An unprecedented portion of attendees at this winter's Context Summits conference in Miami were in favor of investing in cryptocurrencies — an asset that institutional investors have so far avoided.

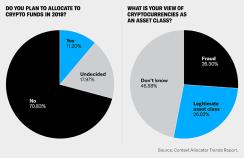

Of 400 allocators surveyed at the January 31 to February 2 event, around 11 percent predicted allocating to crypto funds in 2018. The respondents included staff from funds-of-hedge-funds, consulting firms, endowments, foundations, sovereign wealth funds, pensions, and family offices representing a combined $5 trillion under management.

At least a quarter of the respondents were from family offices, according to a spokesperson for Context Capital Partners, who declined to further break down the sample.

Although 71 percent of the surveyed allocators had no plans to invest in crypto funds, the results show greater interest than previous surveys have. Endowments and foundations polled by consulting firm NEPC in February had been overwhelmingly against cryptocurrencies, with 96 percent saying that they did not invest in electronic currencies like Bitcoin and had no immediate plans to do so.

[II Deep Dive: This Firm Wants To Bogle-Ize Cryptocurrencies]

Attendees at the Context Summits event were undecided on whether or not cryptocurrencies should be considered an asset class. About a quarter thought cryptocurrencies are a fraud — roughly the same portion as those who saw them as a legitimate investment. Almost half said they didn't know how to classify blockchain-based currencies.

Other findings from the Context survey included a surge of stated support for environmental, social, and governance strategies. Only about 38 percent of surveyed attendees said they considered ESG or other responsible investing factors as part of their overall investment strategy, but slightly over half planned to increase their allocations to ESG or impact investing funds in 2018.