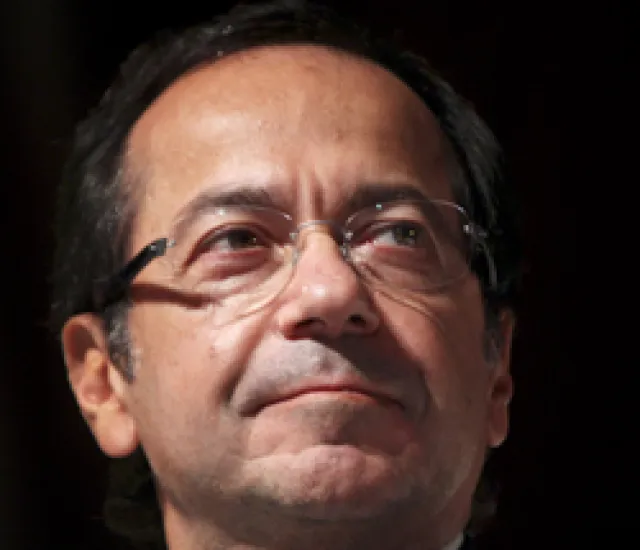

This has been a humbling year for John Paulson.

The billionaire hedge fund manager in May extended his losses in his Paulson Advantage fund, falling 4.06 percent for the month. As a result, the fund, which contains his best ideas, is down 5.26 percent for the year.

Advantage Plus, the leveraged version of the fund, dropped nearly 6 percent last month and is down 7.54 percent year-to-date.

Even Paulson’s huge bets on gold couldn’t save him last month.

His gold fund lost 6.39 percent in May, shrinking its gain for the year to 0.79 percent.

As a result, the gold shares of Advantage are up just 1.18 percent for the year while for Advantage Plus they are down 1.30 percent for the year.

Not all investors with Paulson are complaining. Partners L.P., his oldest, flagship fund eked out an 8 basis points gain in May, giving it a 6.64 percent return for the year.

Its gold shares were down 1.10 percent for the month, but are still up 14.13 percent for the year.

This is a big reversal of fortunes for Paulson, whose gold bets goosed returns in 2010.

While a number of hedge fund managers have recently pulled back on their bold bets, Paulson has been standing pat.

In the first quarter, his largest holding by far remained the SPDR Gold Trust exchange traded fund.

However, his largest new positions were in Hewlett Packard, Lubrizol and Weyerhauser. His six million-share position in Lubrizol easily made him the largest shareholder of Lubrizol, the specialty chemical company, and his 31.7 million shares made him the second largest holder of Weyerhaeuser, the forest products company.

In the first quarter he completely closed out eight positions, the two most significant being drug makers Pfizer and Sanofi.