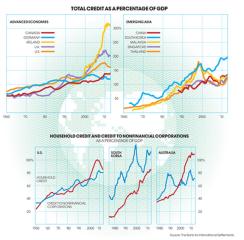

The financial crisis taught everyone the painful consequences of having too much debt. For those looking to avoid a future calamity, however, debt statistics are not widely available or readily comparable across major countries. The Bank for International Settlements seeks to fill that gap with a new credit database covering 40 advanced and emerging-markets economies, and the results are intriguing.

The credit addiction that once seemed to be a very American phenomenon has spread around the world. In the West, Ireland, the U.K. and most of Scandinavia have significantly higher credit-to-GDP ratios than the U.S., while much of emerging Asia is fast reaching American debt levels. U.S. household credit, where excesses triggered the crisis, has dropped by more than 15 percentage points, to barely 80 percent of GDP, while in Australia the comparable figure is more than 100 percent of GDP. Nonfinancial companies in the U.S. have also tightened their belts, while their South Korean counterparts have higher, and rising, debt. The data doesn’t scream crisis, but it does bear watching.