The rise of the Chinese consumer has been one of the most important structural trends of the past decade. Recently, however, Chinese consumer companies have come under pressure. A weakened macroenvironment, coupled with curbs on spending by government bureaucrats, has hit a range of consumer businesses and in some cases forced a reassessment of expansion plans.

On the surface this poses challenges for equity investors looking to benefit from growing income per capita and purchasing power in China. Yet in Pimco’s view, this also presents opportunities. Mass retailers, which face oversupply and low pricing power, are likely to continue to struggle. On the other hand, companies with strong business models in sectors in which supply may be constrained, such as casinos, or in which powerful brands act as competitive moats, such as luxury goods, are likely to maintain high operating margins and returns on capital.

This approach is important not just for returns during the next year but also for long-term investment, as our research shows that highly profitable firms tend to remain so over time and also outperform the broad market (see Pimco’s report, “The Profitability Premium in EM Equities”).

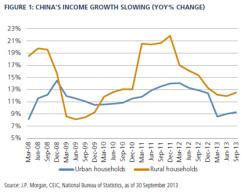

From a macroperspective, Chinese year-over-year GDP growth has declined from 9.8 percent in the fourth quarter of 2010 to 7.8 percent in the third quarter of 2013, denting consumer confidence. The impact of the slowdown on income growth has been particularly pronounced during the past 12 months, with urban household income growth falling more than 3 percentage points to just over 9 percent.

Compounding the impact of slowing income growth, the Chinese government has moved to curb spending by bureaucrats by restricting their dining, travel and gift buying. In the liquor sector, for example, a bottle of Moutai, a luxury brand of traditional spirits made from sorghum, has fallen from a retail price of almost 2,000 yuan ($316) in 2012 to around 900 yuan, reflecting weakened demand. Similarly, department store operators are seeing negative same-store sales growth, much of which has been ascribed to declining distribution of gift cards. With little optimism that income growth will rise in the near term or spending restrictions will be removed, Pimco’s view is that the cycle of falling demand may continue for at least another six months.

Whereas consumption is slowing, it is important to recognize that it has not collapsed, nor do we expect it to. Although down from a peak of more than 20 percent in 2008, year-on-year growth in Chinese retail sales was still running at 13 percent as of September 30. Rising secular demand among Chinese consumers still offers a play for a long-term equity investor. It’s just increasingly important to differentiate among the companies in this space.

Since mid-2010 valuations of Chinese retailers have contracted, while valuations of Chinese firms selling staple goods have expanded. Although it may be tempting to expect some mean reversion, we think there are strong reasons for the underperformance in the retail sector and believe it is likely to continue.

Same-store sales growth has declined to just above 1 percent for listed Chinese retailers, after peaking at more than 19 percent in early 2011. This downward trend reflects both the broader slowdown in income growth within the economy and the negative headwinds of the spending restrictions. What is compounding problems for retailers, however, is that the slowdown in spending has been exacerbated by an increase in supply. This perhaps echoes some of the oversupply issues seen elsewhere in the Chinese economy, where easy money has fueled an investment boom.

Although industry data are incomplete, Pimco’s opinion is that in many local markets in China, the root of the problem is the expansion in physical retail stores. Whereas growth of department store density in emerging markets remains well below that of the U.S. and U.K., China is comfortably ahead of most of East Asia, including richer nations such as South Korea and Japan. This supports the view that this past decade Chinese retailers have focused on capacity expansion without sufficient regard for operating expenses and capital efficiency. This has since come home to hurt performance in the form of declining margins across the sector in 2013.

Looking forward, we see little evidence of these trends changing over the cyclical term, even if the third quarter turns out to be a demand trough. With operating cost inflation and product price pressures, retailers may continue to see declining profitability and eroding returns on capital. We think this low profitability is likely to be associated with share price underperformance.

Although the retail outlook may be negative, the good news is that Chinese income growth is still far outpacing that of the developed world. And while capacity expansion in the retail sector may be dragging on returns, there are other sectors in which supply constraints are providing the structure for sustainable profit growth or in which brands are powerful, allowing companies to extract high returns. These businesses should be able to deliver sustainable, high levels of profitability — and, potentially, share price outperformance.

One of these sectors is casinos. Like retailers, casinos generally benefit from a secular trend of income growth, which, although moderating recently, is still running at more than 9 percent among the urban population in China and more than 11 percent among the rural population. Demand has been further boosted in Macau by improved transportation links from the Chinese mainland, including access to high-speed rail. Most important, in contrast to the retail sector, supply remains constrained. Due to the regulated nature of the gaming sector and limited availability of licenses, supply of tables grew at a compound annual growth rate of only 5 percent between 2008 and 2012. In contrast, total gaming revenues grew at a 30 percent CAGR during the same period. By our estimates, they are set to continue to grow at double-digit levels with supply remaining constrained. This highly favorable combination of growing secular demand and limited capacity is reflected in consensus profit estimates that far outpace the broader China consumer sector.

Sustainable profitability can also come through powerful brands. Luxury goods companies that sell into the Chinese market are a prime example, benefiting from secular demand growth without facing the oversupply issues of the mass retail sector. Many of these luxury companies are well-known developed market brands, but there are also domestic Chinese companies with powerful market positions. Certain domestic Chinese firms have premium liquor brands, for example, and enjoy strong pricing power through their relationships with distributors.

In addition, we think that outside the luxury segment, consumer staples firms that focus on creating new product categories rather than engaging in head-to-head competition may also be positioned to sustain long-term margins.

Overall, although Chinese consumption may be challenged in the near term, we think the impact will continue to be felt most in the retail sector, where slowing demand is compounded by oversupply. In contrast, we see opportunity in sectors that benefit from secular demand growth and constrained supply or strong brands. Although valuations in such sectors, notably casinos, have risen during the past 12 months, we believe that opportunities remain, whether in select gaming companies or in other luxury or premium sectors. We do not expect these dynamics to shift in the near term and believe that investors will be best placed by focusing on these potentially profitable consumer-linked sectors.

Richard Flax is a senior vice president at Pacific Investment Management Co.’s London office and an emerging-markets equity analyst.

See Pimco’s disclaimer.

Get more on emerging markets.