Currently ranked: 9

Previously ranked: 9

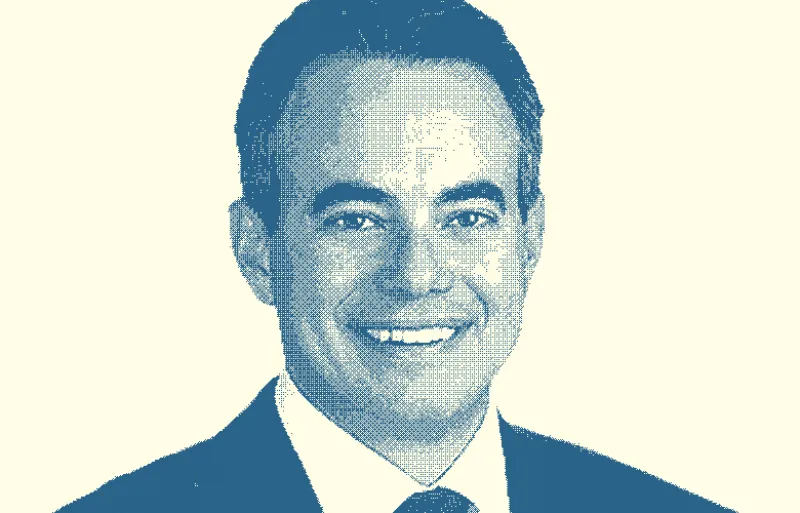

The importance that Goldman Sachs Group places on strategic fintech investing is measured in numbers matched by few if any of its peers: a portfolio of some 80 companies managed by 30 people in the firm’s principal strategic investments group. “Venture capital activity in fintech remains healthy, albeit at less elevated levels,” says PSI global head Darren Cohen, who was named a Goldman Sachs managing director in 2010 and a partner in 2014. His group’s deal-making has held steady, and its strategy “remains unchanged as we continue to look for companies with great management teams that combine strong technology, deep domain expertise, and a track record of successfully scaling organizations,” he says.

Goldman has long been known for spotting technology trends early. Examples in the portfolio include blockchain-based payments start-up Circle, cognitive computing firm Digital Reasoning, and machine-learning-driven market analytics provider Kensho. The investment banking giant has wielded trading system and market structure influence as a consortium shareholder in Markit (now IHS Markit), REDI Holdings (now owned by Thomson Reuters), and Tradeweb Markets. Three-year-old Symphony Communication Services, a joint venture spun off from Goldman, “has become a leader in secure messaging for finance,” notes Cohen, who first joined Goldman in 2000 as a software and technology services analyst in London. He left in 2004 to be a senior analyst with Calypso Capital Management and returned to Goldman in 2007.

“We are now seeing a more diversified group of co-investors interested in investing in the fintech landscape, including venture capital firms, hedge funds, asset managers, and other corporate venture teams,” Cohen says. Recent PSI investments include blockchain infrastructure provider Axoni, regulatory compliance firm Droit, cybersecurity company Dyadic, small-business credit and financing start-up Nav, foreign exchange trading company Spark Systems, and NYSHEX (New York Shipping Exchange).