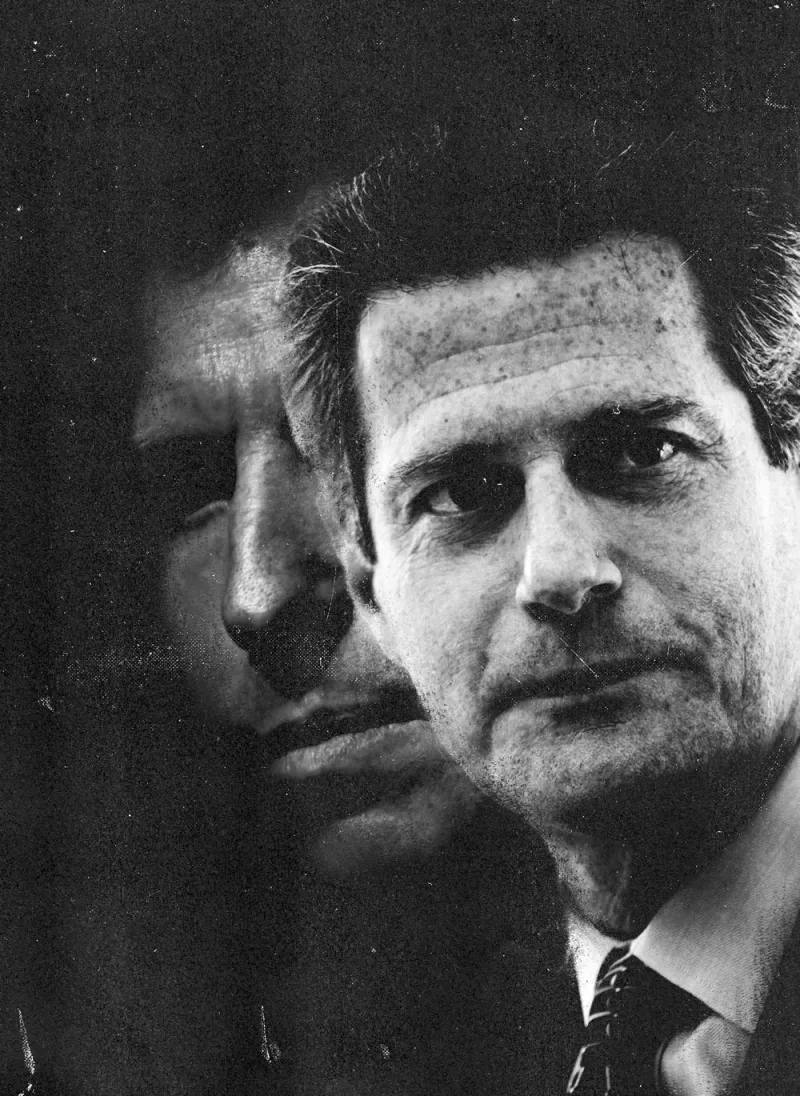

Daniel Och and Sculptor Capital CEO Robert Shafir

(Illustration by II. Rick Maiman, Scott Eells/Bloomberg)

There was no single meeting on the 40th floor of New York City’s 9 West 57th Street when it was decided that it was time to abandon any reference to Och-Ziff, no come-to-Jesus moment that convinced insiders to cut loose from one of the most famous brands in hedge fund history.

Instead, like a wave building toward shore, the evidence gradually became insurmountable.

Executives had tried once before to distance the firm’s future from its past, which was both storied and mired in scandal. But it was a soft separation.

In June 2017 the firm had taken a well-worn page from the history of big brands, with Och-Ziff Capital Management becoming Oz Capital. The hedge fund industry will cringe at the comparison, but it was little different from when Kentucky Fried Chicken embraced the slick KFC name as the fast-food company moved to erase the word “fried” from its history.

With Oz a younger generation of leaders — including co–chief investment officer Jimmy Levin — wanted to signal that its larger-than-life founder Dan Och was moving on and to make the firm their own. They also wanted to also keep the profitable legacy of having been the largest publicly traded hedge fund — as well as one of the first to cater to capital-rich institutions — while distancing themselves from a multimillion-dollar bribery scheme in Africa. (Levin, a driven 36-year-old computer science major from Harvard, had built Och-Ziff’s profitable credit business after the global financial crisis, and until recently had been Och’s handpicked choice for a successor.)

But even though Och officially retired from the company in early 2019, “Oz,” it turned out, wasn’t enough.

“Even though Dan was no longer involved, a lot of people still called it ‘Dan Och’s Och-Ziff,’” says Robert Shafir — a turnaround veteran of Credit Suisse and Lehman Brothers who came on board to succeed Och as the firm’s CEO in February 2018 — in an interview in his office overlooking Central Park.

It had become clear that the firm needed to make a more dramatic break than just scaling back to a couple of initials, Shafir says. Dan Och’s successors needed a way to get past the black marks of the bribery scheme that involved notorious autocrats like Robert Mugabe; a $412 million settlement the firm financed with credit on its balance sheet; and the tabloid details of an 11th-hour succession battle between the 59-year-old Och and his mentee, Levin, who was seen as critical to the firm’s future.

According to sources, the new name was meant to send a message that Och was no longer in control. “Oz would have been a nice compromise, but it didn’t do the trick. That long shadow was still there,” says one source.

And thus, on September 12th, 2019, Shafir, Levin, and the rest of the inhabitants of the 39th and 40th floors came to work not at Och-Ziff, not at Oz, but at what was known, as of that day, as Sculptor Capital Management.

Daniel Och, a New Jersey native who had graduated from the Wharton School at the University of Pennsylvania, joined Goldman on the risk arbitrage desk in 1982. He went on to head proprietary trading, staying with the firm for more than a decade. He exited in 1994 after starting a relationship with the family that had founded the Ziff Davis media empire. It was the Ziffs who bankrolled, and shared naming rights with, Och when he set out into the nascent hedge fund world.

The founder initially focused on what he knew: merger deals. It was early days for hedge funds, which were still largely the purview of wealthy investors. At the time, little was heard publicly from Och because it paid to be quiet in the secretive hedge fund world: The more discreet hedge fund managers were, the more investors clamored to get into the exclusive club. But Och had grander ambitions than just to manage rich people’s wealth. Instead, his goal was to manage the capital of institutions like public pension funds and endowments, which at that point had very little money socked away in hedge fund vehicles.

Success followed quickly. By 2005, Och-Ziff Capital had $50 billion in assets; it went public two years later, one of the first hedge funds to go through an initial public offering. The hedge fund industry and its old guard wanted to become institutions that would grow beyond the big personalities and singular talents of their founders. More important, perhaps, they wanted to sell shares of their enterprises in the public markets and turn the equity of their private companies into stock worth billions. It was the industry’s first of several attempts to create businesses that would outlive the men who built them.

But even after Och-Ziff went public in 2007, Dan Och wasn’t about to give up too much control. The deal was structured so that he kept a majority of the voting shares. The IPO made him a billionaire, and he still got to determine the firm’s direction.

Then came the global financial crisis and, in the years to come, the rise of the young star who would one day be at the center of a power struggle for control of the firm.

Jimmy Levin, who joined the firm in 2006 as an analyst, led the firm’s first major foray into credit after the financial crisis. He pushed for a big bet on hard-hit residential and commercial mortgage-backed securities and other structured-credit plays. Leveraging the success of these trades, Levin — still in his 20s — then took over and built out the firm’s capabilities across credit. In 2012, Och-Ziff, a firm known primarily for equity investments, made $2 billion — about half of its total profits that year — on Levin’s strategies. In 2013, Levin became global head of credit. Och soon gave him more equity and a role on the management committee.

A year later the alleged scheme to bribe African officials for business became public. As it turned out, Och-Ziff hit its peak in assets under management — $50 billion — in 2015.

In 2016 the firm put the investigation by the Department of Justice and the Securities and Exchange Commission behind it — legally, at least — settling the criminal and civil allegations for $412 million. Although Och wasn’t alleged to have known about the bribery scheme, he personally paid $2.2 million for causing violations of the recordkeeping rules.

But clients were already pulling their money. By the end of 2016, Och-Ziff was below $40 billion in assets. Soon that would be cut by one third.

By 2017, Och made some changes in an attempt to stem the losses. Even though he retained his titles, including CEO, he had already handed much of the day-to-day oversight of the business to the firm’s executive operating committee, which had been formed in 2014 and included Levin; Wayne Cohen, now president and COO; David Windreich, who had founded the firm with Och; Joel Frank, then CFO; and JK Brown, then head of investor relations. Levin and Cohen became co-chairs of the operating committee in 2017. In a letter to clients in the summer, Och said that Levin would be his eventual successor. He also awarded Levin a compensation package tied to performance goals that could have resulted in share awards of $280 million over the following ten years. Och himself contributed 30 million shares to Levin’s comp package. Levin’s star was rising as a third of the firm’s $32 billion was in credit strategies.

But Levin’s swift rise and outsize 2017 pay package caused tension at the struggling firm, according to reports at the time. The funds suffered withdrawals, and total assets fell to $32.4 billion. The firm’s flagship multistrategy funds fell 35 percent — even though returns were 10.4 percent, among the best in the category.

In the summer of 2017, given everything the firm had gone through, Och decided it was time to retire. He and independent board members negotiated a succession plan that included payments to Och and other former executives, as well as having the founder cede shares so he would no longer control the firm.

But in December, as reported at the time, Och rejected the plan and passed over Jimmy Levin for CEO owing to disagreements on a number of issues, including the health of the balance sheet.

Levin now says he ultimately stayed for two reasons: the loyalty of a core group of clients and the loyalty of his investment team. (The money didn’t hurt either.) “I rode it out because of their faith in me. Asset management is always about the team and people willing to back the team,” he says.

“But it’s not all fluffy and emotional,” Levin adds. “We are in the investment business. None of the issues had to do with this thing we do for a living: investments. Some scandals strike at the core, the main show. Those prove to be problematic. Our issues were peripheral to the thing that we actually do.”

At the end of January 2018, Och-Ziff announced that it was hiring Shafir as CEO. Levin stayed on. And Dan Och retired. He gave up the chairman role in March 2019.

“This is a blank sheet of paper. Let’s figure out how we can work together and close the issues hanging over the firm,” Shafir says he told Levin. Shafir claims a good relationship with the younger man, in part because Shafir is in his role is for a limited period of time and was brought in to solve very specific problems. (His contract runs until the end of 2021.)

And Shafir has a long history of turning around problems that seem intractable. Och first approached him about possibly taking the CEO role in 2016, when Shafir was leaving Credit Suisse Group as chairman of the Americas.

“I knew Dan for a long time. Och-Ziff was one of the first truly institutional-oriented hedge funds in terms of its approach to clients — but the firm had gone through the difficult period involving Africa. A lesser firm would have gone under,” Shafir says.

Och told Shafir that the firm had a great group of people and a next generation of talent, but that someone needed to manage everyone through a transition, according to sources familiar with the situation. They add that the settlement with the government had taken a lot out of Och and that his heart really wasn’t in being CEO anymore. That’s why Shafir decided to take the job, he says: “Often a founder will hire an outside CEO but not truly hand over the responsibility. I knew Dan wanted to move on, and that made it more attractive, because he would let me run the company.”

Shafir loves getting “things swimming again.” He notes that the firm has an “exceptional” group of senior professionals that have an average tenure of 13 years. “And they are young, which is fairly unusual. A lot of competitors trade people like stocks. You go to a corner, do your thing. If there’s bad performance, you’re out,” he says.

“I said to the team, ‘These are fixable problems that we’re going to solve. You need to understand that what you have here is very hard to re-create. You grew up together, are comfortable with each other, you trust each other, know each other’s strengths and weaknesses.’ So we had the investment engine.”

The new CEO went to work addressing the open problems that no one had been able to fix so far. He spearheaded a recapitalization of the firm, strengthening its balance sheet.

Shafir completed the promotion of a younger generation of professionals, including Jeff Lin, Ghassan Ayoub, and Peter Wallach. David Windreich retired. Levin became the sole CIO.

Shafir and the management committee also got equity transferred to a core group of partners who are leading the firm. Though he still has an ownership stake, Och gave up control. It wasn’t easy: The publicly traded company eliminated distributions to non-public shareholders so people could see no one was treating the firm like an ATM. Sculptor also sold off some capabilities that it didn’t consider core, such as energy, to focus instead on multistrategy, liquid credit, and real estate.

“The closing of the recap in February 2019 was a seminal event,” says Levin. “We viewed that as day one. Luckily, we were able to start on day one with an investment team that had been together 13 years and an incredible group of smart and tough investors.”

Then there was the name.

“Coming out of our regulatory issues, we needed to make some changes to the firm to reflect that something had changed here,” says Cohen. But, he adds, “to the extent that you were going to take a time-out from us, the time-out is over” — and despite needed changes, the core team of partners and investment professionals remains intact.

Unlike a retail mutual fund company, Sculptor needed to reach a relatively small group of potential investors with its rebranding — but that small group would almost unanimously associate the previous name with a single man: Dan Och. No one comes to mind when you hear Sculptor Capital Management, and that is on purpose.

Cohen says that the 23 partners, egos included, were all involved in the “democratic process” of choosing a name. The group, which included some non-partners, considered about 1,000 of them — even if some were just a germ of an idea. They gathered names that would represent different geographies, including Europe and Asia. They analyzed different translations, how they might be received by different sets of investors, and what a brand based on the name might look like. Partners took turns beating up various ideas. The whole process took place over a couple of months, says Cohen. In the end the firm solicited ideas from its staff and an employee submitted the winning suggestion — Sculptor.

“My requirements were for it to be easy to spell, easy to translate into any language, and not a ski run in Aspen,” says Levin.

And with that, Sculptor Capital Management was born.

There is a subset of clients who will never sign on the dotted line with Sculptor because of the headline and the career risk of it, according to people at the firm.

There are some going through the seemingly endless due diligence questions.

There are some asking about new compliance procedures and other safeguards that Shafir has put in place.

There’s also a category of people who understand what happened and what Sculptor has done about it — but are still in wait-and-see mode. Shafir explains that he spent the first year listening to clients and hearing their concerns. For the past year he’s been talking to them about the changes the firm has made in response, from fund closings to splitting the legal and compliance department in two. Some new money even came through the door in 2019, including capital from the Arizona State Retirement System and the Texas County & District Retirement System.

There are other good signs. The firm had no trouble raising $1.2 billion in a first close of its Real Estate Fund IV at a time when similar funds haven’t been bringing in new money. According to a source, there were 100 investors in Fund III; all but three re-upped for Fund IV.

Last year the firm’s flagship multistrategy fund returned 15 percent net returns, among the top performers in the category. The fund is attracting attention as investors grow anxious about the long bull market and are putting some protections in place, Sculptor says.

The firm is also hiring again. It recently added 21 investment professionals and ten investor relations staffers.

Sculptor has a young and energetic team that people in the industry say is out to prove itself, according to some clients. Notes the head of the alternatives group at a large pension fund: “It’s the same hunger you generally get with startups. I say bring it on.”

But what does success look like? According to Cohen, it’s not about getting back to some mythical place.

“We’re not measuring ourselves against our peak AUM. People might say, ‘Hold on, you’re not a $50 billion firm, and your multistrategy fund is no longer $30 billion.’ But we don’t feel like that day to day. All of our products are performing really well. We have $10 billion in the multistrategy fund — that could go up or down. Flows will come if and when they come. But we’re focusing on performance.”

Still, Shafir says Sculptor hasn’t yet stabilized outflows, in part because the hedge fund industry itself is struggling. It’s been ten years of great returns in public markets; hedge funds, designed to protect investors, haven’t been able to keep up, he notes.

But everything is cyclical. Investors will once again discover hedge funds, Shafir hopes. “You fix your wagon, you begin to tell your story, you slowly build your brand — and it helps when you perform,” he says.