As last month’s World Economic Forum in Africa trained a spotlight on the continent, we believe that the case for investment in Africa remains compelling. A number of positive structural developments — improvements in the quality of governance, a sharp decrease in armed conflicts and the rise of democratically elected governments — are reinforcing the strong economic growth dynamic that has emerged since the turn of the century. This is particularly the case in the most significant economies and investment destinations on the continent.

As a consequence of these developments, the African continent has enjoyed unprecedented economic growth in recent years. Over the past decade, only Asia has seen more growth than Africa. This performance has been resilient too. Since the start of the global financial crisis in 2008, Africa has maintained its growth trajectory and outperformed the developed world and most other developing regions. The story is even more impressive if we focus on sub-Saharan Africa. Although growth in the region has slowed marginally, by about 1 percentage point a year from the precrisis peak, the latest IMF forecasts have growth returning to precrisis levels, with a rate of 5.6 percent predicted for 2013 and 6.1 percent for 2014.

The structural growth drivers in key African markets that have taken root — against the backdrop of greater peace, political stability and democracy — include more prudent macroeconomic policies, a growing consumer class driven by rapid urbanization and favorable demographics, and a renewed emphasis on much-needed infrastructure investment and natural resource discoveries. In the first of two articles, we explore these drivers in detail and point out that they are self-reinforcing — and therefore are likely to sustain the growth takeoff experienced in Africa in recent years.

Increased quality of governance: We regard the considerable improvements in peace and security and the significant increase in the number of democratically elected governments in Africa today (compared, for example, to the 1980s) as the catalyst that set a number of subsequent growth drivers in motion. Historically, the absence of political stability and reliable legal institutions that enforce property rights has been a considerable obstacle to investment and economic development. Furthermore, violent conflict and civil war exact enormous costs, both directly through the funding of conflict and indirectly by deterring investment, shortening political horizons and requiring postconflict reconstruction. Finally, unelected governments and dictatorships are typically less responsive to the needs of their electorates and less concerned with implementing sound policies and generating economic growth in order to be reelected. Today, Africa looks very different from most of its history since independence in terms of both the prevalence of conflict and the extent to which its governments are democratically elected. Although episodes and areas of conflict remain, the scale of conflict — particularly in those countries that are most relevant to investors — is nowhere near that of the 1970s and 1980s.

Improved macroeconomic stability: This more conducive political environment has enabled one of the most striking changes on the continent, particularly from an investor perspective: the implementation of dramatically improved monetary and fiscal policies, with broad-based macroeconomic stability as a result. The improvement in long-term government debt dynamics has been profound. The combination of higher growth, improved tax revenue collection, better cyclical fiscal policy and selected debt write-offs have resulted in much improved debt-to-GDP ratios for sub-Saharan Africa. As the aggregate African GDP has increased (and the stock of debt remained fairly stable), the debt-to-GDP ratio has fallen dramatically since the late 1990s.

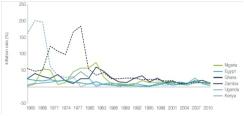

There has also been a significant improvement in monetary discipline across Africa, particularly in key investment destinations on the continent. As shown in the chart below, both the level and the volatility of inflation have steadily decreased since the early 1980s. Today, single-digit inflation is the norm in most African markets, and central banks are typically quick to react to the emergence of price spirals by raising interest rates. Along with the improvements in peace and political accountability, the era of financing government (or conflict) through the printing press has passed. The monetary and fiscal stability and discipline now observed in Africa is a prerequisite for economic growth and development.

In our next article we’ll go on to consider the remaining positive structural developments that are reinforcing the strong economic growth dynamic that has emerged since the turn of the century.

Chris Derksen is the head of Frontier & Emerging Market Equities at Investec Asset Management.