While the moral argument for increasing the quality of jobs for both the worker as well as society is clear, it is often met with skepticism by investors who tend to view cutting labor costs as one of the quickest ways to maximize short-term earnings. Yet, over the long term there’s evidence that exactly the opposite is true as poor job quality often results in higher employee turnover, operational inefficiencies and customer service problems each of which leads to lackluster financial returns for many companies. As we will examine in this paper, a Quality Jobs (QJ) program is one in which companies are encouraged to promote workforce engagement, recognize the importance of all employees, and facilitate an adaptable business to meet market demands. In return, we believe that by adhering to such a framework whereby treating employees as assets – not liabilities – is crucial to maximizing profitability and operational efficiencies.

Bad jobs… lots of bad jobs

Shockingly, a recent study by the Good Jobs Survey found that only 40% of Americans had a “good” job and the remaining 60% of workers were in “mediocre” or “bad” jobs. That, coupled with the bleak trend data suggest that this isn’t a passing phenomenon and doesn’t paint the brightest picture for US job quality. While America is not the only country struggling with this issue, Figure 1 shows that the US has some of the highest levels of earnings inequality globally.

Figure 1: Lack of job quality is a global issue, with the US among the highest in earnings inequality

Source: OECD job Quality database, 2017. Based on most current available data among 37 eligible countries in OECD’s database. The Gini coefficient is based on the comparison of cumulative proportions of the population against cumulative proportions of income they receive, and it ranges between 0 in the case of perfect equality and 1 in the case of perfect inequality.

This is not a phenomenon that has happened overnight. In fact, the US Private Sector Job Quality index2 has shown a net decline for the past three decades. Also, the new jobs growth created has been concentrated in industries known for “bad jobs,” resulting in only 37% of the jobs created since 1990 being a quality job. Economists debate what has caused this issue. Is it the labor market dynamics in the US, the steady decrease in manufacturing jobs, or is profit maximization and investor short-termism to blame? While it might be a case of chicken-or-egg, one thing that many economists can agree on is that job quality is one of the top drivers for labor market participation that leads to GDP growth.

The socioeconomic costs of poor jobs

In 2019, 46.5 million Americans were working in occupations where the median wage was less than $15 per hour. This represents over 28% of the total US labor force.

To put this into perspective, let’s assume a worker makes the median wage of $15/hour, works a full-time schedule of 40 hours a week for 52 weeks a year (no holiday, sick-day or vacation time). That would put annual earnings at $31,200 a year, before taxes. Utilizing the data aggregated by Zippia and the MIT Living Wage Calculator (which estimates how much an individual or family would need to earn in a particular county, major metropolitan area, or state to cover their own or their family’s essential costs: food, childcare, medical expenses, housing, and transportation) you can see that $31,200 is below the living wage in every single state in the Union.

Figure 2: A $15/hour wage is not sufficient to provide a living wage anywhere in the US

Source: MIT, Zippia, as of March 2020. The living wage shown is the wages that an individual in a household must earn to support his or herself and their family. For more information, visit www.livingwage.mit.edu

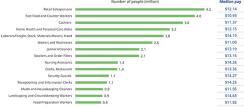

Poor quality jobs tend to be clustered in a handful of industries that include retail, restaurants, hospitality, healthcare services and business services (Figure 3). These jobs often have low pay, higher job insecurity, and little control over shift hours.

Figure 3: The 15 lowest-paying occupations and number of people employed within

Source: Gallup 2021.

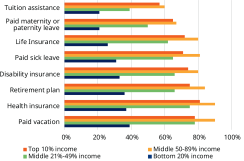

A Quality Job is not just about higher wages, it is also about providing other basic needs including affordable health care (not simply that a company is offering health insurance, but is it affordable and accessible to all employees), retirement plans, training and equal opportunity for promotion. A study by Gallup found that less than 40% of workers in the bottom 20% of earners have access to affordable health insurance, disability insurance, retirement plan or paid sick leave.

Figure 4: Low-earners experience a significant decrease in benefits and income

Source: Gallup 2020.

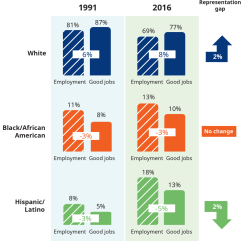

Figure 5: Non-White workers continue to be under-represented in good jobs...

Source: Georgetown University Center on Education, US BLS, current population survey, 1992-2017.

There is significant burden on the employee when they are unable to afford their basic needs. It often results in both housing and food insecurity, as well as a lack of decent health care. Employees in poor quality jobs often have little to no savings or retirement provision, which further leads to socio-economic stress. Less commonly spoken about is the impact on mental health. Financial insecurity leads to high levels of stress that in turn is linked to depression, anxiety and other health conditions, according to research by The Good Jobs Institute.

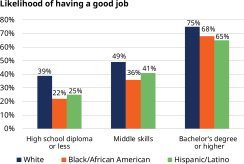

Race, ethnicity and gender are strongly correlated with the level of job quality. According to a study by the McCourt School for Public Policy and Georgetown University, White workers are the only racial demographic where the majority of jobs qualify as Good jobs. White workers not only have higher percentages compared to Black and Latino workers, their share of quality jobs has risen since the early 1990s, contrary to the experience of other demographics.

Much of this is attributed to access to education, particularly secondary education, as the economy shifted from manufacturing to services, and more jobs required a college degree. However, that is only half the story as all demographics have made significant gains in education, White workers are more likely to have a good job across all skill levels.

Figure 6: ...and Non-White workers are also under-represented across education and job skill level

Source: Georgetown University Center on Education, US BLS, current population survey, 1992-2017.

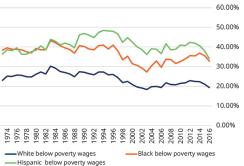

Overall job quality is poorest for non-white females. The COVID-19 pandemic has only widened the gap, as a January 2021 article highlighted the extent it has had Black and Latina women’s employment was disproportionately negatively impacted in 2020. The Center for American Progress approximates that 9 million of the country’s 24 million frontline employees are people of color, and that proportion will only grow over time. Black and Latina women are also disproportionately employed in some of sectors with the poorest quality jobs including hospitality, health care services and retail. Roles are often part-time, lack key benefits, and shift inflexibility. A study by the American Center for Progress, found that among those who worked full time all year in 2018, Black women earned 61.9 cents for every dollar that White men earned.

Figure 7: Workers of color are far more likely to be paid poverty-level wages than White workers

Source: Economic Policy Institute, using most currently available data as of September 2020. Poverty-level wage shares are the share of workers earning equal to or less than the poverty-level wage, or the hourly wage that a full-time, year-round worker must earn to sustain a family of four with two children at the official poverty threshold.

The wealth gap, a key indicator to narrowing the racial disparities in the US, has continued to widen since the great recession of 2008. Given the ever-increasing shift of US jobs into services industries and the need for higher education for these positions, it is crucial that divide narrows to end some of the systematic barriers to job equality.

This is both a financial and economic problem

A Gallup survey3 found that 14% of US employees are actively disengaged from their job. This can have a significant impact on a company’s bottom line. This includes 37% higher absenteeism, 18% lower productivity and 15% lower profitability – amounting to an estimated overall cost of 34% of a disengaged employees salary; in other words, a disengaged employee costs $3,400 for every $10,000 earned.

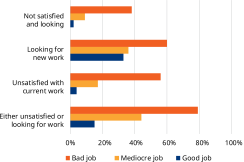

It’s not just disengagement that impacts the bottom line, excessive staff turnover results in excessive costs for companies over the long-term. High turnover can result in poor service (potentially resulting in a significant hit to sales and market share), potential safety concerns, as well as replacement and training costs to the company. Employers spend around 33% of a worker’s annual salary4 during the replacement process. Turnover of an $8/hour employee can cost a business around $3,500. Companies spend an average of $1,886 and 47.6 hours a year on training for each employee. For companies to reach a break-even point on managers they hire, it takes an average of 6.2 months due to costs incurred. Turnover can be significant as almost 80% of individuals in poor quality jobs are either unsatisfied or looking for work.

Figure 8: The percentage of workers unsatisfied with their current work, by job quality

Source: Gallup, as of 2020.

Much is talked about from the “risk” perspective on how much bad jobs can cost an organization. However, there is significant value creation opportunities by investing in employees. Studies5 show that reducing employee turnover by 50% can increase productivity by 20%. Higher paid staff help create a culture of hard work which often results in greater customer service and loyalty. Higher employee engagement (median difference between top and bottom quartile) is correlated with strong sales (+20%) and profitability (+21%). Even more importantly, about 70% fewer safety incidents and 41% drop in absenteeism.

A vicious cycle or virtuous cycle?

A QJ framework is designed to create value and deliver economic returns as it seeks companies that have jobs that do not meet employee needs which are ‘bad jobs’ that tend to lead to high turnover, disengaged employees and poor productivity and quality. This results in high turnover, operational inefficiencies and customer service problems resulting in lackluster financial returns. A Quality Jobs strategy promotes workforce engagement, recognizes the importance of all employees, and facilitates an adaptable business to meet job market demands.

Professor Zeynep Ton is the founder of The Good Jobs Institute and has discussed at length the concept of creating a virtuous cycle versus a vicious cycle at length in her book, The Good Jobs Strategy. Ton argues that if you provide your employees with living wages and make a significant investment in them over the long-term it will lead to operational superiority as well as higher sales and profits.

If effectively implemented, a QJ strategy dispels the false myth that higher employee benefits always lead to lower returns.

Figure 9: An illustration of the “Virtuous” versus “Vicious” cycle and job quality

Source: The Good Jobs Strategy, Zeynep Ton 2014

QJ in action: Hospital linen services provider prioritizes QJ to turn company around

A leading regional provider of outsourced linen management services for hospitals and nursing homes as well as uniform rental and laundry services suffered from significant operational inefficiencies that resulted in poor job quality and decreased profitability.

Stuck in a vicious cycle:

Insufficient plant leadership and HR oversight resulted in poor shift coordination, employee dissatisfaction, and excessive overtime. Employee disengagement coupled with low wages led to a 150% turnover rate.

Investing in a virtuous cycle: Recognizing the disruption high levels of disengagement and turnover were having on their business the Board committed to improving retention and hired an expert to lead QJ initiatives. The company took steps to re-price new business to profitably accommodate competitive wages. Additionally, they made investments in onboarding, training, human capital systems and reporting. This all led to improved shift efficiency and added accountable plant leadership. As a result, the company reduced employee turnover from 149% to 83%.

A QJ strategy is as much about streamlining operations as it is about paying employees more and providing benefits. Professor Ton and The Good Jobs Institute implemented the strategy successfully at number of retailers by focusing on four key pillars (Figure 10):

Figure 10: An illustration of The Good Jobs pillars of successful quality-job creation

Source: The Good Jobs Strategy, Zeynep Ton 2014

This Good Jobs framework is a holistic system throughout the company not owned by just the operations or finance and metrics.

QJ in action:

Boxing out the competition

People shop at big box stores for reasonable quality at a compelling value. One Box store (A) knows what their customers want and they consistently deliver it. By eliminating and removing wasteful activities, it has allowed for continuous improvement and has recently been named the #1 employer for compensation and benefits in the US by Indeed.com, ahead of the likes of other well-known Fortune 100 companies.

Box Store A has long invested in its people by paying high starting wages, providing benefits, and empowering employees. It also spends a significant amount on training its employees. Although Box Store A’s cost per employee is significantly higher than many of their peers, its revenue per employee far exceeds them,6 as does the historical returns of the company’s share price (Figure 11).

Figure 11: Box Store A price outperformance relative to competitor Box Store B

Source: FactSet as of December 31, 2020. Companies referenced are for illustration only and do not reflect any recommendation to buy/sell any security. Past performance is not indicative of future results.

A greater number of quality jobs is also essential for a more equitable economy. Closing the job quality gap is key to a stronger long-term US economy as the purchasing power of those most adversely impacted by a lack of quality jobs will continue to rise.

When looking to cut costs, many management teams and investors first seek ways to reduce employee expenditure without fully analyzing the long-term detrimental impacts. Companies with high turnover and low employee engagement have shown over time that many of them tend to underperform those companies which invest in their employees.

A QJ operational program seeks a double bottom-line return; enhancing the operational efficiency and returns of the business while also improving employees’ lives. Although the concept of QJ is not universally defined, a “Quality Job” generally offers an employee the fundamental elements of well-being with a particular concern for fair and equal compensation that affords one’s basic needs, employment practices that foster worker safety, work-life balance and an avenue to address medical and wellness issues. A successful QJ company is one that seeks to create a culture whereby the employees at all ranks are essential contributors towards the company’s continuous improvement and growth. Implementing a QJ program requires commitment, stability, and time. Changes will not occur overnight, however company’s dedicated commitment to invest in employees a company should expect lower turnover and improved employee productivity and operational efficiency. A Quality Jobs company creates a workforce with an equity mindset whereby every employee is a valued stake holder rather than capable commodity.

Creating a virtuous cycle for the employee and the company, while challenging norms, is not an easy feat. It will take time and investment, but the double bottom-line benefits are clear, in our view. The question is not why a company should invest in their employees given the long-term earnings benefits, but why not?

1 Source: Good Jobs Institute | Bad Jobs are for Bad Workers, 2017

2 The U.S. Private Sector Job Quality Index: Daniel Alpert, Jeffrey Ferry, Robert C. Hockett, Amir Khaleghi November 2019

3 Source: Gallup. Only 35% of US Managers are Engaged in their Jobs, 2015.

4 2020 RETENTION REPORT | STATE OF THE WORKFORCE

5 1HBR, November 2017

6 Source: CSIMarket, through Q3 2020. Based on trailing 12-months basis.

Schroder Investment Management North America Inc.

7 Bryant Park, New York, NY 10018-3706

For more information please visit us at www.schroders.com/us/institutional and www.schroders.com/QJ.

Twitter: @SchrodersUS

Important information: For use with North American audience only. The views and opinions contained herein are those of the author as of February 2021 and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other Schroders communications, strategies or funds. This document is intended to be for information purposes only. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or security or to adopt any investment strategy. The information provided is not intended to constitute investment advice, an investment recommendation or investment research and does not take into account specific circumstances of any recipient. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice.

Information herein is believed to be reliable but Schroders does not represent or warrant its completeness or accuracy. No responsibility or liability is accepted by Schroders, its officers, employees or agents for errors of fact or opinion or for any loss arising from use of all or any part of the information in this document. No reliance should be placed on the views and information in the document when taking individual investment and/or strategic decisions. Schroders has no obligation to notify any recipient should any information contained herein changes or subsequently becomes inaccurate. Unless otherwise authorized by Schroders, any reproduction of all or part of the information in this document is prohibited. Any data contained in this document has been obtained from sources we consider to be reliable. Schroders has not independently verified or validated such data and it should be independently verified before further publication or use. Schroders does not represent or warrant the accuracy or completeness of any such data. Past performance is not a guide to future performance and may not be repeated. Referenced indexes are for illustrative purposes only. Indexes are unmanaged. Investors cannot directly invest in indexes.

Investments in Private Equity involves special risks, including illiquidity, market, and operational risks, and are intended only for sophisticated investors who understand these risks. Smaller-cap companies tend to have less liquidity and greater operational risk compared to larger-cap companies.

Schroder Adveq Management US Inc. (“Schroder Adveq US ”) is registered as an investment adviser with the US Securities and Exchange Commission. It provides asset management products and services to clients in the United States. Schroder Fund Advisors LLC (“SFA”) markets certain investment vehicles for which Schroder Adveq US is an investment adviser.

SFA is an affiliate of Schroder Adveq US and is registered as a limited purpose broker-dealer with the Financial Industry Regulatory Authority and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Quebec, Saskatchewan, Labrador and Newfoundland.

This document does not purport to provide investment advice and the information contained in this material is for informational purposes and not to engage in a trading activities. It does not purport to describe the business or affairs of any issuer and is not being provided for delivery to or review by any prospective purchaser so as to assist the prospective purchaser to make an investment decision in respect of securities being sold in a distribution. Schroder Adveq US and SFA are indirect, wholly-owned subsidiaries of Schroders plc, a UK public company with shares listed on the London Stock Exchange.

WP-QUALITYJOBS