Illustrations by Emmanuel Polanco

Where money meets power in this arid desert monarchy, Stanford University has sway.

The U.S. institution laid groundwork decades ago for the deep ties it has constructed in Saudi Arabia. Then the network effect took over. In the kingdom’s business community, Stanford has become the ultimate brand. And as a new generation of Saudis aspire to build a profoundly different future for their country, they are taking lessons from the school of Silicon Valley.

The kingdom has been under a spotlight for the past two years. In April 2016, Crown Prince Mohammed bin Salman — known as “MBS” — laid out extensive plans to diversify the economy away from its historical dependence on oil. While the government had long held such ambitions, MBS’s Vision 2030 was audacious in its detail and complexity.

The architects of Vision 2030 want Saudi Arabia to become a global investment hub, connecting Africa, Asia, and Europe, and to unite investors in the West with those in Islamic countries.

For investors, plans to privatize government services, fund technology and energy startups, and dramatically increase foreign direct investment stood out, as did the proposal to significantly increase the private sector’s contribution to the economy from 40 percent to 65 percent of GDP.

Observers got a hint of things to come four months ahead of the Vision 2030 unveiling, when Saudi Aramco — the world’s largest oil and gas company — announced plans for an initial public offering. But the Aramco story is just one element of a much bigger, transformative economic plan. Those in charge of it have one thing in common: a Stanford University education.

Stanford has spent years getting its tentacles deep into the kingdom. Back in 1992, it became the first Western university to operate a regular alumni travel program to Saudi Arabia, and ties have developed significantly since then. The California-based school has rapidly built its reputation in the region through partnerships with local universities and businesses — some private and some government-owned. It has supported these relationships by dispatching visiting lecturers to meet dignitaries and speak at conferences, while establishing several extensive alumni networks.

The result? Stanford has a formidable power base in Saudi Arabia. Its alumni hold dozens of influential positions at investment firms, banks, advisory businesses, and state-owned behemoths, including Aramco.

When Institutional Investor approached Stanford to discuss the university’s strategy in the Middle East, a spokeswoman instead offered a written statement saying the school does not tailor its programs to individual countries but is “continually evaluating” its “educational offerings” to increase its global impact.

While the university may not specifically tailor its programs to individual nations, its partnerships in Saudi Arabia have succeeded extravagantly.

In 2008 the university’s Institute for Computational and Mathematical Engineering was appointed as part of a five-year mandate to develop the curriculum for the King Abdullah University of Science and Technology — aka KAUST — a new postgraduate university sponsored by Saudi Arabia’s monarch.

According to the statement released at the time, Stanford’s deal also permitted the U.S. school to choose the first ten faculty members. Top Saudi government advisers and financiers have since attended the university and benefited from curricula structured in Stanford style. A month after the partnership with KAUST began, Stanford confirmed it had received a $10 million grant from KAUST to develop the materials science and engineering unit back in the U.S.

Four years later the president and CEO of Aramco, Khalid Al-Falih, would travel to California to speak at Stanford, and opened his remarks by calling the graduate school of business “one of the finest business schools in the world.” The partnership between Stanford and KAUST has continued to strengthen in recent years, with staff from both universities working together on various projects.

In 2011, Aramco, King Fahd University of Petroleum and Minerals, and Stanford announced a “strategic relationship” in education and scientific research. In a report on the Aramco Expats website at the time, John Etchemendy, then provost of Stanford, said the school already had “a strong partnership with Saudi Aramco” and that the deal “broadened” the relationship and allowed the school to become “more actively involved in research and academic development in Saudi Arabia.”

In 2014, for example, Stanford confirmed it and Saudi scientists had begun a six-year project in aerospace research. These ties have not been limited to individual projects and speeches, however. Stanford alumni have established various professional networks long after leaving the university. Some are backed by the university; others are less formal.

One broker based in the United Arab Emirates told me the Stanford community in Saudi Arabia is “one of the strongest in the world,” saying business leaders who went to Stanford “benefit from a shared set of values and experiences, which immediately establishes trust.”

Stanford has numerous networks in Saudi Arabia, which build, maintain, and strengthen these ties between alumni. The Stanford Club of Saudi Arabia is perhaps the best known. Its members include alumni, current students, affiliates, parents, and spouses of those who have studied there. The American Middle Eastern Network for Dialogue at Stanford — AMENDS — was established to help future leaders working across the Middle East and North Africa connect with colleagues in the U.S. and work together on initiatives. Individuals working on private deals in the kingdom say there are also a number of informal gatherings and networking events that solidify these relationships.

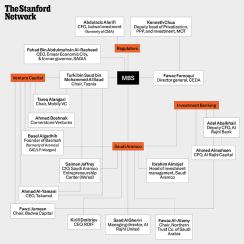

As the ruler of the kingdom, Crown Prince Mohammed bin Salman is central to all decision-making involving government-owned investment institutions. While he didn’t attend Stanford, many of his trusted advisers did. The numbers are even higher when you consider those who attended KAUST, the aforementioned local university with strong Stanford links.

In the investment world, the Stanford network is vast. In February, Kirill Dmitriev, the Stanford-educated chief executive officer of the $10 billion Russian Direct Investment Fund, told Reuters that RDIF was seeking to make multi-million-dollar investment deals with Saudi Arabia over the coming three months, including a significant investment in Aramco.

As CEO of RDIF, Dmitriev is obviously a prominent investor, but he has also held numerous high-profile roles at Goldman Sachs and McKinsey & Co. and was a key adviser in the sales of Delta Bank to General Electric and Delta Credit Bank to Societe Generale.

Ibrahim Almojel, among the most influential Stanford alumni in the kingdom, is the founding president of the Stanford Club of Saudi Arabia and acting director general of the Saudi Industrial Development Fund. He has also served in significant positions of power within Aramco. He was until recently the oil giant’s head of investment management, overseeing portfolio management, direct investments, and investment services for the company’s pension scheme.

Until 2013 the head of Aramco’s direct investments unit was another Stanford grad. Saad AlGheriri, who earned his MBA there in 2011, also used to lead Aramco’s hedge fund program. These days he is managing director at Al Rajhi United, an investment management firm based in Riyadh.

Projects arising from Vision 2030 show just how deep Stanford connections go. Former Stanford students can be found leading investment bodies linked to the government, or at the kingdom’s Public Investment Fund.

One of the beacons of Vision 2030 is the development of a brand-new city: King Abdullah Economic City (KAEC), stretching 67 square miles along the coast of the Red Sea, north of Jeddah. In 2005, KAEC was earmarked to become a major commercial center by former king Abdullah bin Abdulaziz Al Saud. The man in charge of Emaar Economic City, the company handling the development, is a prominent figure and, of course, a Stanford alumnus. Fahad Bin Abdulmuhsin Al-Rasheed is a graduate of Stanford’s MBA program, and also holds a clutch of qualifications from other leading colleges. He was chief financial officer and governor of the Saudi Arabian General Investment Authority and is on the board of the World Economic Forum’s Global Shapers Community. He also worked for Aramco’s finance division and project-managed a host of corporate finance and investment initiatives.

Stanford-educated leaders of state-owned entities, ministries, and departments are not difficult to find in Saudi Arabia. The highest-profile of these is arguably Fawaz Farooqui, the adviser to the minister of economy and planning. Farooqui is also director general at the Delivery and Rapid Intervention Center for the Council of Economic and Development Affairs (CEDA) of the Saudi government. CEDA is led by MBS. Farooqui was previously in charge of attracting investment into KAEC. These days his role at CEDA means he is highly influential on decisions pertinent to delivering Saudi Vision 2030. Until November 2017 he advised the previous economic minister, Adel bin Muhammad Fakeih. However, Fakeih was arrested during the country’s clampdown on corruption under the orders of MBS.

For investors looking to be a part of future public-private finance initiatives, it may be worth reaching out to Kenneth Chua. A Stanford MBA holder, Chua has been deputy of the Saudi Ministry of Transport’s Privatization, PPP, and Investment division since October 2017. The former McKinsey analyst has also completed stints with the World Bank and, more recently, at the Philippines’ Department of Finance as chief of staff.

Local financiers recognize venture capital and private equity as growing in importance due to the many business expansions, mergers, buyouts, and spinouts taking place within the kingdom.

Taqnia, the kingdom’s venture capital arm, makes direct investments in early-stage technology companies both domestic and global. Its deals to date have been in aviation, cybersecurity, and renewable energy, among other areas. With investor interest in corporate venture capital thriving, according to local advisory firms, Taqnia’s role is significant.

Taqnia is chaired by Turki Bin Saud Bin Mohammed Al Saud, holder of a Stanford Ph.D. He is also a member of the university’s school of engineering advisory council. Taqnia’s former chief operating officer, Ahmad Al-Yamani, is also Stanford-educated. But he left the group in August 2016 to take up another prominent investment role as CEO of Takamol Holding, a quasi-governmental body set up to encourage flows between investors and growing businesses.

Takamol’s programs include an initiative to attract venture capital, private equity, and mezzanine investors. It aims to provide finance for early- and mid-stage growth companies seeking development finance or funding for pre-IPO or IPO activity.

The top investment decision-maker at Aramco’s entrepreneurship center — Wa’ed — is also a Cardinal (Stanford’s athletic nickname). Salman Jaffrey became chief investment officer of Wa’ed in January 2017, having previously led portfolio management for Saudi Aramco Energy Ventures. Jaffrey’s prior experience included roles with three of the Big Four global accounting firms (PwC, Ernst & Young, and Deloitte). Aramco’s Wa’ed division offers direct equity investment and seed funding for eligible businesses and is in step with the government’s ambitions to diversify the kingdom’s investments and economic profile. Other Stanford-qualified leaders prominent in Saudi Arabia’s venture scene include Tareq Alangari, chair of Mobily VC, and Ahmed Boshnak, partner at Cornerstone Ventures.

In addition to a vast number of science and technology companies tipped to merge or go public in the coming years, brokers in the region expect the financial services sector to transform. This transformation is likely to be easiest to witness in the Saudi banking sector, which has long been a candidate for consolidation due to the number of companies operating independently in the kingdom.

As Saudi Arabia’s program to transform its economy gathers pace, investment groups in the country have battled to attract the top talent. As of March, Saudi recruitment website Naukri Gulf had 4,597 job postings tagged portfolio management and a further 491 roles listed under investment banking.

Also noteworthy is how funds are beginning to seek talent as a hedge against global economic bumps. Will Jackson-Moore, leader of PwC’s global private equity and sovereign investment funds division, explains that the largest Saudi investment funds have been seeking expertise to bolster their capabilities in real estate, infrastructure, and direct investments.

“We are seeing the Saudi funds becoming more active,” he says. “The interesting next phase for all of these funds, particularly the ones that have moved relatively recently into direct investing, is how they cope with managing those investments through the next recession.”

As the region’s financial firms start to hunt for the very best talent available, you can probably hazard a guess which college is top of the list. Stanford-educated leaders can be found at the top of many of the investment groups advertising open positions.

And the region’s most-influential list certainly includes Stanford business school graduate Abdulaziz Alarifi, the chief financial officer of Jadwa Investment, an investment banking and asset management group. He was previously the head of financial and investment sector listings at the country’s regulator, the Capital Market Authority, between 2010 and 2012.

Fawaz Al-Alamy is another familiar face to the Saudi elite. A graduate of Stanford’s executive education program, he is also the chair of the Northern Trust Co. of Saudi Arabia, a corporate adviser, and a committee member of the University of Prince Mugrin’s corporate social responsibility advisory panel.

Then there is former Morgan Stanley M&A banker and Stanford MBA holder Fawzi Jumean. Today, Jumean is partner and chair at advisory and banking group Badwa Capital. While not leading Badwa, sits on the board of Prince Mohammed Bin Salman College of Business and Entrepreneurship and serves on the board and executive committee of AlRajhi United’s global investments business.

Another former Morgan Stanley banker with a Stanford link is Basel Algadhib, the founder of Basmah Commercial Investment Co. Algadhib’s sphere of influence is visible from his career history alone. Having left Stanford with a master’s in construction management, he went on to hold senior positions at national and global financial giants. In addition to Morgan Stanley, Algadhib has done star turns at Aramco, the Gulf Investment Corporation, Riyad Bank, and J.P. Morgan, among other organizations. Today he leads Basmah, which does sell-side and buy-side deal-making activities, project finance, asset management, and equity and debt capital markets issuance.

Also worthy of note is Al Rajhi Capital, an asset manager and investment bank that offers full brokerage and research services in the region. The provider of the Stanford connection here is chief financial officer Ahmed Almohsen, an alumnus of Stanford’s Graduate School of Business. Almohsen was previously CFO at Al Rajhi Bank, but since April, Al Rajhi Bank has another Stanford graduate advising the leadership team. Adel Abalkhail took over as deputy CFO, having held regional financial chief roles in Malaysia and Jordan with the same group.

The final cohort of Cardinals are those striving to be tomorrow’s titans. As Saudi Arabia looks to diversify its oil-slicked economy, upstarts in technology, e-commerce, health care, and renewable energy have the ear of investors in the region as well as plenty of government encouragement.

Among these future leaders, there are far too many Stanford grads to list comprehensively. Those worthy of a standout mention include serial entrepreneur and technologist Wael Kabli, who is currently CEO of medical consultation tech firm Cura.

Then there’s Abdulrahman Alshetwey, the CEO of cybersecurity group Innovative Solutions. While Alshetwey didn’t complete his undergraduate or postgraduate study at Stanford, his admission to Stanford’s Executive Program for Growing Companies permits him access to the network.

While Stanford’s web of influence is extensive in Saudi Arabia, it would be wrong to assume the university’s alumni have it all their own way. There are, of course, individuals from disparate educational backgrounds in important positions at the country’s many large organizations.

But once observed, the Stanford–Saudi connection cannot be unseen. The fact that so many powerful individuals have links to the institution attests to the brand power Stanford commands across the kingdom. And while the school’s top rivals may also deliver educations fit for a king, only Stanford has the keys to the kingdom.