< The 2015 All-America Research Team

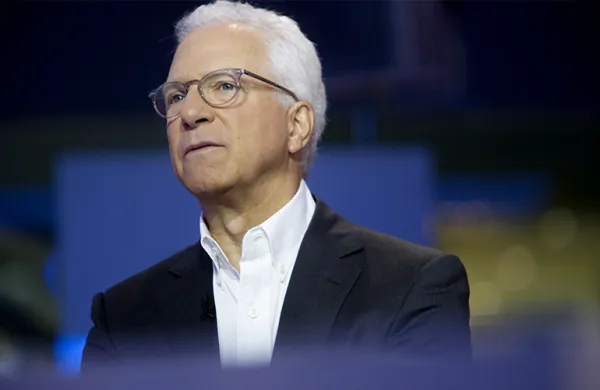

Eric Weissenstein & team

Guggenheim Securities

First-place appearances: 0

Total appearances: 19

Team debut: 1996

Guggenheim Securities advances from third place to notch its fourth No. 2 showing on this roster since 2010. Under the direction of Eric Weissenstein, the firm’s seven-person crew in Washington stands out for its coverage of “public policy and the important work of regulatory agencies,” one portfolio manager says. “They do a great job on telecommunications, and they’re probably the best at keeping tabs on the [Federal Communications Commission] — there’s been a lot of important policy coming out, especially on the spectrum auctions and net neutrality.” With regard to the FCC, the group is carefully following the issue of retransmission consent, whereby cable operators and other multichannel distributors are required by law to obtain permission from broadcasters before carrying their programming. Broadcasters currently have the ability to increase license fees on cable and satellite television companies, but “FCC concerns over rising cable TV prices could lead it to pressure broadcasters in various ways,” reports Weissenstein, 52. He and his colleagues foresee the agency’s taking action that “will create a headwind for broadcasters in the second half of 2015.” They also are keeping a watchful eye on the U.S. Department of Defense’s disbursements. “We expect spending on ground vehicles to increase significantly over the next five years as spending on aviation declines,” the team leader reports. Such a shift in allocations should be beneficial for such companies as BAE Systems of the U.K.; West Falls Church, Virginia–based General Dynamics Corp.; and Wisconsin’s Oshkosh Corp., he says. Boeing Co. of Seattle and Hartford, Connecticut’s United Technologies Corp. are likely to be among those feeling the sting.