Illustration by II

(Bigstock photo)

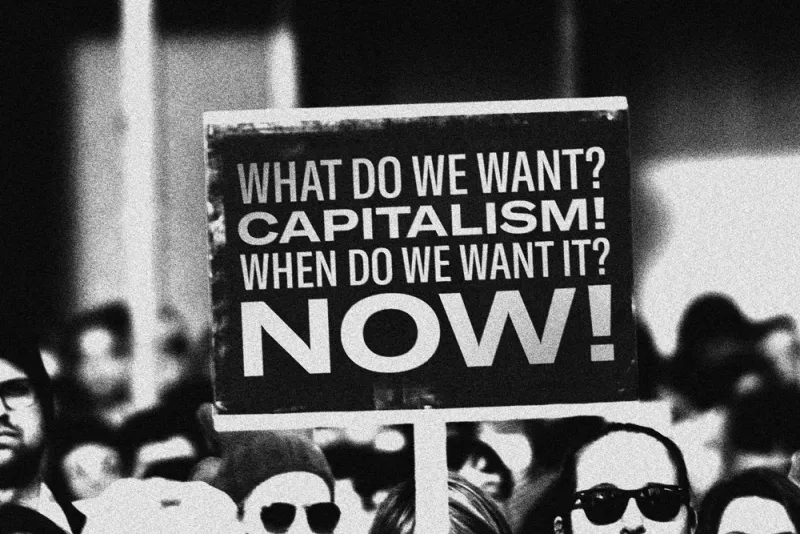

Lately, an unusual series of pundits have been discussing problems in the U.S. economy, and how capitalism is failing a majority of market participants.

Even staunch supporters of capitalism — people who have profited enormously from our economy, like Bridgewater Associates founder Ray Dalio — have, quite vocally, argued that the current system isn’t working.

In many ways I agree.

The economic engine we have in place today has for decades produced virtually no increase in wealth for the majority of earners. According to information pulled from the Federal Reserve, the median net worth of the bottom three quintiles of families declined in inflation-adjusted dollars from 1998 until 2013, tumbling by 20 percent or more. This decrease has hit working-class families the hardest; their real net worth has been halved over this time.

On the other hand, the inflation-adjusted wealth of the top 10 percent of earners has spiked dramatically in that same period, rising 75 percent cumulatively. This has resulted in a heavily skewed distribution of wealth that makes overall “average” changes in income meaningless. Today the top 0.1 percent of the population controls as much total wealth — roughly 22 percent — as the entire bottom 90 percent combined. This trend has worsened significantly since the late ’80s, reversing a half-century-long trend toward more egalitarian prosperity. In fact, the picture today looks more like it did back in the early 1900s, during the heyday of the robber barons and their trusts.

And for the first time in several generations, today’s earners on average — in real wealth terms — are likely to be worse off than their parents. The percentage of children who have grown up to earn more than their parents has fallen to 50 percent today from 90 percent in 1970, and it’s heading lower as increasingly lopsided income distribution exacerbates this wealth disparity.

According to information compiled by researcher Karen Smith at the Urban Institute think tank, earners in the top 10 percent of income brackets earned seven times what the bottom 10 percent did in 1965, and twice those in the median. By 2016 those ratios had jumped, with the top income generators making nearly three times as much as those in the 50th percentile and 13 times the bottom-decile earners.

Such a trend is not sustainable, and it is symptomatic of an unhealthy economic system; on that we are all in agreement.

But on one fundamental tenet of the argument, I disagree completely.

Most critics contend that this failure of capitalism is, perhaps ironically, the result of unchecked corporate profit maximization. Once again I agree. However, capitalism is not axiomatically about profit maximization; it’s not about corporations. In fact, true capitalism was originally agnostic on both of those subjects. Only in modern times has profit maximization become the broadly accepted definition of this economic model.

To understand my argument, let’s turn to a brief history of capitalism.

Capitalism, as an ideology, can trace its seeds to the mid-17th century. During this period the economies of Europe were dominated by two principal activities: farming and trading. Feudalism had begun to break down across the continent, and serfdom, whereby peasants were forced to work the lands of their lords as an immutable feudal obligation, was gradually being replaced by a more market-based system of employment in exchange for a combination of rent and salary.

However, capital goods — primarily land and wealth — became increasingly concentrated in the hands of fewer and larger landholders. In fact, in places, peasants were not legally able to own land even if they could afford to purchase it. Sometimes ownership of property was reserved for members of the landed gentry, and families that owned huge agrarian estates could control the titles to those properties through hereditary claims.

Similarly, European merchants — those who traded goods such as spices and textiles from around the globe — were almost universally backed by state controls, including subsidies and monopolistic trading rights. For these state-conferred rights the crown extracted a healthy price, which the merchants were glad to pay.

The seismic effects of cultural and educational shifts occurring at this time — such as the Reformation, which challenged the centralized authority of the Roman Catholic Church in favor of various Protestant churches across Europe, and the Scientific Revolution, stemming from ancient Greek philosophy and medieval Islamic science, which were rediscovered by Western thinkers during the Age of Discovery — led to enormous advancements in the understanding of the natural world and the adoption of the scientific method for examining that world.

By the mid-18th century, philosophers applying this means of logic to economic theory began to argue for a new paradigm: capitalism.

What they proposed was removing the various restrictions that prevented the common man from owning capital goods, and extending to all equally, for the first time, the right to own the means of production.

Capitalism is freedom. At its core it simply means that individuals should have equal rights to own capital and capital goods, and to manage those economic resources or dispose of them however they see fit, in accordance with their own personal well-being.

Moreover, individuals have the right to define what well-being is, and to pursue their own wants and needs. Maybe that means profit maximization and maybe not, but it’s generally accepted that people have a more complex hierarchy of needs than pure profit maximization. And individuals free to pursue those wants and needs will do a better job of lifting their well-being collectively than can be achieved through centralized control of the means of production. This is the invisible hand that Adam Smith discussed when he wrote The Wealth of Nations.

I’d argue that we don’t really have all that much capitalism anymore.

Individuals simply do not have equal, competitive rights to own the means of production. Corporations, which have replaced both the feudal empires of the 1600s and the trusts of the early 1900s, are the contemporary preferred owners of capital goods to be extended privileged rights by central governments.

But corporations aren’t people, and they certainly don’t have wants or needs (or morals) — but they do have GAAP profits that they can easily measure, and maximize. And as Peter Drucker said, “What gets measured gets managed.” Unfortunately, corporate profits have evolved to become virtually the sole yardstick of capitalism.

Further, corporations have been granted significant advantages that individuals do not have. They have limited liability, which reduces their risk in acting in undesirable ways; individuals do not. Corporations often also have advantaged rights to intellectual property ownership; individual employees, who create that capital (I’ve never seen a corporation win a Nobel Prize), do not.

Corporations have lower taxes than many individuals. And they are often able to negotiate them down even further under bespoke arrangements with state and local governments; the common man cannot. Corporations have very close relationships with legislators and regulators, and often help craft the very legislation that defines the rules of engagement in their industries, generally to their (noncompetitive) advantage.

If we frame all of this in the context of Porter’s Five Forces, we see how an industry can become anticompetitive. In 1979, Harvard professor Michael Porter published an article about this in the Harvard Business Review, describing how microeconomic factors and industry dynamics drive the relative attractiveness and profitability of industries.

Within a given industry, firms compete for business. Their positioning is the result of the five separate factors that Porter identified, the first of which, known as industry rivalry, is the number of firms currently competing for customers. The fewer the competitors, the better it is for profit margins, and vice versa.

However, the threat of new entrants into the rivalry or of substitute goods eroding demand for a product or service acts as a limiting factor. If profits are high and it is easy for new goods or new competitors to enter the arena, the margins of existing participants will come under pressure. Profitability can also be diminished by the power of customers to stop purchasing if prices are too high, or if vendors, suppliers, or employees have the ability to pass through higher costs on their inputs.

So, essentially to maximize profits, corporate strategy suggests keeping new competitors out, reducing the number of existing competitors, ensuring pricing power over customers, and squeezing suppliers. And corporations will use all the tools at their disposal to implement this strategy.

Let’s take a look at how this has played out in an industry I know well: financial services.

Over the past century the number of regulations dictating the behavior of financial market participants has skyrocketed. For most of the 1900s, there were a few hundred pages of relatively clear rules. The first decade of this century saw an average of nearly ten new laws per year, each with more than 2,000 pages of complex and often conflicting legal technicalities.

Simply complying with all of the various reporting requirements necessitates significant investment in personnel and infrastructure. Yet, perhaps counterintuitively, compliance with regulatory burdens is a core competitive advantage of the mega financial providers that have emerged. With Blackstone able to offset the cost of its 400 lawyers against $5 trillion of assets, how can small banks or asset managers compete?

The answer is they can’t, so they get acquired (or go out of business).

The number of banks competing for your depository business today is a mere one quarter of what it was a half-century ago, as small local and regional banks have been gobbled up by the national franchises.

As a result, the concentration of power in the remaining winners has increased dramatically. As recently as the early 1990s, the top five banks had a mere 10 percent of market share. Just two decades later, which was when banking consolidation really accelerated, these ultimate acquirers now account for nearly half of all banking assets.

As an investor in hedge funds and private equity funds, I’ve observed how “economies of scale” always accrue more to management and ownership than to employees — and certainly to clients. So perhaps it should come as no surprise that finance as a percentage of GDP is now well more than double what it was half a century ago.

Yet, though I’ve written before about the increasingly wealth-extractive nature of financial services, unchecked consolidation and noncompetitive factors that serve to keep many out of the market are certainly not unique to this sector.

The Herfindahl-Hirschman Index is an economic statistic that measures the size of average firms in relation to the size of an industry or the overall economy as a gauge of competitive rivalry. The higher the number, the less the rivalry, and vice versa.

According to research forthcoming in the Review of Finance, the HHI has increased substantially in more than 75 percent of U.S. industries over the past several decades. And the market share of the four largest firms in each sector has increased even more across most industries.

In fact, a deeper look suggests many industries are even more concentrated than finance. Ford, GM, Fiat-Chrysler, Toyota, and Honda combined account for 68 percent of U.S. auto sales.

CNN, MSNBC, and Fox News control 80 percent of the cable news ad revenue market.

The four largest agricultural technology companies control 80 to 85 percent of the bean and seed market for important crops such as corn and soy.

Ninety-five percent of credit ratings are performed by just three firms: Standard & Poor’s, Moody’s, and Fitch.

And Google alone has approximately a 93 percent market share in search.

Such market domination is thanks in no small part to a far more liberal approach to antitrust reviews by the Federal Trade Commission. The FTC and the Department of Justice are supposed to use laws such as the Hart-Scott-Rodino Act to review all proposed mergers over a certain size in the United States and prevent any anticompetitive mergers that would “substantially lessen competition.”

This language leaves room for a great deal of discretion, and the current interpretation may be too lax.

Having covered merger arbitrage funds for a decade, I’ve heard the pitches for these hedge funds — which profit by buying and selling the shares of a target and acquiring companies after a merger is announced — and the common claim that their ability to judge the probability of FTC approval is part of their edge. Whether or not they actually have that skill is debatable, but many of these seasoned market participants seem to agree that regulators don’t take too hard a look until the top two competitors start to control more than half the market share, or the top three about 75 percent. And they all seem to agree that D.C. generally is far more amenable to megadeals than in the not-too-distant past.

Anecdotes aside, according to the Department of Justice’s own Antitrust Division Workload Statistics reports, the total number of antitrust investigations initiated each year has plunged, despite the robust merger environment.

In more troubling findings, researchers at Harvard Business School have shown that favorable merger reviews are more likely for firms that make large political donations to the politicians who sit on the two committees that oversee the FTC and the DOJ.

I ask: Is that capitalism failing? Or capitalism being shunted aside?

And they have.

Instead of making large capital investments in plant, property, equipment, or R&D, all of which are hard and take time to produce return on capital, corporations can simply raise prices and squeeze costs and immediately improve profits. Scholars at the National Bureau of Economic Research have shown that this is exactly what is occurring. Since the early 2000s private fixed investment in the U.S. has been lower than expected, and the research suggests that this effect is highly correlated with industry concentration.

Other research from NBER provides an analysis documenting that corporate markups have spiked. From 1950 to 1980 or so, prices on average goods were marked up roughly 18 percent above marginal cost; this level was largely stable during the entire period. However, beginning in the 1980s, prices began to rise, rocketing to 67 percent above cost today. When you are an oligopoly and customers have no real choice among the top three to five providers, you don’t need to openly collude. Just all raise your prices together, and customers are stuck.

As a result of this unimpeded industry concentration and the rise of market power, corporate profit margins have surged to all-time highs.

And though increasing profit margins may well be great for management and equity holders, the majority of individual wealth comes from income, not equity ownership.

Unfortunately, given the oligopolistic nature of most industries, not only do customers not truly have a choice of where to shop, but neither do workers really have a choice of where to work.

Researchers have also tracked the share over time of total U.S. employment at entities with more than 10,000 workers, and showed that more and more people are employed by these megainstitutions. This is another clear data point showing power skewing away from the individual.

Other factors shown to be associated with increasing concentration include declining productivity growth, low labor force participation rates, and decreasing overall GDP growth rates.

Check, check, and check.

So that’s what we have today. I would argue that every single one of these statistics means we have far less capitalism than we used to, not more.

Which leads us back to my definition of capitalism.

Capitalism is a system in which individuals have the right to own capital and control the means of production.

In economies, ownership of capital goods and control over the means of production (i.e., the means of survival) are the only things that matter. And rather than wasting our intellectual efforts deliberating on the relative merits of definitions of political “isms,” we should instead think of them as part of a spectrum, from freedom on one end to control on the other.

This spectrum elucidates the reality that going from ten businesses controlling 40 percent of an industry to three firms controlling 80 percent is not more capitalism, it’s less.

Rather than continuing to support more consolidation, more regulation, and barriers to entry — which seems a bit like taking more of the poison that’s making you sick in the mistaken belief that it’s medicinal — we should move back in the other direction.

Certainly, government plays a role in protecting and preserving capitalism, and that role should be to root out noncompetitive advantages to ensure fair competition. The Sherman Antitrust Act of 1890 outlawed monopolies, and once upon a time the DOJ actually “busted” these trusts by breaking them up, including Standard Oil and AT&T.

Perhaps it’s time the government got back to its job of protecting capitalism and the ability of individuals to control their own means of production with a bit more vigor — in two ways.

First, by breaking up businesses, and groups of businesses, that have turned industries into oligopolies with noncompetitive market share dynamics. Even the founders of some wildly successful businesses agree with this; for example, Chris Hughes — the co-founder of Facebook — recently authored an opinion piece in The New York Times to this exact effect.

Perhaps it’s time to include specific limits on industry concentration using HHI or other market-based metrics to extend these principles to the oligopolies, particularly as regulators have been so accommodative on the consolidation approval side. Better-crafted legislation could include metrics and remove some of the current subjectivity.

Second, it’s critical for the government to normalize the legal rights of individuals to, at the very least, give them equal status with the current preferred neofeudal empire, the corporation. This means that simultaneously with breaking up oligopolies, legislators should remove the most cumbersome, rigid, and bureaucratic regulations — regardless of how well intentioned they are — to spur increased entrepreneurship and innovation.

Additionally, we need to rescind the tax breaks that provide corporations with a cost advantage relative to ordinary taxable income for the average person, to restore the corporate accountability that has disappeared through severely limited liability, and to actually extend some intellectual property protection to allow humans to own the intellectual capital they create. Institutions don’t innovate; people do.

In truth, this is no less daunting a task than was upending feudalism, and no different than busting the monopoly power of the trusts. But we reset toward more capitalism after both the agricultural and industrial revolutions, and I believe we can do it again.

It’s worth repeating: Centralized control of the means of production ensures wealth disparity. But as capitalism means the freedom of individuals to own capital goods in order to pursue their own well-being, and what we have are increasingly consolidated corporations controlling the means of production and doing so to maximize profits, let’s stop blaming our problems on capitalism.

After all, you can’t fix a problem that is misdiagnosed.