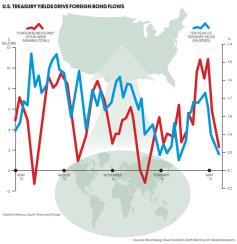

It was the giant sucking sound heard round the world. When Ben Bernanke told the congressional Joint Economic Committee in May that the Federal Reserve might start to taper its bond purchases within the next two to four months, U.S. markets went into a panic. Yields on ten-year U.S. Treasuries surged more than 60 basis points over the next five weeks, while U.S. stocks tumbled.

The reaction was even more dramatic in emerging markets. After years of benefiting from, and sometimes complaining about, Fed liquidity, emerging markets suddenly saw investors fleeing over the prospect of higher U.S. rates. Outflows from emerging-markets debt-dedicated funds hit a record $5.6 billion in the week ended June 26, according to data provider EPF R Global. Those with long memories will recall that drastic tightening by the Paul Volcker Fed in the early 1980s triggered the Latin debt crisis. The potential for higher U.S. rates to cause global pain is far greater today: Local currency emerging-markets debt has expanded nearly 20-fold since the mid-1990s, to more than $5 trillion. That's a lot of flow potential.