By Bob Iaccino, for CME Group

AT A GLANCE

- After falling as much as 30% during COVID lockdowns, global oil demand is now back to about 95% of its pre-pandemic highs

- Tensions with China and a new wave of European lockdowns continue to threaten a recovery in U.S. crude oil exports

Shifting Supply Dynamics

Since the COVID-19 pandemic began in March 2020, most of the discussion has been about the shifting supply dynamics – from production cuts agreed to by OPEC and their allies in OPEC+, to the slowing of production within the U.S. shale oil patch due to the pandemic.

In Q1 of 2018, OPEC was producing 31.58 million barrels per day (mbpd) of crude oil, and that total continued to fall through the pandemic of 2020. By Q3 of 2020, the OPEC number had dropped to 23.61 mbpd, due to an agreed upon extension of 2016 production cuts. The U.S. was producing 10.49 mbpd by the end of Q1 2018. That figure rose to as high as 12.86 mbpd in November of 2019 and fell to 10.02 mbpd in May of 2020 (that number had risen to 11.06 mbpd by year end 2020).

Changes in Crude Oil Consumption

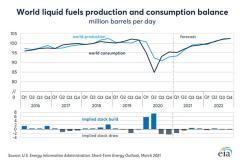

However, the key to the price action in crude and the price of gasoline at the pump during this supply drop was crude oil consumption, which you can clearly see in the chart below had separated from world production at an extremely rapid rate.

In Q1 and Q2 of 2020, world oil consumption (demand) had fallen convincingly below production (supply), adjusting the tight relationship that typically exists. Just as quickly, demand shot higher in late Q3. Then quite suddenly, demand began to rise and outstrip the new, lower levels of supply, but the U.S. had shuttered many wells by then. So, the effect on exports was not easily reversed.

U.S. Crude Exports Surge, Then Slump

In the five years since the U.S. federal crude export ban was lifted in December 2015, U.S. crude exports went from nothing to a sizeable part of the global supply. In 2019, the United States exported about 8.47 mbpd of petroleum products to about 190 countries and four U.S. territories.

The crude-only part of those exports was about 2.98 mbpd, which accounted for 35% of total U.S. gross petroleum product exports in 2019. U.S. crude exports hit an all-time high of 4.15 mbpd for the week ended Feb. 28, 2020, and volumes were expected to average around that 4 mbpd mark most of the year as U.S. production continued to rise. Then the pandemic hit. Exports fell dramatically, not because the supply was not there, but due to the falloff in demand.

According to some analysts, global oil demand, which fell as much as 30% during the pandemic lockdowns, is now back to about 95% of its pre-COVID highs. When you include those OPEC+ production cuts, a bit of balance in supply and demand has been achieved. Global consumption of gasoline, diesel and jet fuel are at their highest in more than a year. Domestic gasoline consumption is at its highest in four months. U.S. exports, however, may have a longer road ahead.

Global Tensions, Lockdowns Impact Outlook for Oil

China is a top U.S. crude importer, buying $5.42 billion worth in 2018 before trade tensions stopped that flow of oil. In January of 2020, China pledged to buy $18.5 billion more of energy products, implying total value of about $25 billion for last year. That didn’t happen, and new tensions are flaring. Europe is still struggling with the pandemic and, as of late March, had a new wave of lockdowns threatening its own economies with a double-dip recession.

U.S. oil exports may not return to previous levels as quickly as U.S.-based producers would have hoped.

Read more articles like this at OpenMarkets