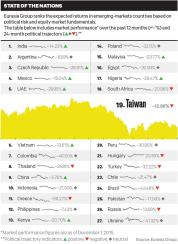

In a historic rapprochement, the president of Taiwan, Ma Ying-jeou, met with the president of China, Xi Jinping, in early November. The Singapore meeting was the first time leaders of the two nations had met since Mao Zedong’s Communist forces drove the Kuomintang-led nationalists from the mainland in 1949.

Since entering office in 2008, President Ma has worked to improve relations with Beijing, which views Taiwan as a defected province rather than a sovereign nation. Cross-strait trade and investment have boomed through preferential trade agreements and the development of technology industry supply chains. The mainland is Taiwan’s largest trading partner, taking 40 percent of the country’s exports.

This interdependence was a boon for the island state when China was booming, but it poses a big risk today now that the mainland economy has slowed down. Chinese growth fell to a six-year low in the first half of 2015. Trade-dependent Taiwan saw its economic activity shrink by just over 1 percent in the third quarter from a year earlier, the first such contraction since the global financial crisis in 2009. The International Monetary Fund revised its forecast of the country’s 2015 growth rate from 3.8 percent in April to 2.2 percent in October after months of weak exports. It sees a modest upturn, to 2.6 percent, in 2016.

Just as the economy has deteriorated, the political environment threatens to do the same. Tsai Ing-wen, the presidential candidate for Taiwan’s independence-leaning opposition, the Democratic Progressive Party, enjoys a healthy poll lead over her Kuomintang rival, Eric Chu, ahead of the January election. A regime change could cast a chill over relations with China and inject fresh uncertainty into the economy at a delicate time.

“Taiwan exports have always been a great yardstick of global growth,” says Daniel Tenengauzer, New York–based head of emerging-markets research at Royal Bank of Canada. The country is a major manufacturer of semiconductors, computers and high-end electronics, mobile gadgets and smartphone components. The IMF expects global growth to stammer to 3.1 percent in 2016 from 3.4 percent in 2015 because of lower commodity prices and weakness in emerging markets.

Demand for smartphones took a hit as the economy slowed in China, the world’s largest buyer, and emerging-markets currencies faltered. A lot of Taiwanese component sales into China are reexported. “It’s a double whammy when domestic consumption in China and reexport demand abroad weaken,” says Charles Wilson, co–portfolio manager of the Developing World Fund at Santa Fe, New Mexico–based Thornburg Investment Management. Investors are not very interested in Taiwan right now,” says RBC’s Tenengauzer, who spoke with investors there in November.

President Ma has attempted to right the downward-listing economy. This summer the government announced plans to spend 36 billion New Taiwan dollars ($1.1 billion) over nine years on Productivity 4.0, a project that aims to upgrade the economy through investments in everything from electronics and machinery to agriculture and transportation. In September, Taiwan’s central bank trimmed its benchmark interest rate for the first time since 2009, from 1.875 percent to 1.75 percent, to spur growth. “The impact of lower rates tends to be fairly constrained,” warns Tenengauzer.

These stimulus policies as well as stable relations with China will need to continue to restore growth in 2016, says Patrick Schena, adjunct assistant professor of international business relations at the Fletcher School, Tufts University. “A deteriorating relationship with China could further isolate Taiwan and limit its flexibility to enhance the competitiveness of its exports, while falling behind regional and global competitors,” Schena adds. China maintains an iron grip over Taiwan’s international ties as it is, barring free-trade agreements with Singapore, New Zealand and others.

Despite its pro-independence rumblings, the DPP will maintain the status quo in cross-strait relations, Thornburg’s Wilson believes. Likewise, China won’t want to disrupt current relations as political trends in Taiwan move away from near-future unification.