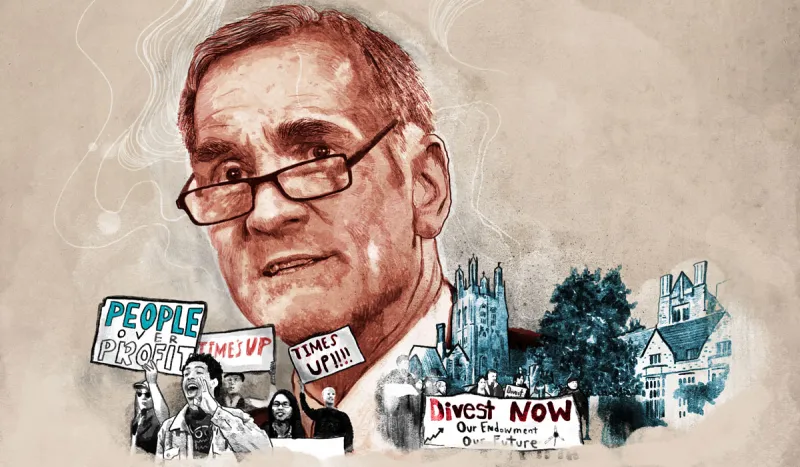

Illustrations by Peter Strain

It was a Friday morning in early March, and David Swensen was furious.

The legendary chief investment officer of the Yale endowment — the best performing of its kind over the last 20 years — had awoken in London to an email from the editor-in-chief of the Yale Daily News.

The email, timestamped 10:05 p.m. New Haven time — or just after 3:00 a.m. in the U.K. — addressed an opinion piece Swensen had written regarding the newspaper’s coverage of an endowment teach-in event held by student activists earlier in the year.

“Apologies for reaching out late at night, but I wanted to get in touch about a section of your piece,” the editor wrote. The email explained that she had decided to remove a sentence from Swensen’s op-ed pertaining to the Yale Daily News’ reporting — a sentence that the newspaper’s staff had determined to be inaccurate. “I understand that you do not want your column edited and we respect that request, but cannot in good faith include that part of it.”

By the time Swensen read the email that morning, the column had already been published online, leaving out the sentence in question, as well as a pertinent footnote regarding Yale’s use of index funds.

Swensen — who had commanded the News staff, in all caps, not to edit his essay — was not pleased.

At 9:19 a.m. GMT, he fired off a response from his BlackBerry.

“Don’t you understand simple English?” he demanded. “What is the matter with you?”

The chain of emails that followed — in which the investment chief blasted the behavior of the Yale Daily News editors as “disgusting” and “inexcusable,” ultimately calling editor-in-chief Rachel Treisman a “coward” — revealed a side of Swensen that had rarely, if ever, been seen in public.

Described by Yale administrators, former students, and former colleagues as generous and benevolent — the kind of man who would take an interest in a young person’s career or make the time to give your young kids a campus tour — Swensen is widely and wildly admired, both at Yale and in the larger investing community.

On the infrequent occasion that he speaks at a public event or agrees to an interview with the press, Swensen is generally thoughtful and measured, carefully articulating his response to each question asked.

But six months into a school year particularly fraught with activist campaigns, misinformation regarding the endowment, and what Swensen perceived as persistently negative coverage by the Yale Daily News, he snapped.

“When I woke up and I saw what the Daily News did, I thought this was just so, so wrong, in so many different ways,” he says a month later, seated in an armchair at the Yale Investments Office in New Haven, Connecticut. “They violated what was a very clear message about how I expected the piece to be treated.”

The resulting dressing down of the editors was not meant for public consumption. But in an editor’s note published two days after the first email was sent, Treisman and her colleagues included a link to a PDF of the email exchange, writing that they were “disheartened that a Yale administrator considers this an appropriate way to voice concerns to the News.”

“Everyone saw the emails,” an allocator with ties to Yale says two weeks after the fact. Aside from being widely spread around campus, the Yale Daily News editorial was also widely spread on Twitter, then by media outlets including Institutional Investor and Bloomberg.

Although Swensen himself makes no such excuse, some former colleagues suggest that the investment chief may have been under added stress at the time of the incident as a result of his health. (In September 2012 the university announced that Swensen had been diagnosed with cancer.)

Regardless, the “unfortunate” exchange, as Swensen calls it, was a rare misstep for the legendary investor, who boasts an exemplary record of investment performance and service to the university.

It is hard to overstate just how much Swensen has done for Yale and its students over the course of his 33-year tenure as CIO. His management of the endowment alone has made the university into what it is today: Endowment funds cover a third of Yale’s operating budget and make it possible for the school to offer generous scholarships to students who could not otherwise afford to attend.

But his involvement at Yale goes far beyond investing. Swensen has taught classes at the university since 1980, back when he was still working on Wall Street. He regularly speaks to students at Yale’s residential colleges, including hosting famous beer and wine tasting events. He hires interns and entry-level staff from Yale’s undergraduate and management schools, and he serves as a key adviser to Yale administrators like the university provost — even lending out members of his own staff when the university has a project that requires economic modeling or analysis.

Ben Polak, the provost since 2013, says Swensen’s influence at Yale spreads far beyond the endowment and the financial aspects of the university.

“He has a very clear sense of what a university’s mission is supposed to be and how you go about executing that,” Polak says. “He’s a counselor and teacher to me — but he has been for generations of provosts and presidents at Yale.”

Teaching is not an uncommon pursuit among endowment CIOs: Executive recruiter David Barrett says the ability to teach a class on finance or investing is often part of the draw for university job candidates. At Notre Dame, for instance, CIO Scott Malpass — one of the few endowment chiefs whose decades-long tenure rivals Swensen’s — teaches two classes periodically with the help of senior members of his investment staff.

“We really want to be part of the university and help train the next generation of top finance professionals with some of the values we try to instill in them here,” Malpass says.

Other investment chiefs, like Princeton’s Andrew Golden — who got his start as a senior associate at Yale’s endowment — might give a guest lecture once a year on a subject like ethics in finance or even, in Golden’s case, philosophy. Swensen gives guest lectures across Yale’s departments and graduate schools, including the management and law schools. This year he got a kick out of being asked to give a guest lecture in a humanities class.

Teaching and mentoring are important to Swensen, who says he remains in touch with former students ten, 20, 30 years after they’ve left his classroom. “Those connections are really important and really valuable to me,” he adds.

Former students interviewed by Institutional Investor gush about their old teacher, whose classes they remember clearly even decades later. One former student, Kiele Neas, says she took two classes with Swensen back when he still taught a giant 200-person lecture in addition to a smaller seminar like the one he teaches today. The seminar led to a summer internship at the investments office, and the following year Swensen served as her senior thesis adviser. Today, as a managing director at the UCSF Foundation Investment Company following a lengthy career at Goldman Sachs, Neas says she wouldn’t be where she is without Swensen’s mentorship.

“His dedication to the institution and to mentoring people is really unparalleled,” she says. “I can’t think of another CIO who’s ever been as engaged on the campus, who’s taught classes and mentored students and advised on theses.”

A more recent student, class of 2017 graduate Henry Albrecht, says Swensen today is “quite the legend” on campus, adding that all of his friends were “very jealous” to hear that he had snagged Swensen as his undergraduate academic adviser.

“To be honest, with the Yale endowment you’re always going to have certain student groups that argue the endowment doesn’t spend enough on certain things or should be run differently,” Albrecht says. “But I’m very much convinced that the vast majority of the university and the student body does not share that opinion.”

It was that campus minority of endowment activists, however, who would escalate tensions between the investments office and portions of the student body, setting off the series of events culminating in Swensen’s harsh emails to student journalists.

Universities have historically been at the center of activist movements in the U.S., from protests of the Vietnam War in the late 1960s to the first major divestment campaigns targeting South Africa’s apartheid polices in the ’70s and ’80s. Since then students have pushed for divestment as a means to effect change in nations like Sudan, a country that has been accused of human rights violations, and Israel, which activists condemn for the oppression of Palestinians. Industries including fossil fuels and firearms have also been targeted by students seeking to combat problems like climate change and gun violence.

“It’s just one of those things that goes with the territory,” says Debra Brown, a senior investment management recruiter at headhunting firm Russell Reynolds Associates. “But it can be quite unpleasant . . . I have yet to find an endowment investment professional who is drawn to campus activism.”

These student activists have been able to find a voice in campus newspapers, in the form of op-eds and news coverage by student journalists. Today that voice is amplified thanks to online publishing and social media. The Yale Daily News, for instance, now has more than three times as many subscribers to its daily email as it has print issues in circulation, according to materials provided to potential advertisers. Its Twitter account has more than 25,000 followers, and its Facebook page has nearly 17,000 likes.

It was the Yale Daily News’ coverage of the endowment, and the number of activist campaigns swirling around it, that prompted Swensen to pen an op-ed. In general Swensen avoids engaging with the student newspaper, whose reporting he has grown to mistrust, in part due to what he describes as an “incredibly unethical” incident that took place earlier in the year, when a News staffer interviewed attendees of a college tea where Swensen had spoken to students off the record. (In a statement provided after the publication of this story, Yale Daily News editors said the newspaper “stands by the practice of interviewing attendees on the record about public events that the speaker has declared off the record, which is conventional in the world of journalism.” They added that they had corrected the factual inaccuracies in their original reporting on the endowment and “will continue striving to report fairly and comprehensively on the endowment and other campus issues.”)

Not long after that incident, however, Swensen had dinner with students who had taken his class in the fall, and the conversation turned to how the endowment is perceived on campus. The class — an extremely popular and hard-to-get-into senior seminar on investment management, taught by Swensen and his second-in-command, Dean Takahashi — had made this small group of students very familiar with how the Yale Investments Office works. It was not an understanding widely shared by their peers.

“The students said, ‘We really understand from having taken the class that the investments office really cares about the character and quality of the investments and that they’re made in a thoughtful and ethical manner,’” Swensen says. “But if you’re a reader of the Yale Daily News, that’s not the impression you get.”

Over the last few years, four issues concerning the endowment solidified as the primary causes of activist groups at Yale: fossil fuel investments, private prison financing, Puerto Rico's debt, and the construction of the Northern Pass, a project that aimed to bring Canadian hydropower to New England. A small part of the planned 192-mile electrical transmission line would have cut through New Hampshire forestland operated by one of Yale’s investment managers. It was controversial for a number of reasons, including concerns from local residents apprehensive about what it would have meant for tourism and real estate values. It also faced opposition from Quebec’s Pessamit Innu, a First Nations tribe with longstanding grievances against Hydro-Quebec, the Canadian utility company that would have powered the transmission line.

The controversy surrounding the Northern Pass was detailed in the Yale Daily News, alongside reporting on the divestment campaigns targeting fossil fuels, private prisons, and Puerto Rico bond holdings, resulting in what Swensen terms “relentless negative publicity” for the endowment.

In February all four issues came to a head when a coalition of seven student groups — the Association of Native Americans at Yale, Fossil Free Yale, Students Unite Now, the Yale ACLU, Yale Students for Prison Divestment, the Yale Undergraduate Prison Project, and the Yale Young Democratic Socialists of America — came together to organize a teach-in event addressing how the endowment is invested and whether the $27 billion fund could be better mobilized to support Yale, New Haven, and various environmental and social causes.

The presentation touched on topics including how much Yale pays in money management fees, which “questionable” investments the university holds, and whether a higher spending rate of endowment funds could benefit Yale students or the city of New Haven, according to slides viewed by Institutional Investor.

Nora Heaphy, a first-year student at Yale and a board member of Yale Students for Prison Divestment, estimates that more than 230 people came to the February 3 event, leaving standing room only in a lecture room designed to seat 170. The attendees included students who weren’t affiliated with any of the seven groups, as well as New Haven residents, elected officials, and members of Yale’s Advisory Committee on Investor Responsibility. A number of students had to be turned away at the door.

Among the attendees was a reporter for the Yale Daily News. Her article on the teach-in, published the following Monday, repeated some of the assertions made during the activists’ presentation, including a claim that Yale had exposure to private prison operators through exchange-traded funds — a statement that was untrue, according to Swensen.

In fact, Swensen claims the presentation contained a number of errors, but it was the private prison issue that he chose to address in his Yale Daily News column.

“Quite simply stated, Yale’s endowment has no exposure to private prison management companies,” he wrote in the op-ed. By reporting otherwise, he argued, the News failed to meet “fundamental journalistic standards” of fact-checking and balanced reporting.

In the editor’s note addressing both Swensen’s op-ed and the email exchange that followed, the Yale Daily News editors said they took his criticism “very seriously” and had issued a correction to the article on the teach-in event.

“The News strives to report responsibly and accurately on campus issues, including Yale’s endowment,” they wrote. “Swensen, however, has not agreed to an on-the-record interview with the News in years. Our reporters are trained to cover every side of important campus debates, but that task becomes more difficult when key sources refuse to explain their positions.”

The saga did not end with the Yale Daily News editorial. In the days that followed, student activists submitted their own op-eds to the campus newspaper. One, written by members of Yale Students for Prison Divestment, asked for a more open dialogue between student advocates and the investments office. Another, penned by Fossil Free Yale members Rachel Calnek-Sugin and Cassandra Darrow, argued that the singular focus of Swensen’s column on private prisons was proof that Yale had exposure to the other investments addressed during the teach-in event.

Like many universities, Yale does not report which money managers it invests with or what specific securities it holds — a sticking point for student activists, who advocate for more transparency. Behind this secrecy is a belief that sharing such information would be detrimental to investment performance because, as Swensen explains, active management is all about exploiting mispricing within the market.

“If you publicly identify what it is that you’re invested in on an asset-by-asset basis, you’re going to undermine your ability to benefit from active management,” he says. “The kind of transparency that people are demanding is at odds with pursuing a successful active management program.”

Swensen contends that student activists don’t actually need to know whether the endowment has exposure to certain sectors or companies in order to engage in thoughtful debate over whether those securities should be divested.

“In some sense, it’s irrelevant,” he says. “It wouldn’t make any sense to say, 'Oh well, we don’t have to have the debate because it’s not in the portfolio' — because it could be in there tomorrow.”

But students still want answers. Denied information from their universities, student groups such as Yale Students for Prison Divestment turn to public tax documents and regulatory filings, which only provide a small glimpse at the total portfolio.

“Information regarding Yale’s investments is extremely inaccessible and opaque,” says prison divestment advocate Heaphy. “While we would not expect Yale to release the entirety of its highly watched portfolio, we find it concerning that, in general, university administrators and representatives of the investments office are not willing to engage in an open dialogue with students regarding the management of the endowment.” Students hoping to engage with the university on issues relating to ethical investing must go through the Advisory Committee on Investor Responsibility, a committee made up of faculty, staff, alumni, and students. This committee, in turn, makes recommendations to the Yale trustees who govern the endowment. Other universities, including Ivy League peers Harvard, Princeton, and Columbia, have established similar channels for student activism.

“Most CIOs do not directly engage with student activists,” says Charles Skorina, an executive recruiter for endowments, foundations, and family offices. “Universities don’t want the investment team to get sucked up into that.”

There are some exceptions — Notre Dame’s Malpass, for instance, is known for having an open-door policy with students, and frequently meets with activists and other groups to help them understand how the endowment is invested.

“It’s certainly [in] their interest and their right to understand the investment process and how we balance being a good fiduciary and a good steward,” Malpass says. “We may not always agree, but I think they appreciate the efforts we make.”

In general, however, executive recruiter Brown says CIOs try to insulate themselves from student activism. But that too can cause problems, leading to very one-sided debates on campus.

“There’s been quite a period where the student protesters have been very vocal and the university hasn’t really responded,” Swensen says. “I think it’s time to respond.”

Swensen and his team are working on position papers addressing each of the four issues at the center of the school’s student activism: fossil fuels, private prisons, Puerto Rico's bonds, and the Northern Pass. While it’s too soon to say whether or how these position papers would be disseminated beyond the investments office, it wouldn’t be the first time the endowment publicly addressed student concerns regarding its investments.

In August 2014, after Yale trustees had voted against divesting from fossil fuels, Swensen penned a letter to Yale’s asset managers regarding the potential economic impacts of climate change. The letter — which was made public and can now be found on the investments office website — called on Yale’s managers to include assessments of carbon footprints and the direct consequences of climate change on expected returns when evaluating investment opportunities.

“There’s no question that dealing with student activists can help clarify your ideas surrounding the issues that they’re raising,” Swensen says. “[The letter] is an example of an issue being raised by student activists and Yale making an institutional decision not to divest, but taking an institutional position on the issue that I believe ultimately was a constructive response to dealing with issues of climate change.”

Students, however, continue to push for Yale to take a firmer stance on fossil fuels: In April the Yale Daily News reported that members and supporters of Fossil Free Yale had rallied outside the investments office chanting “Yale says more money; we say time’s up.” The group delivered a set of demands to the office, asking that Swensen and his team disclose Yale’s holdings in fossil fuel companies and begin divesting from the industry. The demands also targeted Yale’s investments with Baupost Group, the second-largest holder of Puerto Rico debt. (Yale had at least $740 million invested with the hedge fund firm as of June 30, 2016, according to tax filings.)

While the continued onslaught of activism, and the accompanying bad press in the Yale Daily News, is clearly frustrating for Swensen, he says he wouldn’t have wanted to work in a private-sector job secluded from the politics and pressures of a university role.

“Oh, I wouldn’t like that,” he says. “I like this whole package. Being part of the Yale community is a huge privilege.”

The experience of having his “intemperate” remarks blasted across media headlines, however, is not one he is interested in repeating: As a condition of being interviewed by Institutional Investor, Swensen asked to review any direct quotes.