Most people assume I called this column “Avenue of Giants” because the funds I write about are big.

Not true.

To be sure, the funds are big. Some might even say they are the Redwoods of the financial forest. But that’s not what led to the name. My actual intent was to empower and invigorate this community of long-term investors by creating a positive, powerful, and common identity they could be proud of.

I call pensions, sovereign funds, endowments, and foundations Giants because I want them to feel like Giants. I want to wake these funds to the possibility — even likelihood — that they are the most important players in the global financial system. I want the trustees to expect more from their staff and then reward them accordingly. I want staff to have the confidence to go toe-to-toe with any asset managers in the private sector and be ready to walk away if they can’t get alignment. I want my best students to ask me how they too might one day get hired at a Giant.

I call them Giants to create a sense of possibility and wonder at the potential impact of these organizations.

I write to them, here, because I’ve learned over the years that many don’t yet realize who they are. They manage over $80 trillion, but they don’t recognize that they are the very base of our capitalist system. Many Giants around the world are asleep. I’m here to wake them up and give them some direction on how to go about their day-to-day operations. You can think of this column as part “alarm clock” and part “morning shower.” Some of my articles, especially those on fees and costs, attempt to jolt Giants awake. Other articles aim to provide insight and assistance on washing away the past and preparing for a new future.

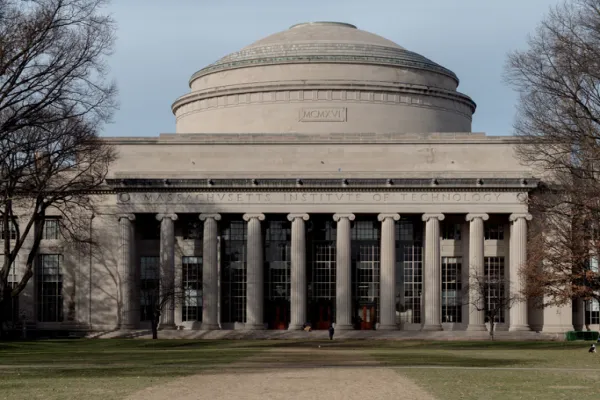

As you can imagine, my work doesn’t stop at the end of this page. The mission of this column is carried forward in all aspects of my working life. At Stanford, we at the Global Projects Center have been working for almost a decade to unlock the Giant’s slumbering capital by showing them empirically tested strategies that can benefit them (in terms of risk-adjusted returns) and the world (in terms of sustainable growth and development). We sit in the School of Engineering, leveraging engineering expertise to help think creatively about long-term projects. We help engineers think about aligned financial partners who can maximize their chances for success. In our experience large, long-term projects need large, long-term investors, and that’s where my Center comes in.

We’re trying to improve the finance industry so that it works for all those people thinking big, audacious thoughts about infrastructure, real estate, computer science, water, energy, climate change, and so on. If the financing doesn’t come together in the right way, the projects may not succeed even if the ideas are sound and the execution solid.

To be candid a big part of giving Giants the confidence and resources to pursue new things requires us — requires me — to put some real distance between the Giants we serve and their colleagues in the for-profit financial services industry. The methods and motives of a pension fund are different from an asset manager, and we need to acknowledge and embrace this difference. We need to show the Giants how the greed-is-good mentality in the finance industry, characterized by the culture of Wall Street, is fundamentally at odds with the long-term value creation undertaken by pensions or sovereigns.

Indeed, the two cultures are, or should be, truly divergent. The people working on Wall Street today are twice as likely to become billionaires than any other type of professional working in America. Seriously. The people working on the Avenue of Giants are honored to have billions under their care and thrilled to earn a million bucks as an over-achiever (i.e., still incredibly well compensated compared to the average American worker). The people on Wall Street often redirect long-term capital into short-term products and funds to meet their needs, while the people on the Avenue of Giants need to go beyond that short-termism and refocus capital on long-term value creation.

These are different communities — on different roads — with different objective functions over different time horizons and different cultures. This difference is something to be incredibly proud of — a job working at a Giant is a truly dignified financial career.

So, the motivation for all of my work — this column, my books, my research center, my startups, my bad jokes — all comes from my belief that helping Giants achieve their objectives in new and more aligned ways will help the world. I want to inspire all long-term investors to join the growing number of organizations setting up shop on the Avenue of Giants. Many of them are still groggy from their long slumber, but they are unique, and they are powerful. They are Giants. And that gives me confidence in our collective future.