When Pi Investments recently lent $200,000 to solar energy projects via Internet crowdfunding platform Mosaic, it saw more than an opportunity to back clean technology. The Chicago-based family office was also keen to “peek under the hood” of a new investment infrastructure, says director of impact investments Aner Ben-Ami. Through crowdfunding outfits like Oakland, California–based Mosaic, small and medium-size U.S. companies can offer debt and soon equity stakes to the public.

“Part of the reason we wanted to be a part of this experiment was to see how it evolves,” says Ben-Ami, whose firm manages the wealth of a member of the Pritzker family, which owns the Hyatt Corp. hotel chain. He thinks crowdfunding may be poised to take off in the cleantech space: “There is demand from investors for greater access to these sorts of assets.”

Crowdfunding may be a natural fit for cleantech, where conventional early-stage funding has fallen off. Last year global venture capital flows to the sector plunged 33 percent, to $6.46 billion, reports San Francisco–based research and advisory firm Cleantech Group. By helping cleantech ventures get off the ground, crowdfunding could make them more appealing to institutional investors.

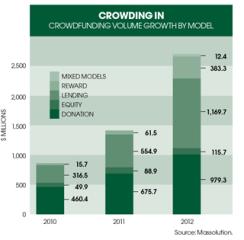

Total worldwide crowdfunding reached $2.7 billion last year, up 81 percent over 2011, according to Massolution, a Los Angeles–based crowdsourcing researcher and adviser. At $1.4 billion, donation- and reward-based models accounted for the bulk of that number. But lending-based crowdfunding grew the most, surging 111 percent, to $1.2 billion. Equity crowdfunding raised just $116 million, partly because it’s still off-limits in the U.S.

A smattering of debt-based U.S. crowdfunding venues focus on cleantech. Mosaic, one of the first, launched three years ago and has raised $2 million for solar projects. Co-founder and president Billy Parish expects that figure to double in the next few months thanks to demand from retail and institutional investors. San Francisco–based SunFunder raises capital for solar investments in off-grid communities in Africa, Asia, the Caribbean and Latin America. Founded last July, the company has gathered about $80,000. CleanHatch, which has offices in New York and Durham, North Carolina, has deployed $7 million to wind, solar, geothermal and other cleantech projects since launching in 2011.

Crowdfunding might help cleantech ventures attract big and risk-conscious investors. “There’s a lot of research that needs to be done before a company can come up with something that an institutional investor will even touch,” says Nick Bhargava, co-founder of Durham-based Motaavi, a crowdfunding platform devoted to tech companies in the life sciences and energy sectors. “Our idea was to use crowdfunding in a way that would bridge that gap.”

But Bhargava admits that figuring out the details won’t be easy. A venture capital or private equity firm may hesitate to invest in a business that has sold shares to numerous retail investors through a crowdfunding platform, he says. “What responsibilities does the company have to those many hundreds of potential investors, and what rights do you give them?” Bhargava asks. “We really can’t test any solutions until we get the rules and regulations from the SEC.”

Ryan Levinson, founder of SunFunder and former vice president of environmental finance at Wells Fargo & Co. in San Francisco, notes that his platform aims to help the cleantech industry develop by focusing on technologies that are past the proof-of-concept stage. “We see ourselves not as providing seed capital but providing scale capital,” Levinson says. “If we’re successful in putting hundreds of millions into this sector and proving that the risks can be managed, we think the mainstream sources of capital that aren’t interested in the market today will start getting involved.” • •