Advanced technology could be what asset managers need to jumpstart stalling revenue growth. Too bad almost half of asset management operations executives say they are not positioned to use it.

In a new survey by consultant Accenture and the Investment Company Institute, 42 percent of respondents said their technology and operations infrastructure wasn’t up to snuff in a way that would help their firms implement new growth strategies. Such growth strategies are needed because the “operational cost model for the asset management community is largely unsustainable,” according to Michael Spellacy, an Accenture managing director who leads the firm’s global capital markets practice.

“The majority of long-only asset managers in the U.S. have a handful of funds that is driving the majority of profitability,” he said in an interview with II. “So if fees are cut in half, your profits are cut in half. Meanwhile your cost base has gone up.”

According to the survey, asset management operations executives are calling for changes to how investments are processed and are updating their operations. The majority of respondents to the survey said they have already completed a major operating model change in the past three years. The survey included 33 ICI members — global asset management organizations with $15 trillion of industry assets.

“While 65 percent of firms have completed activities to try and address the problem, which has only gotten more complex, they haven’t gone far enough,” Spellacy said. “Less than half believe that their operations and technology is ready to support the firm’s strategy.”

[II Deep Dive: The Overplayed, Turbohyped, and Underwhelming World of Artificial Intelligence]

The report from Accenture and ICI, released on Wednesday, warns that asset managers can’t just focus on finding new sources of growth and ways to steal market share from competitors. They also need to find ways to be more efficient in their shops through a combination of outsourcing, cost-cutting, and operational improvements.

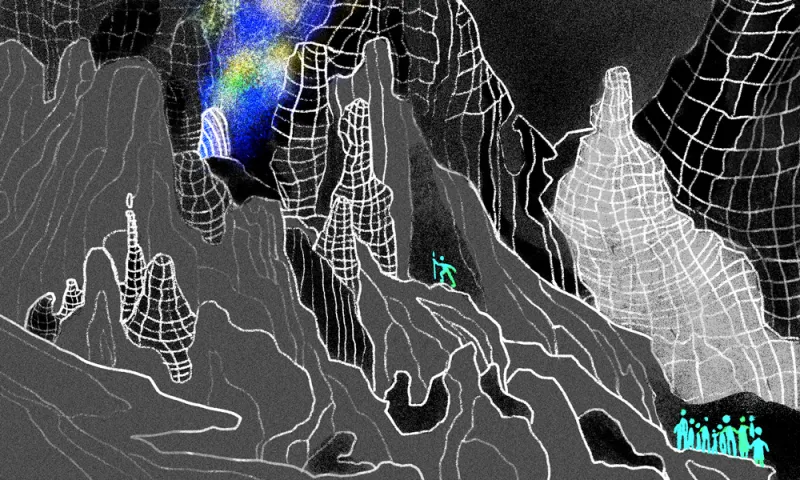

The next wave of cost reductions, according to 70 percent of the survey’s respondents, will come from artificial intelligence.

“Can you intelligently automate knowledge-intensive tasks such as understanding risk, automating work flow around distribution management, etc.? The answer is yes,” Spellacy said. He noted that 30 percent of the top ten asset managers in the U.S. are currently engaging in these types of activities. “It’s not about getting rid of people, but having people’s capacity freed up to bring energy and insights back to customers,” he said.

Although he declined to name the firm, Spellacy said that one of the top 15 asset managers has used a digital strategy and AI to gather almost $700 million in new flows from clients they never focused on before. “That’s massive inflow with existing products by using smart distribution and digital strategies,” he said.

Few asset managers want to put staff or other resources on the chopping block to become more efficient, in part because many have already put the squeeze on costs, according to the study. Fifty-three percent of survey respondents said their top choice to become more efficient is to change the way they’ve historically operated. But almost one-quarter of respondents said they need to bring in new technology to replace existing systems.

Fifty-five percent of firms reported having a formal initiative to evaluate new technologies, including fintech solutions. The “democratization of new technologies have required firms to adopt a more open stance in embracing the fintech community of start-ups, accelerators, incubators and consortia,” according to the report.

The top operational challenge uncovered by the survey was reducing the amount of human intervention required. Others that topped the list include managing data and the holy grail of “cost reduction without sacrificing quality.”