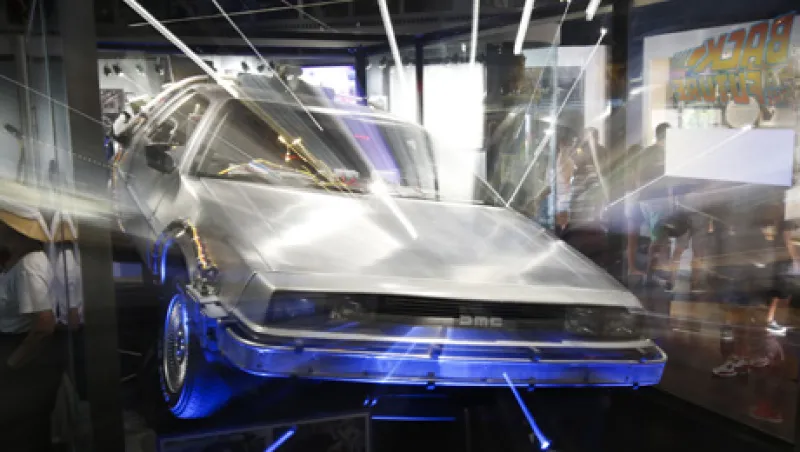

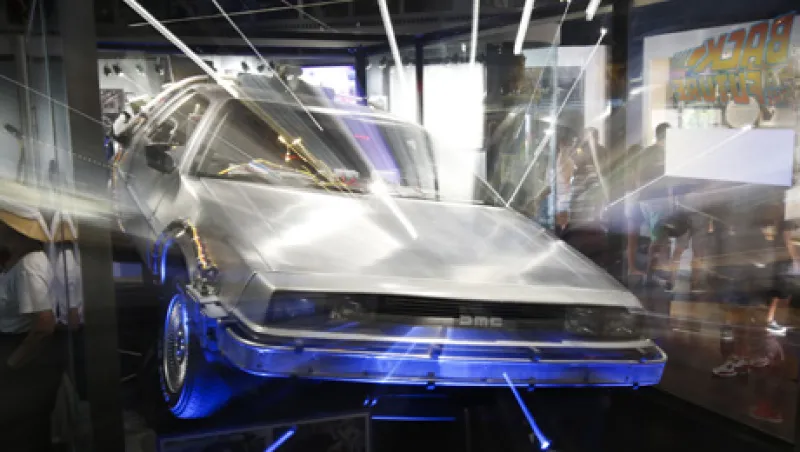

The Hot New Investment for SDFs: Time Machines

I was recently in a San Jose coffee shop with a friend who runs a sovereign development fund. He was in town looking to invest in...wait for it...time machines. Seriously.

Ashby Monk

January 30, 2014