Centana Growth Partners — whose founder originally backed exchange-traded fund pioneer PowerShares — is now betting that a fledgling asset manager, Alaia Capital, can turn the $100 billion structured products market into a blockbuster category.

Alaia is making structured products, now issued by banks and insurance companies and used to hedge investment portfolios, simpler and cheaper.

To support the effort, growth equity fund Centana, which focuses on financial services, led a $5.5 million strategic investment that will be used to expand Alaia’s operations and its lineup, called m+ funds. ThirdStream Partners, founded by the team that ran quantitative firm Barclays Global Investors, including Blake Grossman, also participated in the funding round.

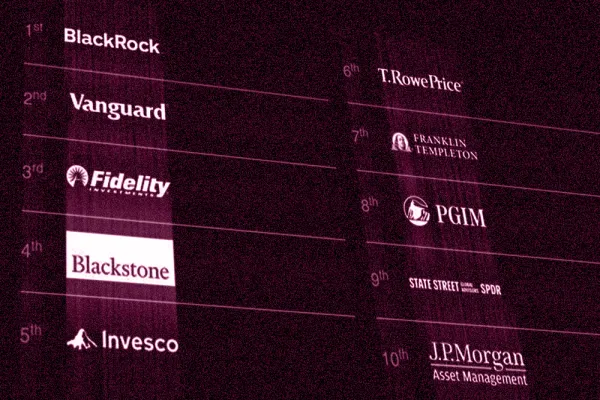

“The point is to broaden the market for structured products by making them more practical,” said Ben Cukier, partner at Centana Growth, in an interview with Institutional Investor. Cukier founded Centana in 2015, and spent 20 years in venture, investing early in PowerShares, which was sold to Invesco; ETF Securities; and IndexIQ, which was acquired by NYLife.

[II Deep Dive: How Allocators are Weatherproofing Their Portfolios]

“What’s powerful here is the transparency. People open up a prospectus, and everything is laid out, including the fees,” says Oscar Loynaz, co-founder of Alaia, who spent 20 years on Wall Street, primarily in structured products. Before co-founding Alaia, Loynaz was the global head of multi-asset structuring at Citi.

Unlike a bank that issues structured products with economic terms that benefit it, Alaia works as a fiduciary, obligated to serve the best interests of clients. For example, registered investment advisors can use them in discretionary portfolios where fees are charged as a percentage of total assets. The products also eliminate the corporate credit risk of the issuing bank. “It’s an evolution of the product, which will allow us to expand into a much wider audience,” added Loynaz.

Investors in Alaia’s funds know exactly what returns to expect from their investments once they reach maturity, a so-called defined outcome. Historically, these types of returns have been available through bank structured notes or indexed annuities offered by insurance companies.

Alaia can also customize the funds for larger investors, such as pension systems. The firm is targeting institutional investors, which Loynaz said are increasingly interested in using the products to hedge their portfolios now that the bull market has hit its ninth year.

Many pensions and endowments are prohibited or discouraged from using derivatives and other complex hedges. Unlike with derivatives, purchasing Alaia’s products is similar to allocating money to traditional funds. For example, a pension could keep its exposure to the Standard & Poor’s 500, but add a defined outcome fund to hedge the risk, rather than sell part of its equity position.

Alaia’s products are unit investment trusts that provides exposure to a broad-based market ETF over a fixed period of time. For example, the Defined Preservation 50 Fund provides exposure to a broad-based market ETF over a fixed period of time, usually ranging from two to five years.

At the end of the period, if the ETF’s price has increased, the investor receives that return. If the ETF has experienced a loss, the investor has limited exposure to 50 percent of the decline. Each fund is constructed using listed FLEX options — customized equity or index option contracts from the Cboe — linked to a reference ETF.