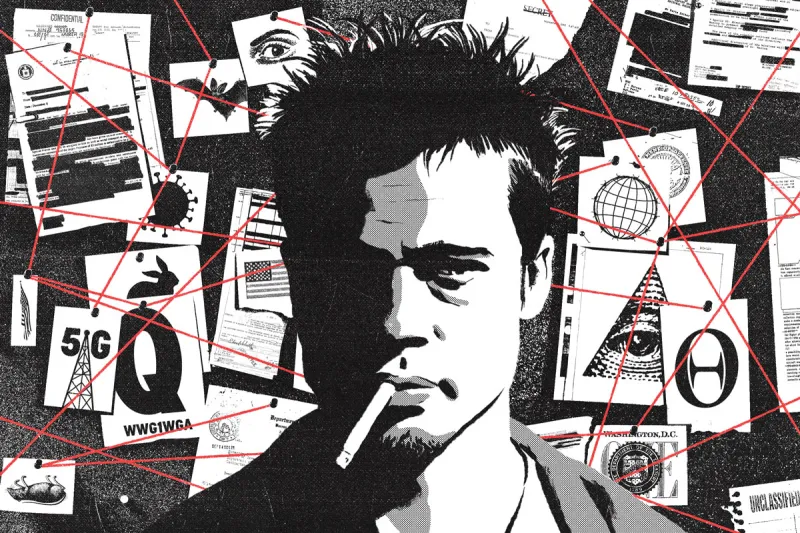

Why Did Financial Flamethrower Zero Hedge Go All in on Conspiracy Theories?

Illustration by Rob Dobi

To its fans it’s a top-notch financial analyst publisher. To its detractors it’s trash. But to many it’s an increasingly dark well of tinfoil-hat conjecture.

Chris Roush

Bloomberg

Nancy Pelosi

Donald Trump

Alexandria Ocasio-Cortez