Currently ranked: 18

Previously ranked: PNR

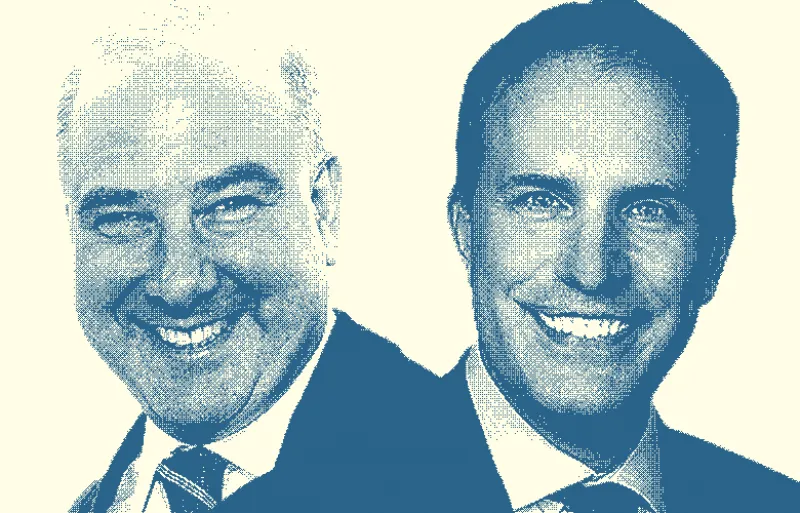

Starting in 2000, Credit Suisse Asset Management’s NEXT Investors built a financial technology portfolio that was funded directly off its parent bank’s balance sheet. That changed in 2013, when NEXT opened up to outside investors and closed a fund the following year at just over $400 million. There has never been a change in leadership — co-heads and portfolio managers Alan Freudenstein and Gregory Grimaldi have been together since 2000 — nor in what Freudenstein terms their “opportunistic” approach. Although Credit Suisse is a resource, offering insights on potential investments and advice to portfolio companies, the fund is managed to make the best possible returns, not to bring technologies into the bank.

Usually taking the lead role in financing rounds, NEXT exited, as of fall 2017, from 54 of the 70 investments it had made since inception, and not one of the sales was to Credit Suisse or another bank, notes Freudenstein, who before 2000 was responsible for start-up incubation and venture investing in the New World Ventures group of Bankers Trust Co. (later Deutsche Bank). As Grimaldi puts it, “We are not VCs. We invest at the growth stage.”

NEXT Investors views technology through an “evolutionary rather than revolutionary” lens, Freudenstein says. Instead of placing bets on the next big things, they identify problems facing the financial industry and look to address them in such areas as market structure, data analytics, enterprise software, and a category they label tech-enabled finance.

The group had an exit in August when foreign exchange electronic communications network FastMatch, which was built on Credit Suisse technology and in which NEXT was a founding investor, was acquired by Euronext. Also in August, NEXT announced a majority investment in Sapience Analytics, an Indian provider of workforce management and efficiency-enhancing solutions, which is looking to accelerate growth in the U.S. Grimaldi joined Sapience’s board along with NEXT senior adviser and former Credit Suisse First Boston global chief information officer Frank Fanzilli.

See the full Fintech Finance 40 here.