared during the January Reddit frenzy, and during the quarter, Melvin sold all of its puts in both names. Melvin sold puts on 750,000 shares of GSX and those on 3.26 million ViacomCBS shares.

Melvin reportedly lost 7 percent in March, and was down 49 percent during the first quarter. It fell 54.4 percent in January, according to a letter to investors seen by Institutional Investor. After Melvin was pummeled during the GameStop events, Steve Cohen’s Point72 Asset Management — which was already an investor in Melvin — and Ken Griffin’s Citadel pumped $2.75 billion into the hedge fund.

As a result, total firm assets were approximately $8.26 billion as of February 1, according to the investor letter.

Yet at the end of March, Melvin held $17.5 billion in publicly traded equities — an indication that Melvin was still using significant leverage in its stock portfolio.

During the quarter, Melvin also closed out put positions in Weight Watchers International, Tabula Rasa Healthcare, ADT, Simon Property Group, Kroger, First Majestic Silver, AMC Networks, Trinity Industries, Ollies Bargain Outlet Holdings, Viatris, Ligand Pharmaceuticals, Invesco Solar ETF, and Cryoport.

It was the public disclosure of these short positions that had made it possible for the GameStop investors to target Plotkin’s firm.

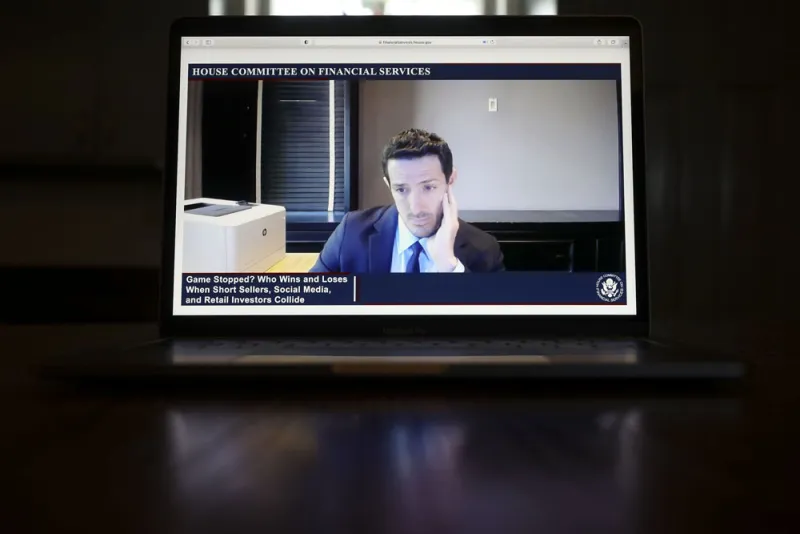

In his February testimony before the House Committee on Financial Services, Plotkin said that when the “frenzy” of trading in GameStop began, his firm had “also reduced many other Melvin positions at significant losses — both long and short — that were the subject of similar posts.”

But even though Melvin has apparently sold — and quit buying — listed put options, which it must disclose, the hedge fund could still be shorting stocks in the traditional fashion. That is, Melvin could borrow the stock and sell it, hoping to pay it back to the lender at a lower price. Short sellers do not have to disclose such short positions.

The firm's assets under management had hit $11 billion by May 1, according to a spokesman, who declined further comment.