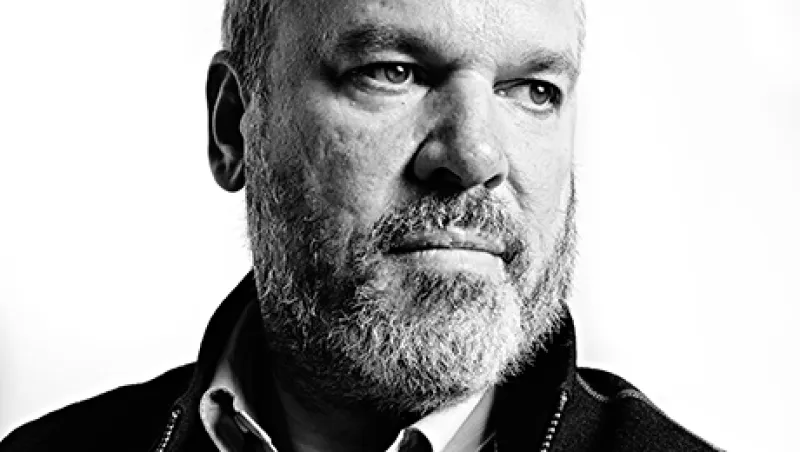

Hedge Fund Manager John Burbank’s Investment Alchemy

The head of San Francisco–based hedge fund firm Passport Capital has figured out how to turn risk management into an alpha strategy.

Jan Alexander

December 10, 2013