What Do You Believe About Investing?

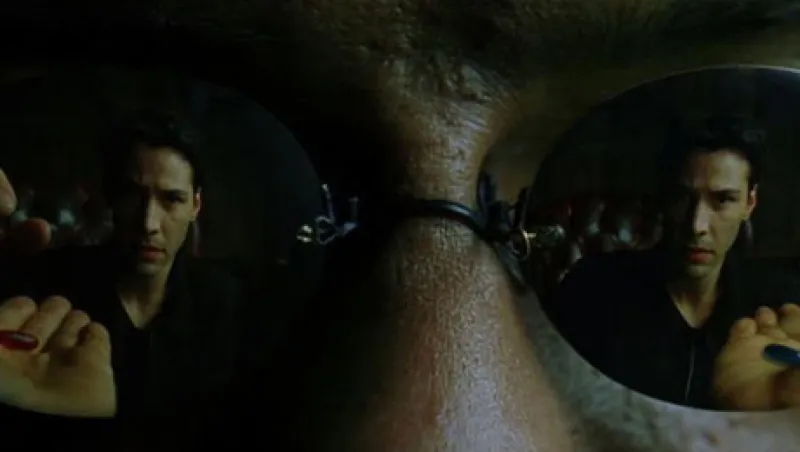

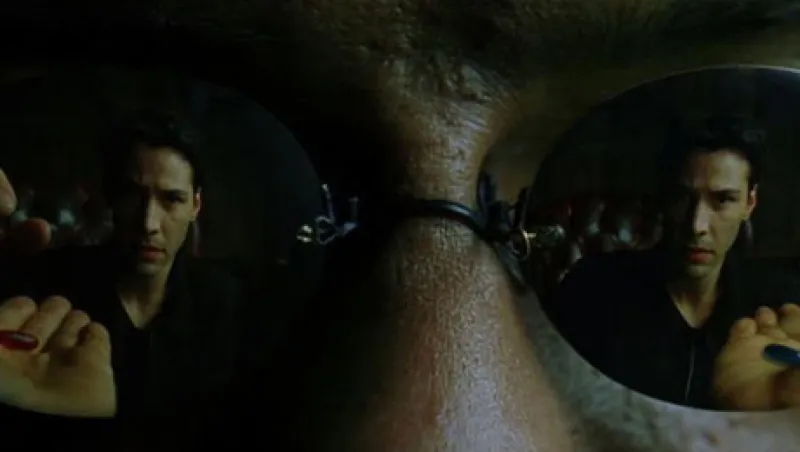

Until recently, investors found great comfort in their traditional models. This was a world where products trumped risks; computers trumped people; the quantitative trumped the qualitative; and top-down trumped bottom up. And then those investors took the red pill... and woke up in the real world.

Ashby Monk

June 27, 2012