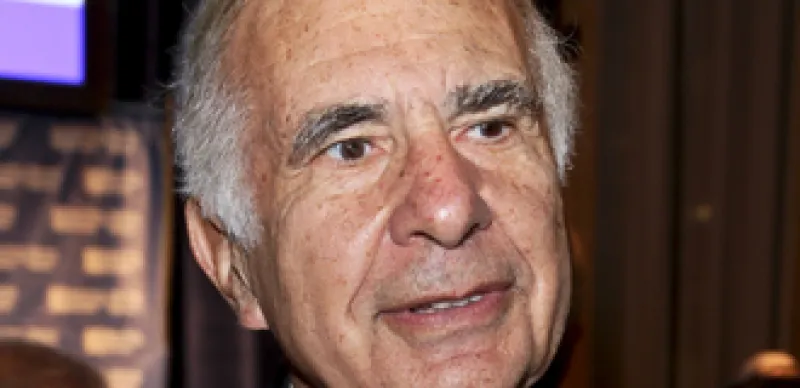

Carl Icahn, chairman of Icahn Enterprises LP, attends the New York Historical Society's (NYHS) History Makers gala in New York, U.S., on Wednesday, Oct. 6, 2010. Lions Gate Entertainment Corp. sued billionaire Carl Icahn over the Metro-Goldwyn-Mayer Inc. studio deal in federal court in New York, alleging the financier was "secretly plotting" to merge the studios. Photographer: Rick Maiman/Bloomberg *** Local Caption *** Carl Icahn

Rick Maiman/Bloomberg