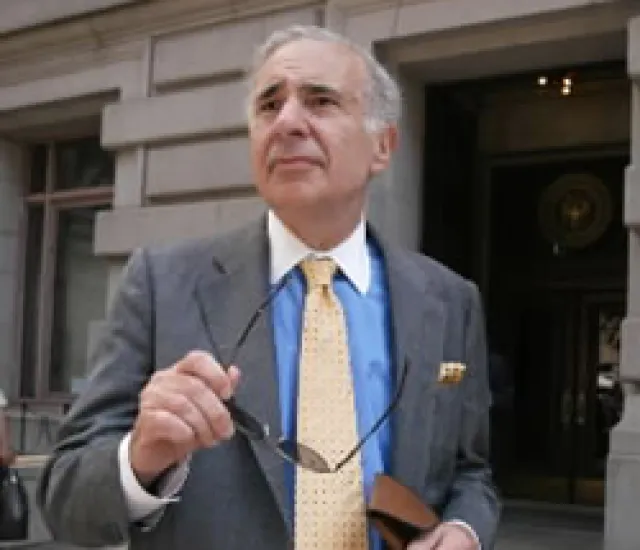

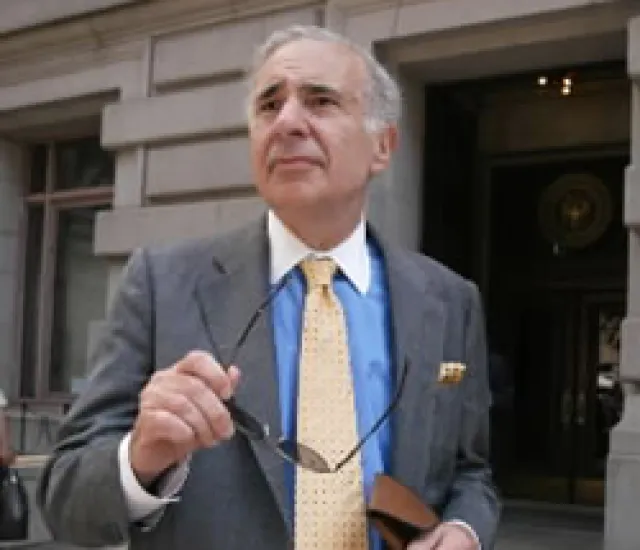

While Icahn Buys, Option Volume Surges In Commercial Metals

Carl Icahn has put the cross-hairs on a new target. And it seems that some investors were sensing something was up with the stock. The activist investor late Thursday said he now owned a little more than 11.5 million shares of Commercial Metals, or 9.98 percent of the total outstanding.

Stephen Taub

July 29, 2011