As investors look to position themselves in emerging markets, we believe small-cap equities are poised to benefit from sweeping macroeconomic and market changes taking place in those economies. To understand why, we at State Street Global Advisors examined the emerging-markets small-cap premium.

Using MSCI emerging-markets data from 1994 to the present, one might conclude that premiums are nonexistent. Index data can be misleading, however, because they have a small number of constituents and a short history. We found that results differ when performing an analysis using companies not only in the MSCI emerging-markets index but also in the Standard & Poor’s/International Finance Corp. index. We combined those indexes to calculate four measures of returns.

Our data showed evidence of a small-cap premium ranging from 4.8 percent, for U.S. dollar-denominated-weighted average returns, to 7.1 percent, for dollar-denominated average returns. Our research shows that the small-cap premium in emerging markets, similar to that in developed markets, is not static; rather, it can rise and fall alongside macroeconomic ebbs and flows.

In the late 1990s and early 2000s, the premium was negative, mainly because of macroeconomic trends that propped up large-cap more than small-cap returns. At that time, emerging markets were export- and commodity-based. Large state-owned entities were best positioned to benefit from growth in revenues, gross domestic product and return on equity. Hefty large-cap inflows kept a small-cap premium at bay.

The premium reached a ten-year bottom in 2010 but has been rebounding since then (see chart 1). In recent years, emerging markets have focused on domestic issues because of stresses on exports and commodities.

Data is taken from individual companies, broken out into size tiers.

The new, domestic-driven economy is occurring for various reasons. Reindustrialization in the West has led to a decline in exports, and Western firms have taken more of their manufacturing back onshore. Exports to China in particular have declined, as the country seeks to transition from an investment-based to a consumption-based economy. Commodities are in a long-term slump.

Yet in the new emerging-markets world, export and commodity trends matter less. Consumption and domestic reforms constitute the bedrock of asset returns. As a result, the positive themes in the market are not as restricted to large-cap manufacturing firms.

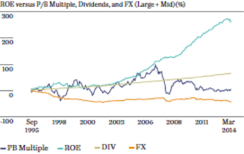

Using the Ibbotson approach, we break up the returns of the MSCI emerging-markets and MSCI emerging-markets small-cap indexes into the following:

•returns attributable to return on equity

•returns derived from dividends accrued to shareholders

•returns attributable to equity multiples (price-to-book)

•returns from accrued foreign exchange effects.

The data reveal that ROE is the primary driver of returns for both indexes. Additionally, that factor is a greater contributor to returns for emerging-markets small-cap than for large-cap, whereas the other three factors did not appear to have a major effect (see chart 2).

Source: Bloomberg, SSGA, and MSCI (data as of December 31, 2014).

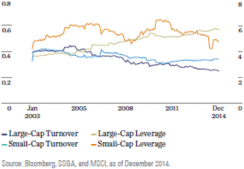

Following the 2008–’09 financial crisis, emerging-markets policymakers pushed through monetary and fiscal reforms primarily via the banking sector. This mostly affected large banks that were able to lend more money to major firms, and significant spending on fixed investment ensued for larger companies. The small-cap lending environment was not as robust as that for large-caps, and debt-financed investing was limited. Furthermore, small-cap earnings were earmarked to pay down existing debt, rather than to take on new ventures. As a result, since the global financial crisis, leverage has fallen in small-cap emerging markets and asset turns have increased. At the same time, revenues and margins have barely moved. Over the same period, large-cap firms have seen leverage increase dramatically (see chart 3), whereas other drivers have remained flat.

Source: MSCI emerging-markets small-cap index and the MSCI emerging-markets index. Data used is from the period January 31, 2003 to December 31, 2014.

The small-cap investment process must be designed to account for higher idiosyncratic risk, less analyst coverage and greater uncertainty in fundamentals (earnings/risk of default) that, as various academic and market data show, are characteristic of small-cap stocks. For investors seeking exposure to emerging markets in the future, we think emerging-market small-caps offer the most attractive positioning, because earnings, ROE and leverage metrics have all been improving since the recession.

Lori Heinel is chief portfolio strategist of State Street Global Advisors in Boston.

Get more on emerging markets and on equities.