Just a week ago, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law. Now, fifty-five of the Congressional members who wrote the bill have joined investment industry associations in seeking guidance from the Small Business Administration and the Treasury Department on how it will be enacted.

The National Venture Capital Association and the Institutional Limited Partners Association have called on Treasury Secretary Steven Mnuchin and the SBA to issue guidance on a particular provision of the bill that would lump separate businesses that are owned by the same private equity or venture capital firm together, effectively erasing their ability to access loans from the Small Business Administration.

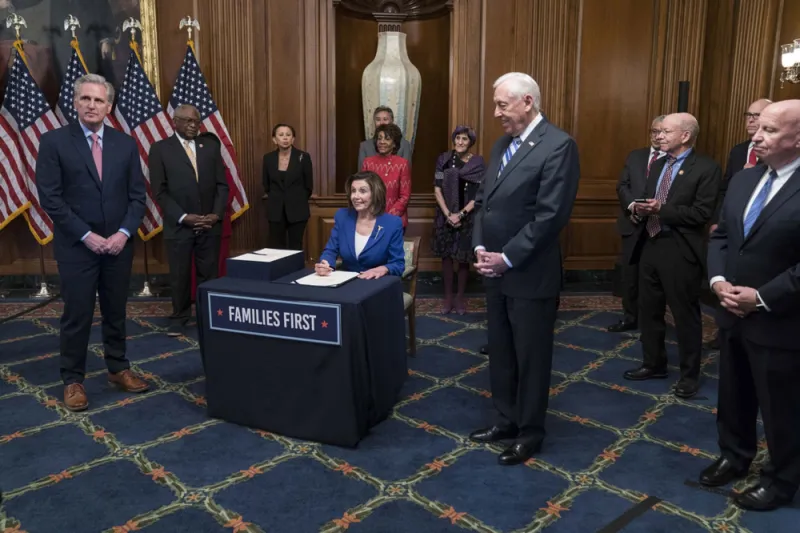

Members of Congress joined that call on Thursday, sending their own letter to Mnuchin advocating for guidance.

“We’re thrilled to see this level of significant support for the issue,” said Justin Field, the senior vice president of government affairs at the NVCA, by phone Thursday. “It goes to show how important it is to make sure that we don’t make a massive mistake here. Startups are as vulnerable as any small business during a crisis.”

To be eligible for small business loans, companies must employ less than 500 people. However, separate companies backed by the same private equity or venture capital firm are considered “affiliated.” This is a designation that has been attached to previous programs for small businesses, according to Chris Hayes, senior policy counsel at ILPA.

In other words, if a private equity firm owns several individual companies that each employ 500 or fewer people, those companies would be counted together as a single company and thus would be ineligible for small-business loans.

“We certainly agree that small businesses should be the ones participating in this,” Hayes said by phone Thursday. “We're more concerned about this aggregation rule.”

If the total number of employees combined at all companies in a private equity firm’s portfolio exceeded 500, none of those companies would be able to access small business funding, unless a Small Business Investment Company was among its investors.

“Without clear guidance enabling startups and other small businesses supported by equity investment to access the [loans], many of these companies will be rendered ineligible causing them to fail,” the letter from members of Congress read. “The confusion alone could lead to waves of preventable layoffs.”

The Small Business Administration has already published guidance on the CARES Act. However, that guidance did not address the affiliation issue.

“We're hopeful that subsequent guidance will come out in the next week or two,” Hayes said. “Failing that, we hope there’s a change in an upcoming economic stimulus package.”

ILPA is asking for the Treasury Department and SBA to issue guidance on whether they would be able to extend the Small Business Investment Company designation to all private equity and venture capital funds for the duration of the law.

“We see no reason why being owned in a fund structure should result in these businesses having less access to the capital needed to keep their employees on the payroll,” according to the letter sent Tuesday by ILPA.

[II Deep Dive: What the Experts See Coming in U.S. Jobs Figures]

The NVCA’s letter proposed another solution, one that would be specific to startups owned by minority investors. Right now, according to the letter, the application for these loans “creates the impression that minority owners between 20 and 50 percent of ownership may trigger the affiliation rules based upon percentage of ownership alone.”

The letter suggests that the SBA increase ownership thresholds to above 40 percent.

“Congress has created an incredibly powerful job retention program that, if effective, will save millions of jobs across America,” according to the letter. “Immediate clarity to the questions raised in this letter are critical to the ability of startups to preserve jobs through the economic crisis created by Covid-19.”