What’s in a name? For hedge funds, it might be their ability to draw in capital.

Hedge fund investors allocate more to funds with names exhibiting “gravitas,” according to a new study by Juha Joenväärä, a postdoctoral researcher at the University of Oulu in Finland, and Cristian Ioan Tiu, a finance professor at the University at Buffalo’s School of Management.

They examined 17,766 active and defunct hedge funds, using data from January 1994 through September 2013. Then, using word categories from the Harvard IV Psychological Dictionary, they filtered hedge fund names for instances of “gravitas”: words relating to economics or geopolitics, or which convey power.

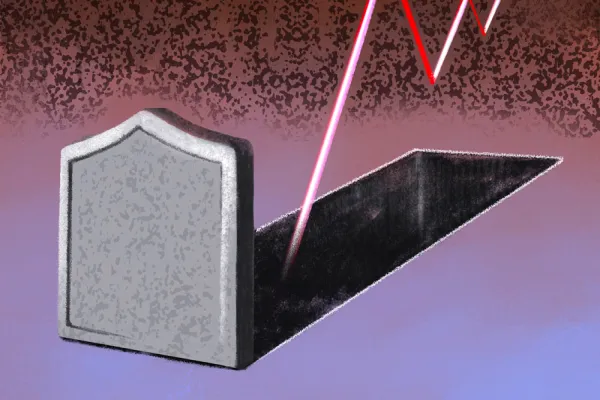

The pair found that having a name associated with weight, influence, authority, seriousness, or good judgment makes a hedge fund more attractive to investors, even as their performance lagged. Adding a single word indicating gravitas will increase capital to the average fund by $227,120 every year, Joenväärä and Tiu estimated.

Yet, “the propensity of a fund manager to choose a name with gravitas does not seem ... to be a signal of the fund’s sophistication,” they wrote, finding that such firms typically used less sophisticated, more liquid strategies.

Although hedge funds with powerful names saw the highest inflows, they tended to have lower returns, alphas, and Sharpe ratios, as well as experience higher volatility and more severe drawdowns. They earned almost 1 percent less in annualized excess returns than hedge funds with less weighty names, and their maximum drawdowns were more than 5 percent higher.

“The hedge fund industry’s clients are supposed to be, by contrast to individuals, sophisticated, and are mostly institutions, in theory more immune to behavioral decision-making biases,” Joenväärä and Tiu wrote. “Yet we document that behavioral sensitivities still exist.”

Eventually, though, their clients do catch on. While investors can be duped at first by an impressive-sounding name, the researchers found that, over time, as investors witnessed a hedge fund’s true investment abilities, they “punished” underperforming funds, “oftentimes severely enough that the [hedge funds] exit the sample altogether,” according to the study.

“Investors reduce, although not completely eliminate, their name gravitas sensitivity as they learn about the funds,” the researchers wrote.