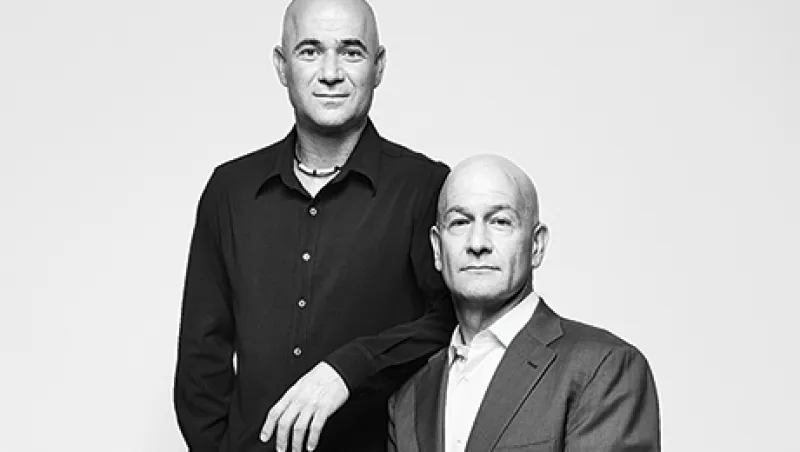

Andre Agassi and Investor Bobby Turner Team Up for Charter Schools

The tennis great and real estate executive Turner recently closed a second fund to develop schools in U.S. urban centers.

Imogen Rose-Smith

October 2, 2015