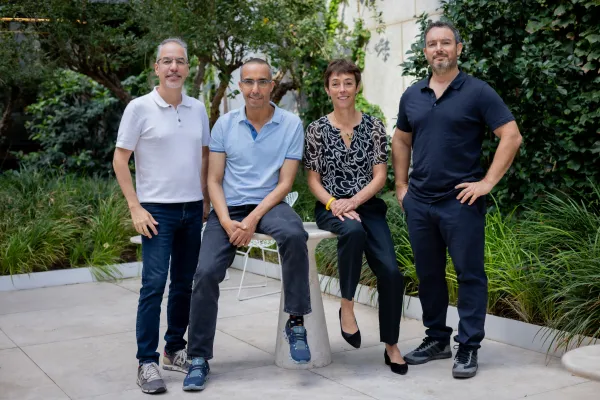

< The 2015 All-Europe Research Team

Pierre Boucheny & team

Kepler Cheuvreux

First-place appearances: 13

Total appearances: 24

Team debut: 1992

At No. 2 on this roster for a second consecutive year is Kepler Cheuvreux’s 20-strong, Paris-based troupe. Under the guidance of Pierre Boucheny, the analysts track 146 French stocks, impressing clients as being “highly knowledgeable” and having “excellent contacts with managements across all French industries,” in the words of one portfolio manager. For 2015 the group likes Publicis Groupe, which is headquartered in Paris. After the advertising and public relations giant’s proposed merger with New York–based rival Omnicom Group collapsed in May, it rebounded smartly by announcing in November a $3.7 billion, all-cash acquisition of digital ad specialist Sapient Corp. of Boston. Publicis should benefit from a corporate reorganization that includes a new digital agency network, Razorfish Global, as well as “the relaunch of the 2018 margin growth plan and the stabilization of account losses,” reports Boucheny, 54. Closing January at €66.43, the stock earns a target price of €70. Kepler Cheuvreux’s researchers also favor Paris-based publishing powerhouse Lagardère, which has suffered reputationally from “misperceptions related to the ill-fated acquisition of Sportfive in 2006,” the team leader notes, and trades at a discount to the media sector. To its credit, management has abandoned its conglomerate structure, disposed of unrelated assets and “improved the earnings mix,” says Boucheny. The analysts assign Lagardère’s stock a price objective of €30, which implies a 23.6 percent upside to its value at the end of last month.