Troubled South Africa Spells Opportunity for Investors

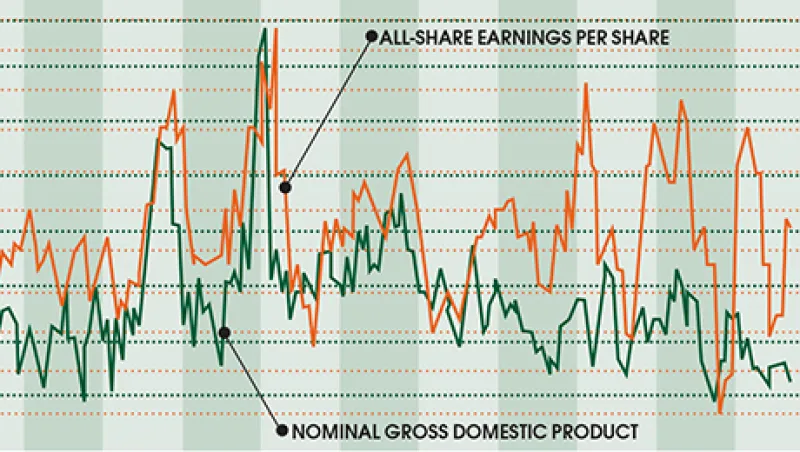

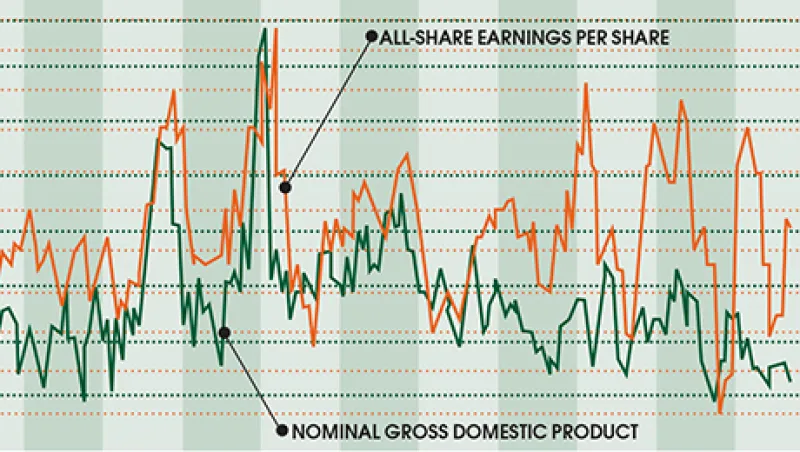

Despite its sluggish economy, the country offers attractive stock picks from a corporate sector whose earnings have outpaced GDP growth.

David Turner

October 16, 2014