Elias Masilela may be a “man of many talents”, but one talent among his many seems to be standing out: His ability to run an unconventional and yet highly successful public pension fund...in Africa. According to the Bloomberg machine, the South African Government Employees Pension Fund (via the Public Investment Corp.) had 12% returns on its overall portfolio in 2011 and 18% returns on its African portfolio (excluding SA).

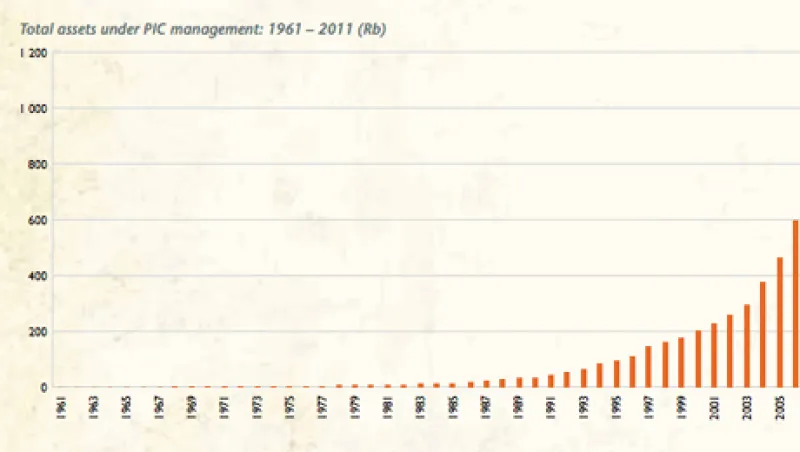

That’s remarkable; I defy you to find another public pension fund that has done that well (aside from the Danish risk masters at ATP). Granted, one year isn’t all that long of a time period, but it’s nonetheless interesting. And it’s actually a reminder of how solid this pension fund has been over the long term, during good and bad years. For example, the pension is today 100% fully funded (according to the latest actuarial valuation), and its long-run returns are simply astounding (see chart below).

How does the GEPF do it? By thinking unconventionally, it would seem.

“While delivering healthy returns for our clients, PIC is also contributing to broader socio-economic development. With the endorsement of our clients, PIC is making significant investments in rural and township development, as well as in the development of the country’s airports infrastructure.”

Normally, I would see a problem here. I would worry about graft and corruption. I would worry about ‘bridges to nowhere’. I would worry about politically motivated investing. So, then, how does the GEPF make this “double bottom line” approach work? Good governance:

“In promoting good governance, the PIC has a clear obligation to practise what it preaches. In pursuit of this aim, the PIC has, based on the matrix that it uses to rate the investee companies on the JSE, rated itself and used that rating to improve its governance practices.”

Commendable! It focuses on its own governance as much as it focuses on the governance of its portfolio companies (cf CalPERS). Anyway, I think the fund’s mission statement offers a really useful framework for thinking about “long-term investing” – especially since the fund is celebrating its 100-year anniversary this year:

“The PIC – having been established by an Act of Parliament to provide for the investment by the corporation of certain monies received or held by, for or on behalf of the Government of the Republic and certain bodies, councils, funds and accounts – will:

- Deliver investment returns in line with client mandates

- Create a working environment to ensure that the best skills are attracted and retained

- Be a beacon of good corporate governance

- Contribute positively to South Africa’s development”